Goldman Sachs chief credit strategist Lotfi Karoui departs after 18 years - Bloomberg

- Steady income and strong growth are features of a great long-term portfolio.

- Today, we will discuss stocks that possess these qualities that you can consider buying.

- For this, we will utilize insights from InvestingPro.

- Now you can take advantage of InvestingPro at a discount. Unlock AI-powered stock picks for under $8/month: Summer sale starts now!

Do you want steady income and long-term growth in your portfolio? Look no further than companies with strong market backing, impressive double-digit growth potential, and a history of rewarding shareholders with dividends.

These qualities signal not just financial rewards, but also the market's confidence in a company's future. Today, we'll dive deep into five stocks that tick all these boxes, offering valuable insights into their financial health and highlighting their potential for investors seeking stability and growth.

1. Matador Resources

Matador Resources Company (NYSE:MTDR) explores, develops, and produces oil and natural gas across the United States. Originally named Matador Holdco, it rebranded as Matador Resources Company in August 2011. Founded in 2003, the company is based in Dallas, Texas.

On July 23, the company will release its quarterly results. The previous quarter surpassed expectations, with revenue reaching $787.7 million, marking a 40.6% increase from the previous year, and earnings per share (EPS) rising by 14%.

Source: InvestingPro

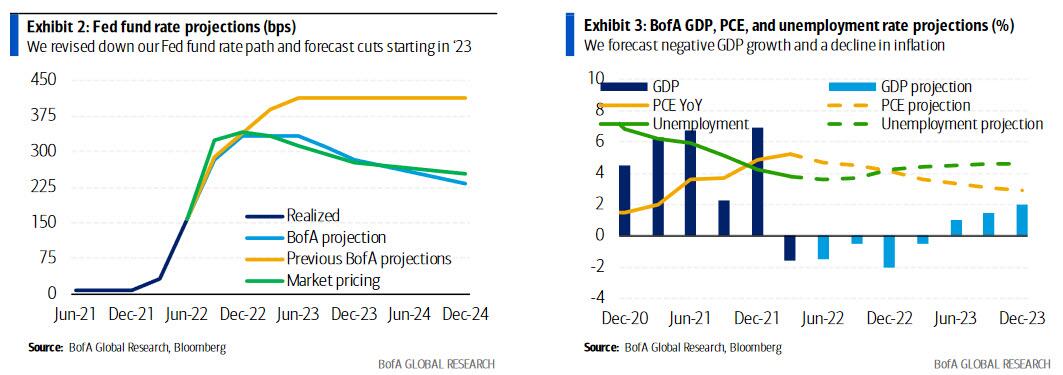

The dividend yield is 1.33%. With a payout ratio of only 10.74%, it has ample room to increase dividends in the coming years.

Source: InvestingPro

It has 12 ratings, of which 11 are buy, 1 is hold and none are sell.

Its fair value or fundamental price is 19.3% above its share price, specifically at $73.96, indicating that the stock is undervalued.

The market price target is at $79.93.

Source: InvestingPro

2. Murphy Oil

Murphy Oil Corporation (NYSE:MUR) is an oil and gas exploration and production company in the United States and Canada. It was formerly known as Murphy Corporation and changed its name to Murphy Oil Corporation (NYSE:MUR) in 1964. It was incorporated in 1950 and is headquartered in Houston, Texas.

It offers a dividend yield of 2.90% and has increased dividends steadily since 2021. Moreover, with a payout of only 31.04%, it has room for continued dividend increases.

Source: InvestingPro

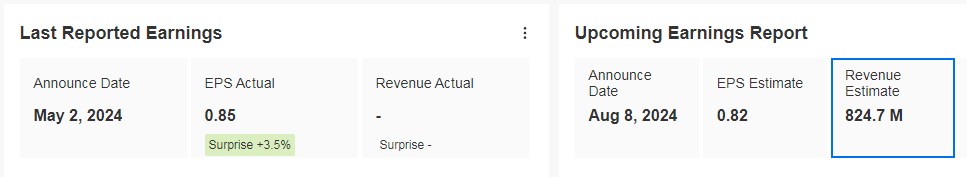

It will release its accounts for the quarter on August 8. Net cash from operating activities increased last quarter by 42.5% year-over-year and the company closed the quarter with a cash balance of $323.43 million. Long-term debt levels were nearly unchanged from a year earlier at $1.33 billion.

Source: InvestingPro

It also conducted a $50 million buyback of its shares at an average price of $39.25 per share.

Looking ahead, growth plans are on track and it is expected to accumulate profits over the long term. For example, its Vietnam project is already coming into production.

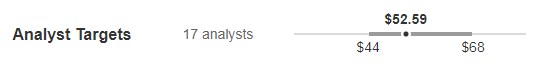

It has 15 ratings, of which seven are buy, eight are hold and none are sell.

The average market target price stands at $52.59.

