Navitas stock soars as company advances 800V tech for NVIDIA AI platforms

In this piece, we’re going to run through some of last week’s important data releases.

Let’s dive right in.

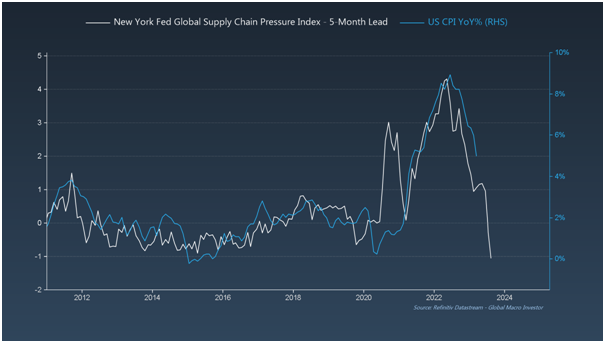

1. New York Fed Global Supply China Pressures Index vs. U.S. CPI YoY%

Another month, another significant drop in CPI, as we’ve been expecting.

Supply Chain Pressures also continue to collapse and lead CPI by five months, which suggests that CPI will be back below 2% sooner than most expect.

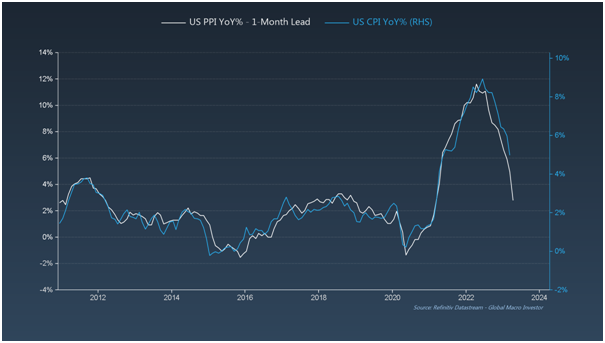

2. U.S. PPI YoY% vs. U.S. CPI YoY%

U.S. PPI also came in below consensus expectations in March (2.7% YoY vs. expectations for 3.0%) and indicated that CPI should already be nearer 3% over the next one to two months.

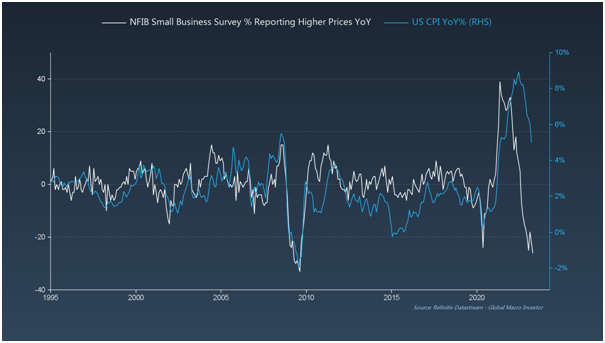

3. NFIB Small Business Survey % Reporting Higher Prices YoY vs. U.S. CPI YoY%

Additionally, according to the latest NFIB data released this week for March, U.S. small businesses continue to report a rapid decrease in prices – current YoY reading is the lowest since July 2009.

