SoftBank Group Q2 profit blows past expectations; sells Nvidia stake for $5.8 bln

- The Federal Reserve looks set to start cutting interest rates in September.

- Using the InvestingPro, I identified several undervalued stocks that are poised to benefit from falling borrowing costs.

- As such, discussed below are three stocks worth owning as the U.S. central bank prepares to lower interest rates in the months ahead.

- Looking for actionable trade ideas to navigate the current market volatility? The InvestingPro Summer Sale is live: Subscribe for under $8/month

As the Federal Reserve prepares to potentially cut interest rates, investors have a unique opportunity to position themselves for substantial gains. Lower rates can have a pronounced positive impact on certain sectors, particularly those sensitive to borrowing costs.

Harnessing the power of InvestingPro, I identified several undervalued stocks that are poised to benefit from falling borrowing costs. This professional tool directed to the retail investor offers several features that can assist investors in identifying high-quality stocks with strong potential upside.

And the best part? It cost less than $8 a month using this link.

Among these stocks, here are three names that stand to benefit significantly from a rate cut and are currently undervalued, as per the AI-powered quantitative models in InvestingPro, presenting attractive entry points.

1. Kraft Heinz

- 2024 Year-To-Date: -4.3%

- Market Cap: $42.8 Billion

Kraft Heinz (NASDAQ:KHC), a leading global food and beverage company, offers a strong dividend of $1.60 per share at a relatively high yield of 4.52%, making it an attractive option as interest rates begin to fall. The company’s portfolio includes household names such as Heinz, Kraft, Oscar Mayer, and many others.

Source: Investing.com

Falling interest rates would reduce Kraft Heinz's debt servicing costs, allowing the company to allocate more capital towards growth initiatives, such as expanding its product lines or entering new markets. This financial flexibility can enhance its competitive position and support higher earnings.

Why Buy:

- Attractive Dividend: With a high yield, Kraft Heinz is appealing for income-focused investors, especially as lower interest rates diminish returns on fixed-income investments. The substantial yield provides a reliable income stream in a lower-rate environment.

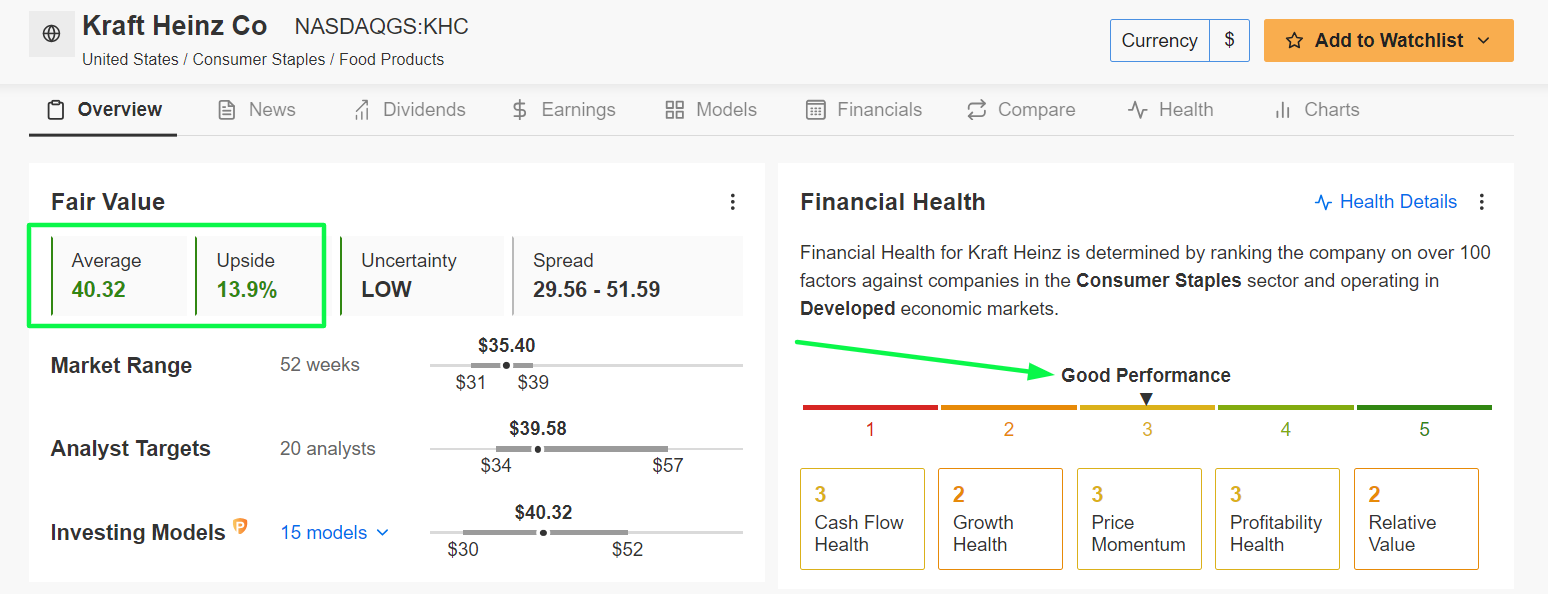

- Undervalued Stock: According to InvestingPro's AI-powered models, Kraft Heinz is significantly undervalued with a +13.9% upside potential to its Fair Value price estimate of $40.32. This makes it an excellent buying opportunity for investors looking for value.

