European stocks retreat on tech valuation concerns; U.K. economic woes

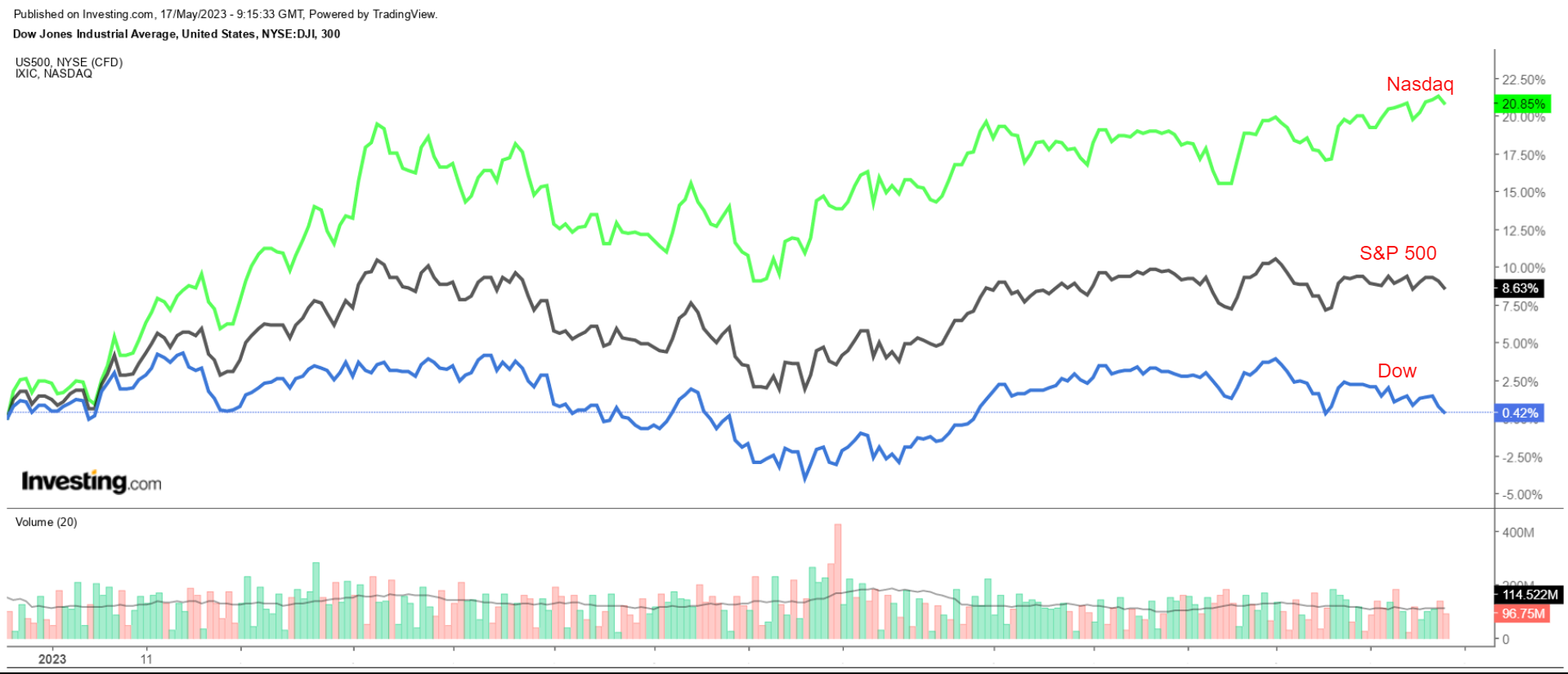

- The Nasdaq Composite has outperformed the S&P 500 and the Dow Jones Industrial Average by a wide margin thus far in 2023.

- High-growth tech stocks have come back in favor following last year’s extreme selloff as money flows back into the sector.

- As such, I used the InvestingPro stock screener to find high quality, undervalued technology gems to buy now with strong upside ahead.

- Looking for more top-rated stock ideas to protect your portfolio amid the increasingly uncertain economic climate? Members of InvestingPro get exclusive access to our research tools and data. Learn More »

The tech-heavy NASDAQ has been the best performer of the three major U.S. indices by a wide margin so far in 2023, surging 22.8% as investors rotated back into the beaten-down growth stocks of yesteryear.

That compares to a 7.3% year-to-date increase for the benchmark S&P 500 index and a 0.3% decline for the blue-chip Dow Jones Industrial Average.

Taking that into consideration, I used the InvestingPro stock screener to identify the best undervalued technology stocks to buy amid the current market environment.

With InvestingPro, you can conveniently access comprehensive information and outlook on a company in one place, eliminating the need to gather data from multiple sources such as SEC filings, company websites, and market reports.

In addition to analyst targets, InvestingPro provides a single-page view of complete information, saving you time and effort. Try it out for a week for free!