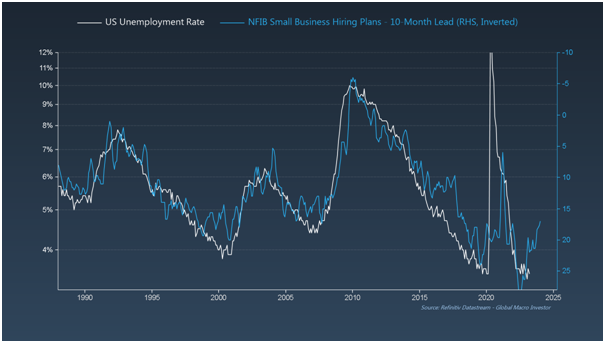

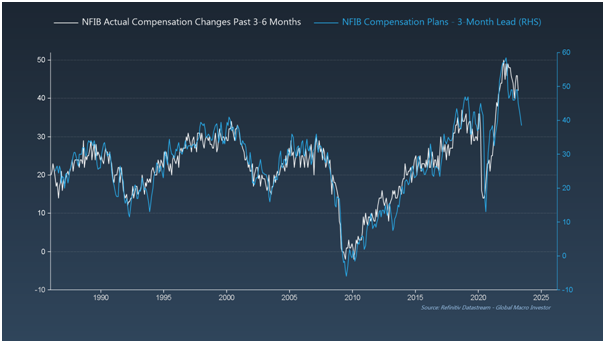

NFIB Hiring Plans also continue to move lower (here inverted) and suggest that unemployment will start to rise very soon, something we’ve been warning about based on how lagging the unemployment data is – here, NFIB Small Business Hiring Plans are advanced by ten months.

Finally, NFIB Compensation Plans are still falling and indicate that wage inflation is yesterday’s news.

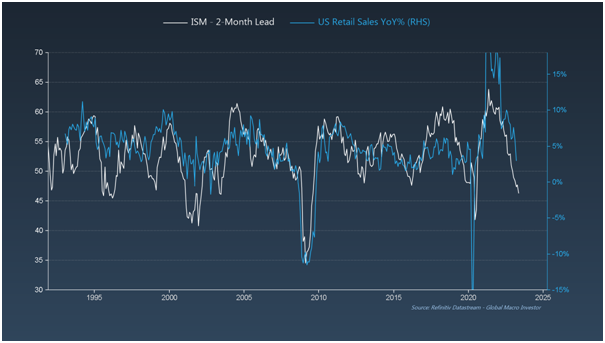

4. ISM vs. U.S. Retail Sales YoY%

March Retail Sales data (also released this past week) posted a big negative surprise and, based on the normal two-month lag versus the ISM, should turn negative over the next couple of months.

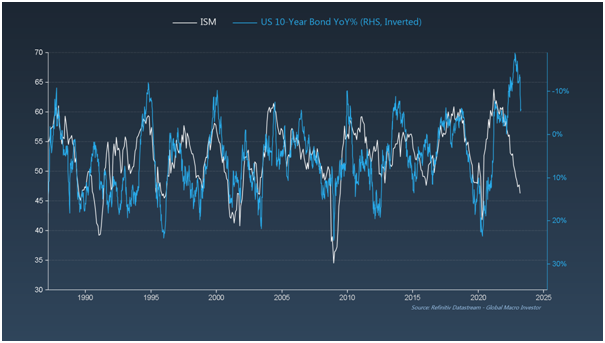

5. Bond Update

Lastly, bonds continue to close the gap versus ISM after reaching one of the most extreme divergences from the business cycle in history. We think the risk/reward for bonds here is still extremely attractive and continue to believe that these alligator jaws will close via bond prices rising.

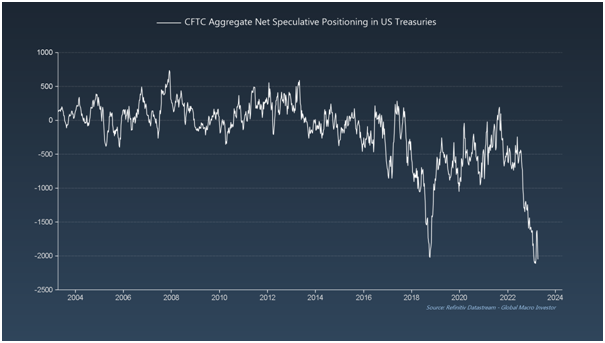

And everyone is still extremely short, which is providing fuel for the fire.

Conclusion

As we’ve been expecting, inflation data continues to collapse, and coincident data like retail sales and imports are still slowing – the perfect environment for bonds – and the large short position only increases our conviction around the trade.

***

Want to read these the moment they come out? Sign up entirely free for my newsletter, Short Excerpts From Global Macro Investor here. New articles are published every single Sunday.