AlphaTON stock soars 200% after pioneering digital asset oncology initiative

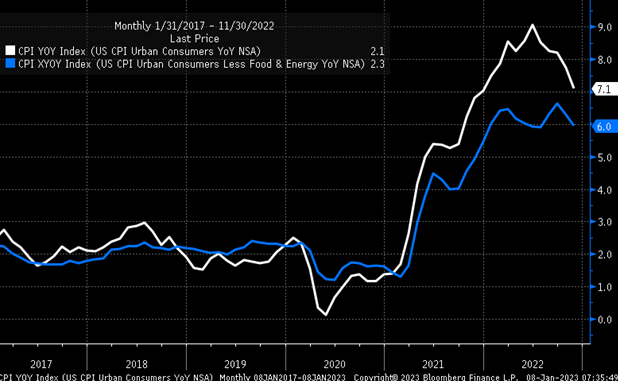

It will be a big week for inflation, with the CPI report on January, with estimates of a 6.5% increase y/y, down from 7.1% in November. We will get import and export prices on Friday and the University of Michigan sentiment numbers.

Jay Powell will be in a Q&A session on Tuesday, Jan. 10, at a Central Bank Independence event. Not sure how much monetary policy discussion there will be, but it could open the door for Powell to talk about the importance of financial conditions and that the Fed’s fight against inflation isn’t over.

Friday’s rally made little sense, given the strong unemployment reading and recessionary-like numbers from the ISM Services report. The S&P 500's rally was twofold, driven by a weaker US dollar and due to implied volatility declining sharply. During the past year, we have seen these types of rallies over and over.

The rally looks like a cup, an up-sloping handle, or a rising flag. The outcome will likely be the same in both cases, an index that reverts to 3,800.

1. 9-Day VIX

The 9-day VIX Index fell sharply on Friday, and it seems likely that heading into Powell on Tuesday and the CPI report on Thursday, we should see implied volatility rise some, which is likely to push equity prices down.

2. CPI

I have no idea whether the CPI report comes in hotter or cooler. I am interested in seeing what happens when CPI and core CPI come closer in line with one another and whether or not CPI gets stuck in the 5 to 6% region.

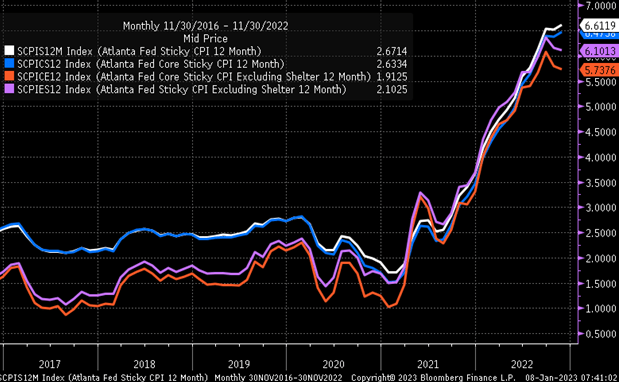

Given that the sticky measures of the CPI have still been rising and seem to be in the upper 5 to 6% region, we are at the point that if the CPI is going to stick, this is the time we should see that develop.

The Cleveland Fed’s 16% trimmed mean CPI is firmly in the 6.6% region.