Source: InvestingPro

- Strong Financial Health: Kraft Heinz boasts a robust Financial Health Score, reflecting strong fundamentals and a positive outlook as lower interest rates could reduce financing costs and improve profit margins. Lower borrowing costs will enable Kraft Heinz to invest more in innovation and marketing, driving future growth.

2. Cincinnati Financial

- 2024 Year-To-Date: +25.6%

- Market Cap: $20.3 Billion

Cincinnati Financial (NASDAQ:CINF) is a regional insurance company that offers property and casualty insurance, as well as life insurance and annuity products. The company has raised its annual dividend for five consecutive years and currently offers a dividend of $3.24 at a yield of 2.49%.

Source: Investing.com

Falling interest rates can lead to increased loan demand, boosting Cincinnati Financial's lending business. Lower rates also improve the affordability of loans for consumers, potentially leading to higher insurance premium collections as customers are better able to finance their insurance needs.

Why Buy:

- Benefiting from Lower Rates: As a regional bank and insurer, Cincinnati Financial stands to benefit from reduced lending costs. Lower interest rates can stimulate loan demand, boosting the company's earnings. Additionally, lower rates can increase the market value of the company's investment portfolio.

- Dividend Growth: The company’s track record of consistent dividend increases makes it a strong choice for income investors. The reliable dividend growth reflects Cincinnati Financial's solid operational performance.

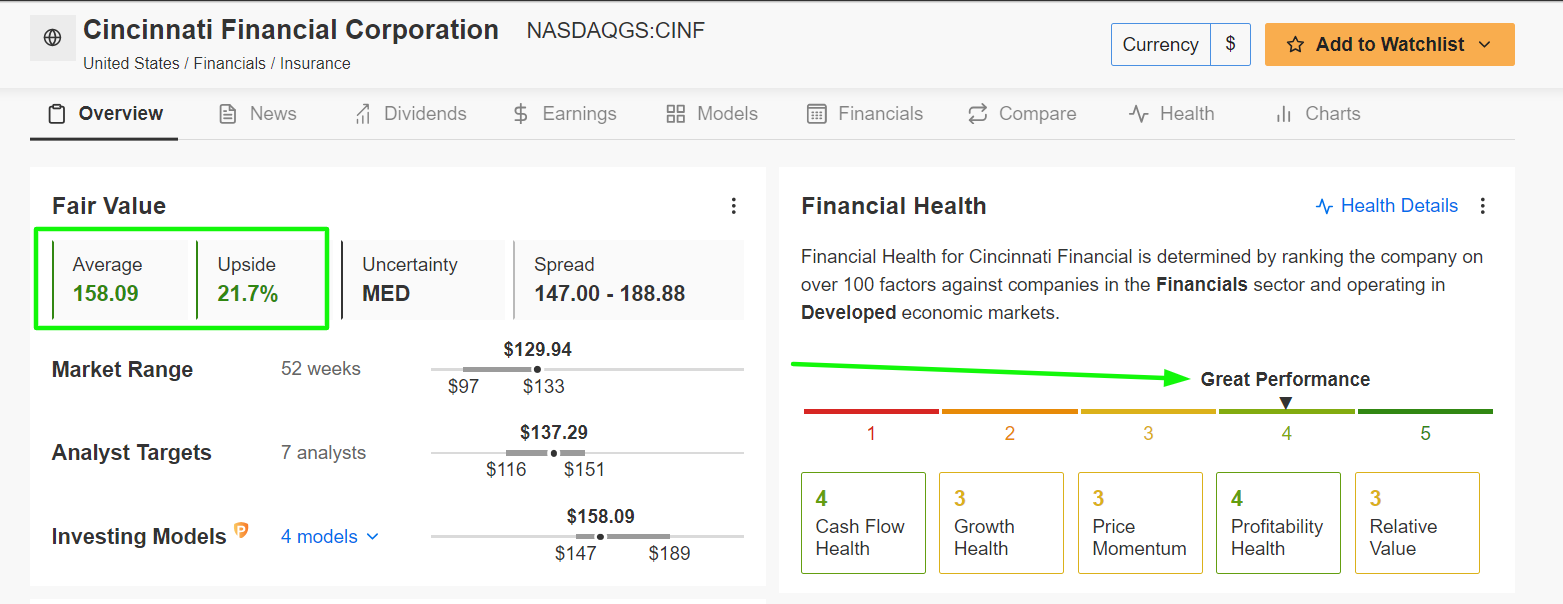

- Undervalued Stock: InvestingPro's AI models point to a +21.7% upside for Cincinnati Financial, with a Fair Value price of $158.09. This indicates substantial growth potential and an attractive entry point for investors.

