Microsoft sued by Australia competition regulator over Copilot, 365 pricing

- Amid a gloomy macro backdrop, earnings are still forecast to have grown in Q2

- IBM hopes to continue its turnaround direction

- Netflix and Tesla hope to reverse momentum amidst several headwinds

Earnings will take the center stage next week when some of the largest US companies begin reporting their latest quarterly numbers amid concerns that the four-decade high rate of inflation, rising interest rates, and persistent supply-chain disruptions will slow growth.

In addition to hard numbers, investors will be closely scanning the earning statements and the management comments about the future outlook to look for signs of softening demand, cost cutting measures, or changes in capital spending plans.

The highest inflation in decades is forcing the US Federal Reserve to pursue an aggressive monetary tightening, a move which has hurt businesses and households alike, and made consumers more pessimistic about the economy.

Analysts, however, still expect some companies to report higher profits, especially the ones that continue to retain pricing power. Earnings for the S&P 500 companies are expected to gain 5.6%, based on actual reports and estimates, according to I/B/E/S data from Refinitiv. As of Friday morning, 35 S&P companies had reported, and 80% of those reported earnings above forecasts, Refinitiv found.

Below, we've short-listed three stocks from different sectors we’re monitoring as Q2 earnings season ramps into full swing:

1. IBM

IBM (NYSE:IBM) will report its latest quarterly numbers on Monday, July 18, after the market close. Analyst consensus on IBM is for EPS of $2.27 on revenue of $15.09 billion for the quarter ended June 30.

Big Blue, which is in the middle of a major turnaround, is showing some signs that it is succeeding at bringing additional sales from its cloud business. In its last earnings report, the New York-based company posted sales that topped analysts’ estimates. The results showed strong demand for hybrid-cloud offerings, signaling continued momentum for its transition to a business fueled by cloud-based software and consulting.

Arvind Krishna, who took over as CEO from Ginni Rometty in 2021, is focusing on artificial intelligence and the cloud to revive growth. Krishna has reorganized the company’s business around a hybrid-cloud strategy, which allows customers to store data in private servers and on multiple public clouds.

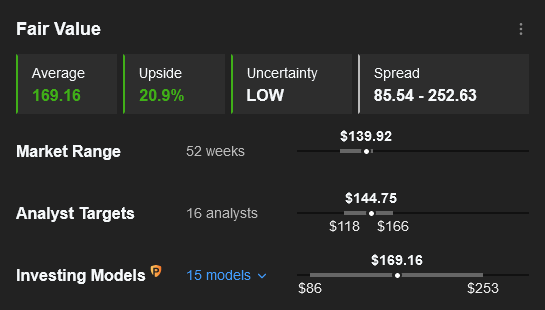

Shares of IBM, which closed Friday at $139.92, have gained about 5% this year, outperforming the Nasdaq-100 Index, which is down 27% during the same period.

Source: Investing Pro+

2. Netflix

Streaming entertainment giant Netflix (NASDAQ:NFLX) is scheduled to report Q2 2022 earnings on Tuesday, July 19, after the market close. Analysts are expecting $2.96 a share profit on sales of $8.03 billion.

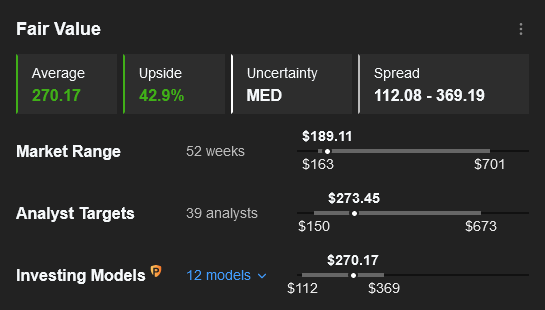

Netflix is among the worst-performing mega-cap technology stocks in the current market rout as the Los Gatos-based company lost its growth momentum after the pandemic-era surge in subscribers ended. NFLX stock, which closed on Friday at $189.11, is down about 70% this year.

After losing 200,000 customers in the first quarter, Netflix predicted in April its subscriber base will shrink by another 2 million customers in Q2, a huge setback for a company that regularly grew by 25 million subscribers or more a year. Netflix also plans to curb its spending on films and TV shows in response to the customer losses.

Source: Investing Pro+

3. Tesla

Electric vehicle maker Tesla (NASDAQ:TSLA) will report Q2 earnings on Wednesday, July 20, after the market close. Analysts are expecting $1.86 a share profit on sales of $16.52 billion.

The Austin, Texas-based EV manufacturer reported this month that vehicle deliveries fell quarter-over-quarter for the first time in more than two years, hurt by the factory shutdown in China and supply-chain disruptions.

Deliveries, however, were up roughly 27% from last year’s second quarter, showing Elon Musk’s company was able to handle supply chain issues much better than traditional automakers who had to idle factories and cut production.

On top of the short-term production challenges that automakers are facing, growing macroeconomic headwinds further diminish their growth outlook.

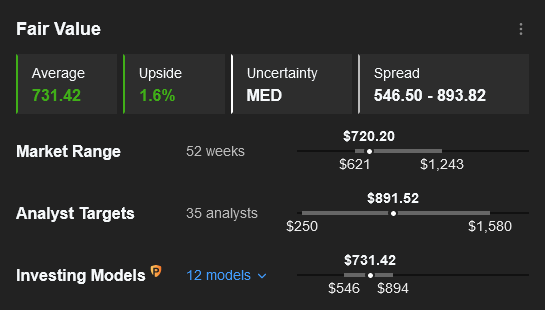

JPMorgan in a note this month dropped Tesla’s Q2 earnings per share estimate to $1.70 from $2.26 and the full-year estimate to $10.80 from $11.50, warning of the potential for sharp battery metals inflation to cut into Tesla’s profits. Tesla shares, after falling 31% this year, closed on Friday at $720.20.

Source: Investing Pro+

Disclosure: The author has no positions in stocks mentioned.

***

Looking to get up to speed on your next idea? With InvestingPro+ you can find

-

Any company’s financials for the last 10 years

- Financial health scores for profitability, growth, and more

-

A fair value calculated from dozens of financial models

-

Quick comparison to the company’s peers

-

Fundamental and performance charts

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »