Tyson Foods to close major Nebraska beef plant amid cattle shortage - WSJ

- UPST stock is up more than 1,100% since going public in December 2020

- Upstart has so far been successful in using technology to streamline the lending process in the personal loan space

- Potential buy-and-hold investors could regard a short-term decline toward $275 as a better entry point

Investors in the lending platform Upstart (NASDAQ:UPST) have seen mouth-watering returns since the company that employs artificial intelligence to consider non-traditional factors to determine credit-worthiness went public in December 2020. On that day, UPST stock began trading at an opening price of $26.

Now, the shares are around $316.50, representing a returned of more than 1,100% in less than 10 months. To provide added perspective, that type of return would have transformed the proverbial $1,000 invested in UPST stock at the end of 2020 into well over $12,000. It is hard to argue with that kind of success.

UPST shares hit an all-time high of $346.54 on Sept. 23. Since then they have lost about 7%. The 52-week range has been $22.61 - $346.54, while the company’s market capitalization stands at $24.7 billion.

California-based Upstart was founded in 2012. It partners with banks to originate personal loans on the Upstart platform. Management claims its AI-platform is beneficial for both borrowers, who get better loan terms, and lenders, who see lower lending risks.

Once the loan is approved, the originating financial institution might retain it on its balance sheet. Alternatively, a portion of these loans get sold to institutional investors. In terms of revenue, Upstart gets a fee from the origination of a personal loan as well as a fee to service that loan while collecting payments from borrowers.

Recent metrics suggest:

“Total outstanding personal loan debt in the United States is $143 billion. There are 21.1 million outstanding personal loans in the US… In total, personal loans amount to less than 1% of total consumer debt, a fraction of credit card debt’s 7.27% share. The average debt per borrower is $8,402.”

The financial technology group released robust Q2 financials on Aug. 10. Revenue was $194 million, up 1,018% year-over-year. Adjusted net income of $58.5 million translated into diluted adjusted earnings per share of 62 cents. Put another way, the company is profitable, separating it from many other young high-growth stocks.

Wall Street was pleased to see Upstart’s bank partners that use the platform originated 286,864 loans, totalling $2.80 billion, up 1,605% YoY. For FY21, management now expects revenues of approximately $750 million versus the prior guidance of $600 million.

On the results, CEO Dave Girouard said:

“Our second quarter results continue to show why Upstart has the potential to be among the world’s largest and most impactful FinTechs…. Lending is the center beam of revenue and profits in financial services, and artificial intelligence may be the most transformational change to come to this industry in its 5,000-year history.”

Given the size of Upstart's addressable market in the US, investors are optimistic that the fintech will increase loan originations significantly in the quarters ahead. Furthermore, it is in the process of entering the auto loan market, too.

On Aug. 9, UPST shares were around $135. Now, they hover at $316.50. That is a return of more than 130% in less than two months. Therefore, analysts debate whether there could be profit-taking in the shares in the near future.

What To Expect From UPST Stock

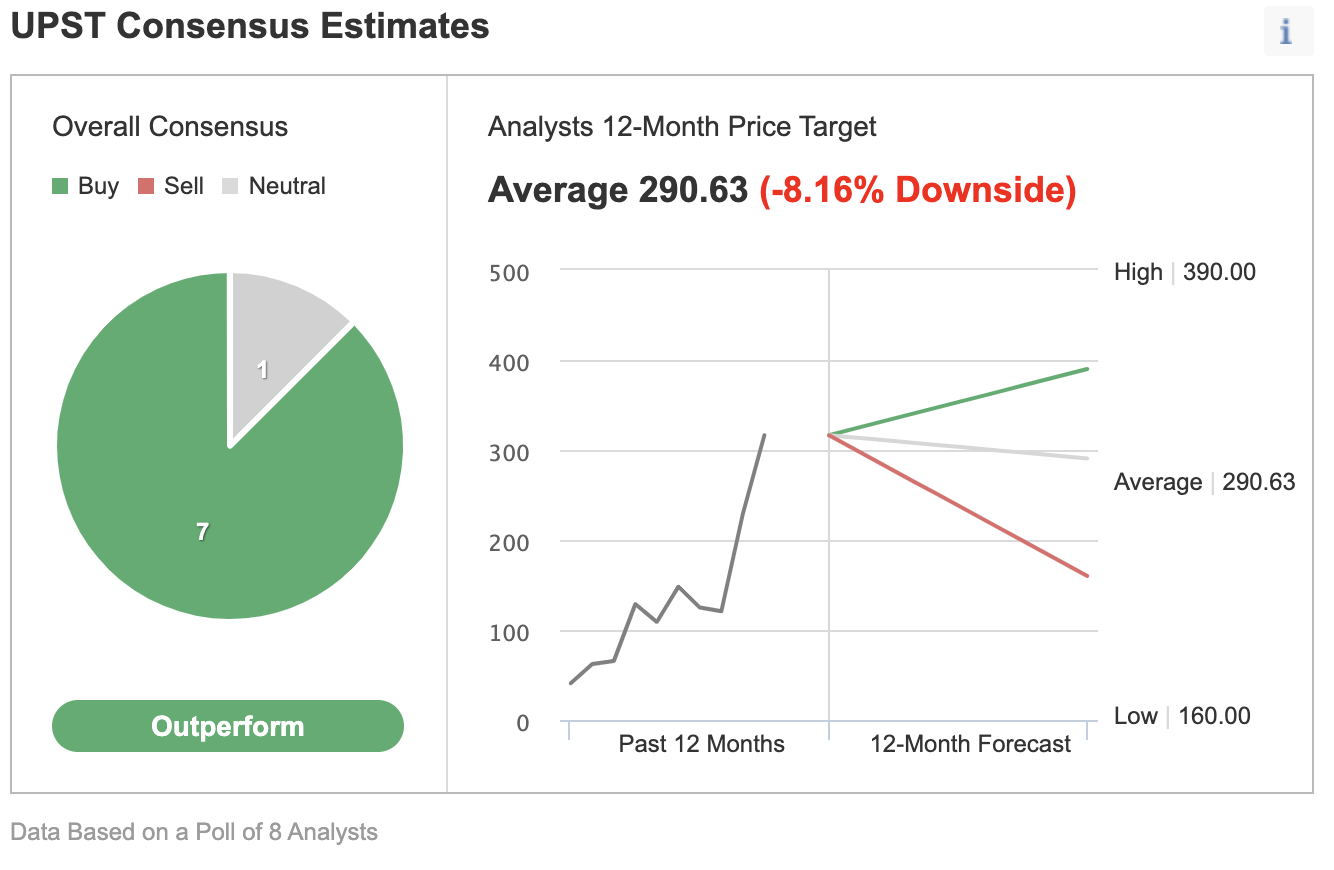

Among eight analysts polled via Investing.com, Upstart stock has an ‘outperform' rating. The shares have a 12-month price target of $290.63, implying a decline of about 8.5% from current levels.

In other words, the Street’s believes all available information and good news have already been well factored into the price. The 12-month price range currently stands between $78 and $109.30.

The trailing P/E, P/S and P/B ratios for UPST stock stand at 491.45x, 55.21x and 32.67x, respectively. Upstart is unique in its AI-platform offering.

However, to compare, look at the metrics for Coinbase Global (NASDAQ:COIN), another young finance group. Its P/E, P/S and P/B ratios, are 28.24x, 9.64x and 10.23x. Meanwhile, P/S and P/B ratios for LendingClub (NYSE:LC) are 5.07x and 3.46x. This shows that many on Wall Street find the current valuation level for Upstart stock to be extremely high and, thus, untenable.

Investors who watch technical charts might be interested to know that a number of UPST stock intermediate-term oscillators are overbought. Although they can stay extended for weeks, if not months, potential profit-taking could also be around the corner.

If broader markets, or high-growth tech shares, were to come under pressure in October, we could potentially see Upstart stock decline first toward $300, and then $275, after which it could trade sideways while it establishes a new base.

Our expectation is for the stock price to come under pressure soon and decline around 10%-15% from these levels. Such a potential drop would offer new UPST investors a better entry point.

As a high-growth disruptor in the fintech space, any potential decline in Upstart shares are likely to be short lived. Toward the end of the year, we could possibly see a new leg up emerge in UPST stock that would eventually lead to a new ATH. Meanwhile, the company could also find itself a takeover candidate.

3 Possible Trades

1. Buy Upstart Stock At Current Levels

Investors who are not concerned with daily moves in price and who believe in the long-term potential of the company could consider investing in Upstart shares now.

On Sept. 30, UPST stock is at $316.50. Buy-and-hold investors should expect to keep this long position for several months while the stock makes another attempt at the record high of $346.55. Such a move would lead to a return of more than 9%.

Meanwhile, investors who are concerned about large declines might also consider placing a stop-loss at about 3-5% below their entry point.

2. Buy An ETF With UPST As A Main Holding

Many readers are familiar with the fact that we regularly cover exchange-traded funds (ETFs) that might be suitable for buy-and-hold investors. Thus, readers who do not want to commit capital to Upstart stock but would still like to have substantial exposure to the shares could consider researching a fund that holds the company as a top holding.

Examples of these ETFs include:

- Global X Robotics & Artificial Intelligence ETF (NASDAQ:BOTZ): This fund is up 10.5% YTD, and UPST stock’s weighting is 10.74%;

- Global X FinTech ETF (NASDAQ:FINX): The fund is up 2.6% YTD, and UPST stock’s weighting is 5.13%;

- Global X Guru™ Index ETF (NYSE:GURU): The fund is up 11.2% YTD, and UPST stock’s weighting is 2.22%;

- WisdomTree Growth Leaders Fund (NYSE:PLAT): The fund is up 5.3% YTD, and UPST stock’s weighting is 1.72%.

3. Bear Put Spread

Readers who believe there could be more profit-taking in UPST stock in the short run might consider initiating a bear put spread strategy. As it involves options, this set up will not be appropriate for all investors.

It might also be appropriate for long-term UPST investors to use this strategy in conjunction with their long stock option. The set-up would offer some short-term protection against a decline in price in the coming weeks.

This approach requires a trader to have one long Upstart put with a higher strike price and one short Upstart put with a lower strike price. Both puts will have the same expiration date.

Such a bear put spread would be established for a net debit (or net cost). It will profit if Upstart shares decline in price.

For instance, the trader might buy an out-of-the-money (OTM) put option, like the UPST 21 Jan. 2022 310-strike put option. This option is currently offered at $48.00. Thus, it would cost the trader $4,800 to own this put option, which expires in about four months.

At the same time, the trader would sell another put option with a lower strike, like the UPST 21 Jan. 2022 290-strike put option. This option is currently offered at $37.75. Thus, the trader would receive $3,775 to sell this put option, which also expires in about four months.

The maximum risk of this trade would be equal to the cost of the put spread (plus commissions). In our example, the maximum loss would be ($48.00 - $37.75) X 100 = $1,025.00 (plus commissions).

This maximum loss of $1,000 could easily be realized if the position is held to expiry and both UPST puts expire worthless. Both puts will expire worthless if the UPST share price at expiration is above the strike price of the long put (higher strike), which is $310 at this point.

This trade’s potential profit is limited to the difference between the strike prices (i.e, ($310.00 - $290.00) X 100) minus the net cost of the spread (i.e., $1,025.00) plus commissions.

In our example, the difference between the strike prices is $20.00. Therefore, the profit potential is $2,000 - $1,025 = $975.

This trade would break even at $299.75 on the day of the expiry (excluding brokerage commissions).