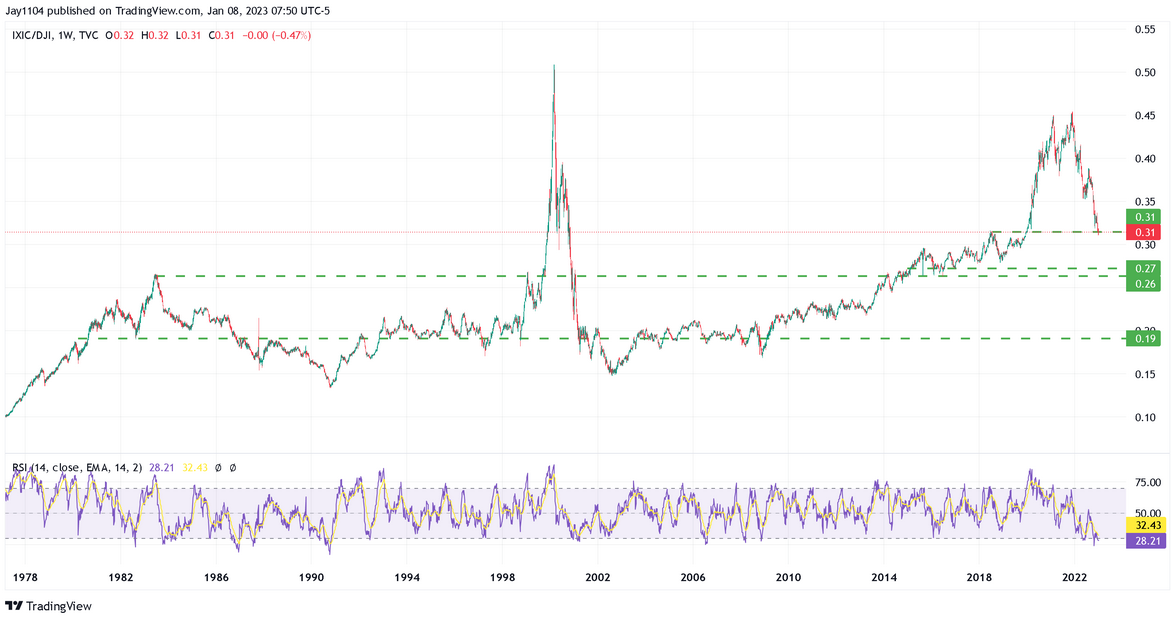

3. Dow

The Dow’s outperformance continues to be a bit of a mystery to me; it could simply be that money is rotating out of high-growth Nasdaq 100 names and back into the more steady blue-chip Dow names. While I would admit, I’m not sure how that works because Microsoft (Nasdaq:MSFT), Apple (Nasdaq:AAPL), and Salesforce (NYSE:CRM) are in the Dow.

Still, the Dow is a price-weighted index, so stocks like Goldman Sachs (NYSE:GS) and United Health have a much more significant impact than Microsoft, Apple, and Salesforce. We have seen this type of rotation before, during previous Nasdaq bubble cycles. If this is right, then the Dow still has much further to rise, or the Nasdaq has much further to fall.

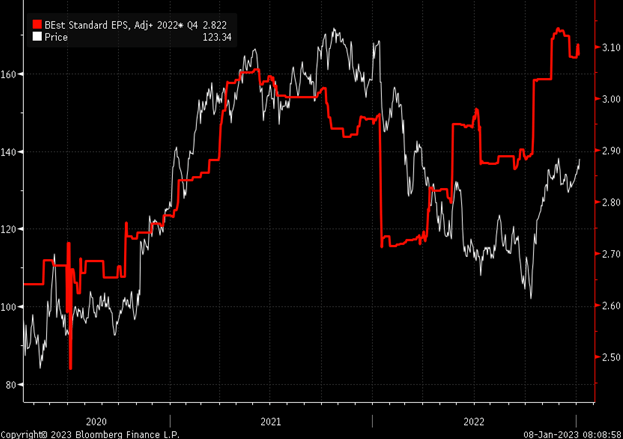

4. JP Morgan

JP Morgan (NYSE:JPM) will report results on Friday, the 13th, to kick off the earnings season. Earnings estimates for JP Morgan have been on the rise for fourth-quarter results and have helped boost the stock’s share price, which probably means the company will need a beat and raise quarter to keep the shares rising. I’m not sure we are in a beat-and-raise environment, but what do I know?

5. Bank of America

Bank of America (NYSE:BAC) will also report results on Friday the 13th too, but unlike JP Morgan, Bank of America’s quarterly estimates have been dropping and are at the lower end of the range. It makes one wonder why the shares have been rising.

It suggests the market thinks results will come in better than expected, which means that Bank of America will need to deliver better-than-expected results to keep the shares moving higher, or the stock is probably heading back to its recent lows.

6. Citigroup

Meanwhile, Citigroup (NYSE:C) will also report on Friday morning, and like Bank of America, the shares have been rising while the earnings estimates have been falling.

It does make you wonder, though, why analysts are upping the estimates for JP Morgan while cutting forecasts for Bank of America and Citigroup. It likely means that either JP Morgan’s estimates are too high or Bank of America and Citigroup’s estimates are too low.

Anyway, best of luck this week.