Bitcoin price today: tumbles below $90k as Fed cut doubts spark risk-off mood

-

New tariffs stoke inflation fears and rattle markets.

-

With recession risks rising, defensive stocks look more appealing.

-

InvestingPro spots three undervalued picks with solid upside.

- Get the AI-powered list of stock picks that smashed the S&P 500 in 2024 for half price as part of our FLASH SALE.

These are not just words. The era of tariffs has arrived, and Donald Trump's decision to impose tariffs of 25% on imports from Canada and Mexico and 20% on imports from China is causing turmoil in financial markets. The S&P 500 closed down 1.8% in the March 3 session, while the Nasdaq 100 fell 2.6%.

The U.S. president's decision has raised concerns about rising inflation, slower economic growth, and a negative impact on U.S. consumers.

This is a troubling scenario, further aggravated by the latest estimates from the Atlanta Fed, which project a 2.8% GDP contraction in the first quarter— a sharp contrast to the 3% growth forecast just a few weeks ago. Additionally, the consumer confidence index has dropped to its lowest level in four years, indicating that households are already anticipating worsening economic conditions.

In short, after years of a stock market rally driven by big tech, it may be time for investors to reevaluate defensive stocks— those linked to companies that tend to maintain stable revenue streams even during recessions.

Characteristics of Defensive Stocks

Key characteristics to look for when identifying defensive stocks include:

- Low beta: These stocks are usually less volatile than the broader market.

- Attractive dividend yield: Shareholders benefit from a high dividend yield.

- Stable revenues: The company maintains consistent demand even during economic downturns.

As for sectors, the best ones to focus on are:

- Essential Consumer Goods: Food, household products, and other low-cost necessities. Demand for these remains steady, even in times of economic uncertainty.

- Healthcare: Pharmaceuticals, healthcare services, and companies offering medical products and equipment. The healthcare sector is generally less affected by economic cycles.

- Utilities: Companies that provide essential services like electricity, gas, water, and telecommunications. Historically, the utilities sector has been more resilient during recessions, as these services are fundamental to daily life and consumed regularly.

How to Identify Defensive Stocks

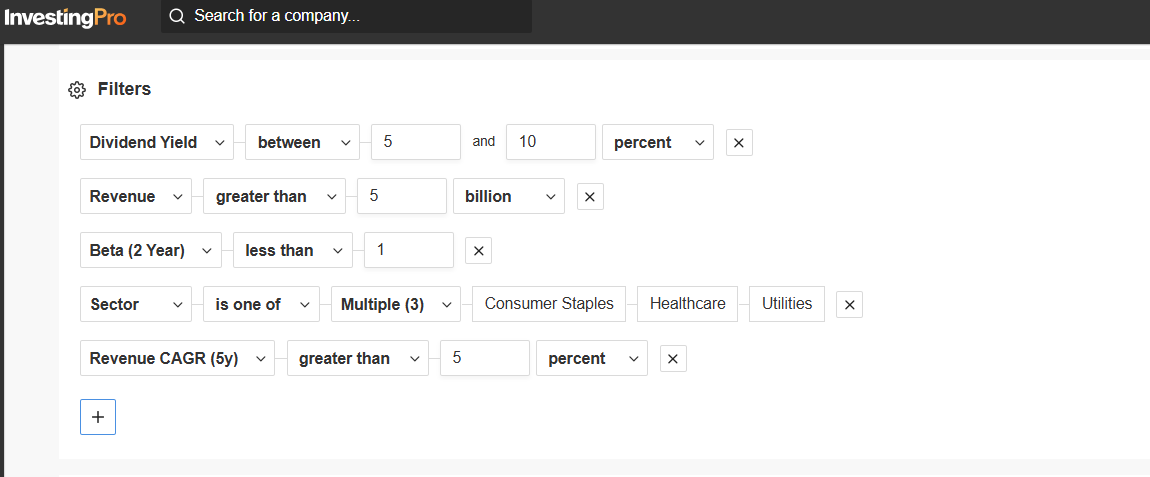

The fastest way to find stocks with these characteristics is by using InvestingPro's Advanced Stock Screener and applying the relevant filters.

Source: InvestingPro

As seen in the chart above, you can refine your search to U.S.-listed stocks in the Consumer Staples, Healthcare, and Utilities sectors that meet the following criteria:

- Beta below 1 over the past five years.

- Dividend yield above 5%.

- Revenue exceeding $5 billion.

- Revenue CAGR (5-year) growth of at least 5%.

Three Undervalued, Recession-Proof Stocks

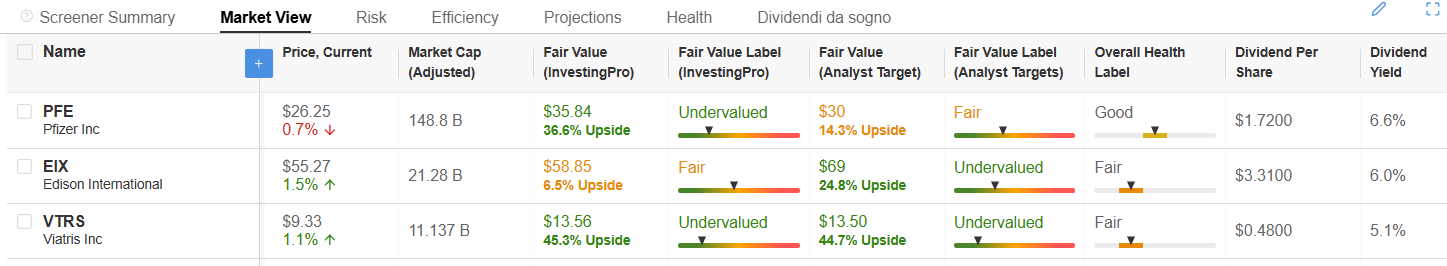

InvestingPro’s tool has identified three stocks that meet all these criteria— each with attractive upside potential based on Fair Value and analysts’ target prices.

They are:

1. Edison International (NYSE:EIX)

A major electric utility primarily operating in California, Edison International has positioned itself as a "pure wires utility" with a strong focus on electric infrastructure management and alignment with California's clean energy goals.

- Fair value: +6.5%

- Analysts’ target price: +26.7%

- Dividend yield: 6%

2. Viatris (NASDAQ:VTRS)

A key player in the global pharmaceutical industry, Viatris specializes in the production and development of generic drugs, with a strong presence in international markets.

- Fair value: +45.3%

- Analysts’ target price: +44.7%

- Dividend yield: 5.1%

3. Pfizer (NYSE:PFE)

A global pharmaceutical giant with a diversified product portfolio, Pfizer serves more than 192 million patients worldwide through its wide range of drugs and vaccines.

- Fair value: +36.6%

- Analysts’ target price: +14.3%

- Dividend yield: 6.6%

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.