Source: InvestingPro

3. Golar LNG

Golar LNG Limited (NASDAQ:GLNG) was founded in 1946 as Gotaas Larsen Shipping Company. In 1970 it entered the liquefied natural gas segment and is primarily engaged in the transportation and marketing of liquefied natural gas. It is headquartered in Bermuda.

It has a dividend yield of 2.92% and distributes a large portion of earnings via dividends to shareholders.

Source: InvestingPro

On August 15, it presents its numbers for the quarter. Earnings per share have exceeded expectations in each of the last five quarters. It closed the quarter with a cash balance of $622 million, and over the past 10 years, revenue and EPS have expanded at a compound annual rate of 13.04% and 9.47%, respectively.

Source: InvestingPro

Its Beta is 0.63, implying that the stock moves in the same direction as the market but with lower volatility.

Source: InvestingPro

It has 5 ratings, with all of them being buy and none of them being sell.

The average market target price is at $40.50.

Source: InvestingPro

4. Constellation Brands

Constellation Brands (NYSE:STZ) is an alcoholic beverage company, producer, and marketer of beer and wine with operations in the United States, Canada, Mexico, New Zealand, and Italy. It is the largest beer importer in the U.S. based on revenue.

Headquartered in Rochester, New York, and founded in 1945, it has over 100 brands in its portfolio.

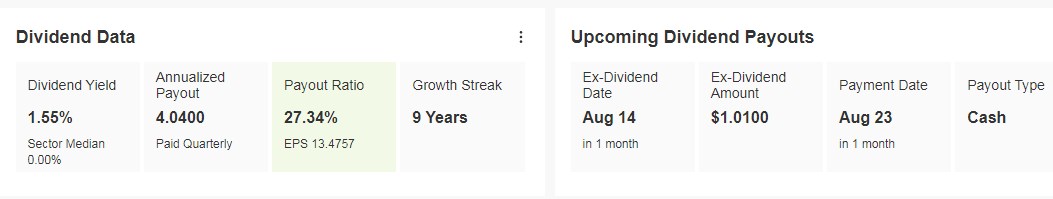

On August 23 it distributes a dividend of $1.010 per share and to receive it you must hold shares before August 14. Since 2015 it has consistently rewarded shareholders with dividends, increasing payments annually for eight consecutive years. The dividend yield is 1.55% and pays out only 27%.

Source: InvestingPro

In addition, it repurchased $200 million in shares during the first fiscal quarter and completed an additional $40 million in repurchases in June, underscoring its strong financial position and commitment to shareholder value.

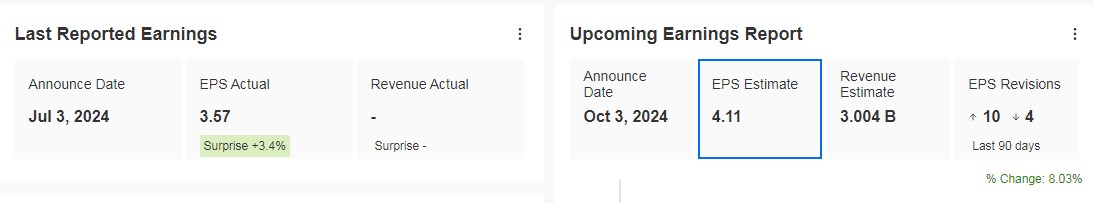

It will report its next results on October 3, having reported its latest on July 3. EPS is expected to increase by 8.03%.

Source: InvestingPro

Financial health is good

Source: InvestingPro

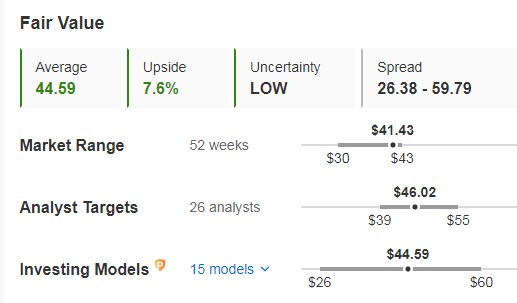

The average market target price is at $300.85.

Source: InvestingPro

5. Verizon Communications

Verizon Communications (NYSE:VZ) is engaged in the provision of communications, technology, information, and entertainment products and services to consumers and businesses worldwide. The company was formerly known as Bell Atlantic Corporation and changed its name to Verizon Communications in June 2000. It was incorporated in 1983 and is headquartered in New York.

It pays a quarterly dividend of $0.665 per share, which adds up to an annualized payout of $2.66 per share. With a dividend yield of about 6.42%, it is a favorite among income-focused investors.

Source: InvestingPro

It reports quarterly numbers on July 22. Earnings per share are expected to be $1.15, with revenue estimates of around $33.02 billion. For the full fiscal year 2024, revenue is expected to be around $135.2 billion.

With an anticipated P/E ratio of around 8.99, it is a relatively good deal at current levels and could be undervalued by about 29%.

Source: InvestingPro

It features 22 ratings, of which 10 are buy, 12 are hold and none are sell. The average market price target stands at $46.02.

Source: InvestingPro

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Are you tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.