Source: InvestingPro

- Strong Financial Health: The company's high Financial Health Score highlights its solid balance sheet and strong operational performance, ensuring it can capitalize on improved market conditions as rates fall.

3. KB Home

- 2024 Year-To-Date: +32.8%

- Market Cap: $6.2 Billion

KB Home (NYSE:KBH) is one of the leading homebuilders in the United States, focusing on building quality homes for first-time buyers and move-up buyers. The company has a long history of financial stability, having maintained a dividend for 39 consecutive years.

Source: Investing.com

Lower interest rates would decrease mortgage costs, making homes more affordable for buyers. This increased affordability can lead to a surge in home purchases, benefiting homebuilders like KB Home. Additionally, reduced interest expenses on debt can improve the company's profitability and enable further investment in land acquisition and development.

Why Buy:

- Rate-Sensitive Sector: As a homebuilder, KB Home is highly sensitive to interest rates. Lower rates would likely reduce mortgage rates, spurring homebuying activity and driving demand for new homes. This can lead to higher sales volumes and improved profit margins.

- Dividend Stability: The company’s consistent dividend history makes it a reliable income investment, providing stability amid market fluctuations.

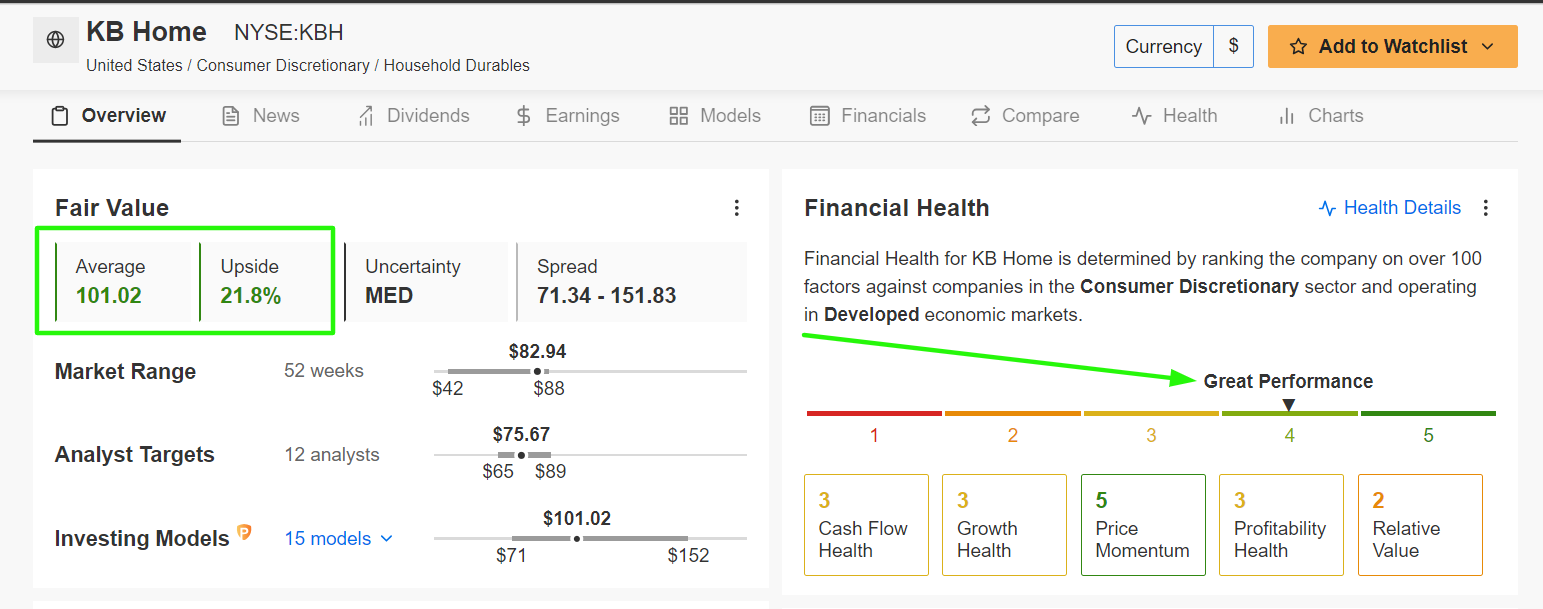

- Undervalued Stock: InvestingPro's models indicate a +21.8% potential upside for KB Home, with a Fair Value target of $101.02. This significant upside potential reflects the market’s underestimation of KB Home's growth prospects.

Source: InvestingPro

- Strong Financial Health: KB Home's above-average Financial Health Score underscores its solid fundamentals and resilience, positioning it well to capitalize on lower borrowing costs and increased consumer demand.

Conclusion

As the Federal Reserve moves closer to potentially cutting interest rates, investors should consider adding Kraft Heinz, Cincinnati Financial, and KB Home to their portfolios. Each of these stocks not only stands to benefit from a lower interest rate environment but also offers substantial upside potential according to InvestingPro's AI-powered quantitative models.

With strong dividends, robust financial health, and significant undervaluation, these stocks are poised to deliver impressive returns in the coming months.

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingProputs the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.