My Methodology:

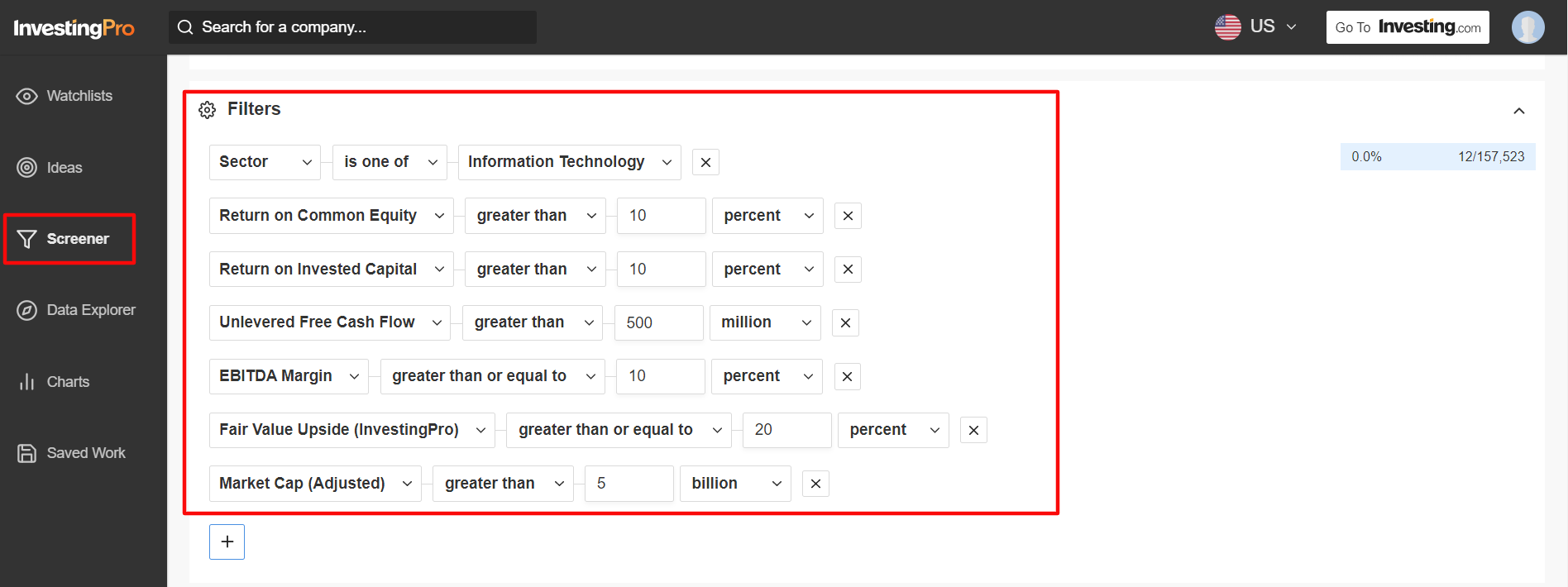

Using the InvestingPro stock screener, I ran a methodical approach to filter down the 7,500-plus stocks that are listed on U.S. exchanges into a small actionable watchlist of high quality technology companies that are expected to provide investors with solid returns in the months ahead.

My focus was on tech companies that have strong upside, solid profitability, a healthy balance sheet, positive free cash flow, and robust growth prospects.

To find those companies I first scanned for names with a 10% or above return on common equity (ROCE). Generally, a high ROCE indicates a firm is generating high profits from its equity capital. It is a ratio used to measure the amount of profit or net income a company earns per investment dollar.

Source: InvestingPro, Screener Screen

I then looked for stocks that also had a greater than 10% return on invested capital (ROIC), which is a financial metric that can help with assessing whether a company is creating value with its investments.

I then narrowed that down to businesses with at least 10% average annual growth in EBITDA margins, which is a popular and widely used profitability metric. It measures how much in earnings a company is generating before interest, taxes, depreciation, and amortization, as a percentage of revenue.

The last and final profitability measure I chose to screen for were companies with unlevered free cash flow (UFCF) greater than $500 million. Essentially, UFCF can help determine the cash generated from a company’s core operations. Firms capable of generating high UFCFs possess more discretionary cash which can be allocated to reinvestments into operations or to fund future growth strategies.

Finally, I filtered for names with an InvestingPro ‘Fair Value’ upside greater than or equal to 20%. The fair value estimate is determined according to several valuation models, including price-to-earnings ratios, price-to-sales ratios, and price-to-book multiples.

And those companies with a market cap of $5 billion and above made my watchlist.

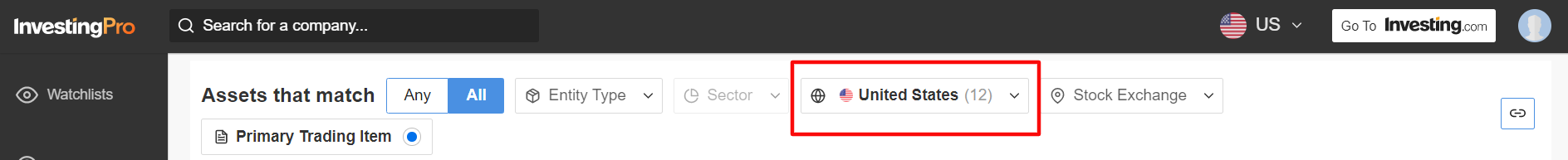

Once the criteria were applied, I was left with a total of just 12 companies.

Source: InvestingPro, Assets That Match Screen

Not surprisingly, 11 of them currently enjoy an InvestingPro ‘Financial Health’ score above 2.75. That’s important as companies with health scores greater than 2.75 have outperformed the broader market by a wide margin over the past 7 years.

7 Undervalued Tech Gems to Buy Now:

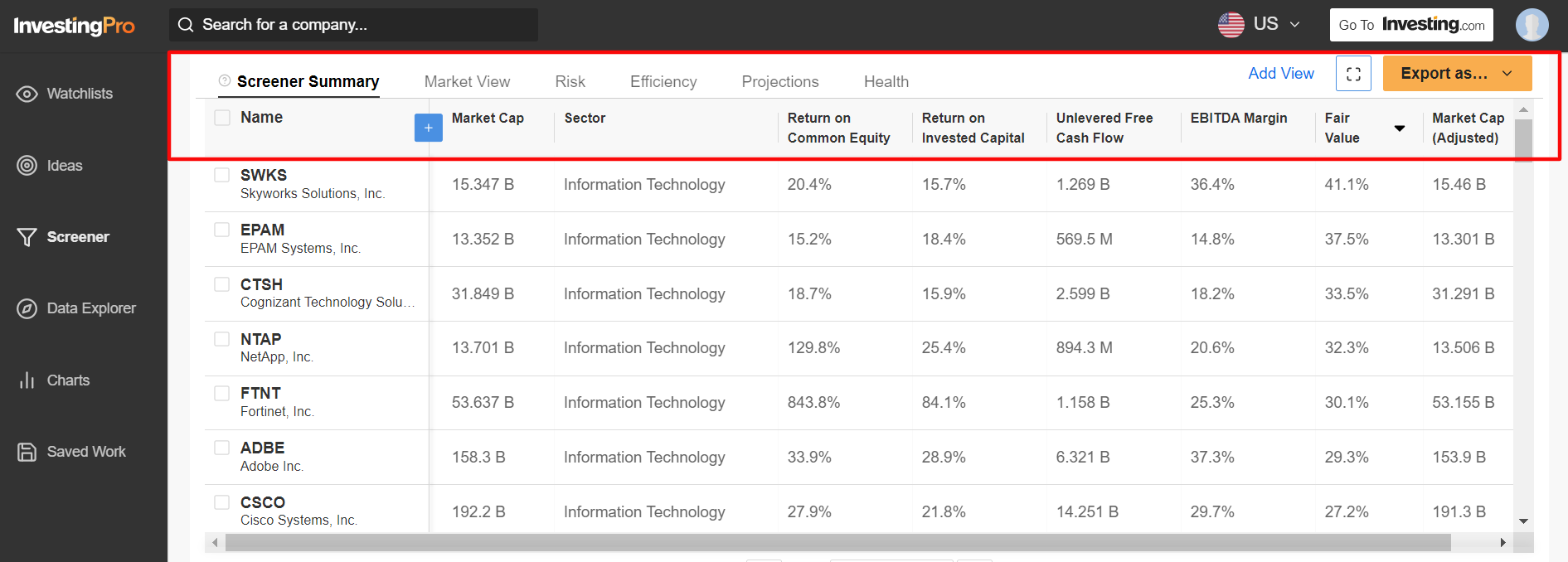

As such, these are the 7 most promising undervalued tech gems which are expected to provide the highest return in the coming months based on the InvestingPro models:

- Skyworks Solutions (NASDAQ:SWKS) (Fair Value Upside: +41.1%)

- EPAM Systems (NYSE:EPAM) (Fair Value Upside: +37.5%)

- Cognizant (NASDAQ:CTSH) (Fair Value Upside: +33.5%)

- NetApp (NASDAQ:NTAP) (Fair Value Upside: +32.3%)

- Fortinet (NASDAQ:FTNT) (Fair Value Upside: +30.1%)

- Adobe (NASDAQ:ADBE) (Fair Value Upside: +29.3%)

- Cisco Systems (NASDAQ:CSCO) (Fair Value Upside: +27.2%)

Source: InvestingPro, Screener Summary

Source: InvestingPro, Screener Summary

For the full list of the 12 technology gems that made my watchlist, start your free 7-day trial with InvestingPro now!

If you're already an InvestingPro subscriber, you can view my selections here.

Here is the link for those of you who would like to subscribe to InvestingPro and start analyzing stocks yourself.

***

Disclosure: At the time of writing, I am short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.