Starbucks union plans Red Cup Day strike in 25+ cities - Bloomberg

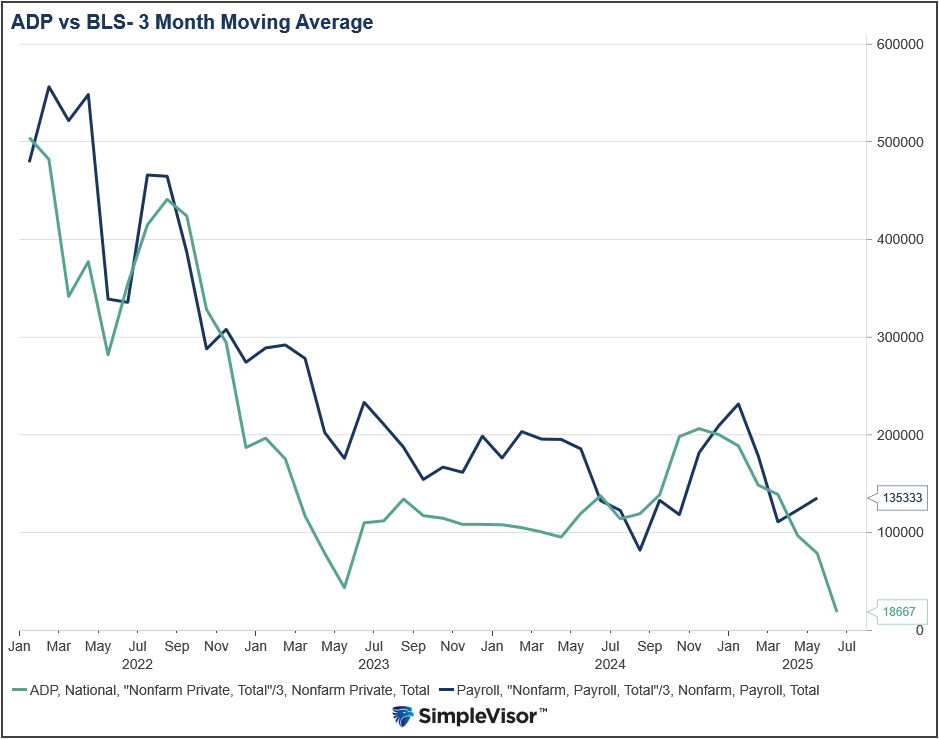

The Fed and most investors primarily assess the labor market based on the monthly BLS employment report. To better guide those estimates, various reports, such as the monthly ADP report, can be helpful. We say “can be” because, since the pandemic, ADP has been less correlated with the BLS than it was before the pandemic.

Regardless, ADP is a more accurate gauge of the labor market, as it utilizes actual payroll records from over 400,000 businesses. In contrast, the BLS relies on surveys of approximately 150,000 companies and individuals.

ADP’s recent trend and yesterday’s data are worth noting. ADP was expected to report that the economy gained 99k jobs. Instead, they said it lost 33k jobs, the first decline in over two years. The graph below compares the three-month moving average of the change in ADP and the BLS payrolls growth. As shown, ADP job growth is averaging 18,667 new jobs a month, almost 100k less than the BLS is reporting.

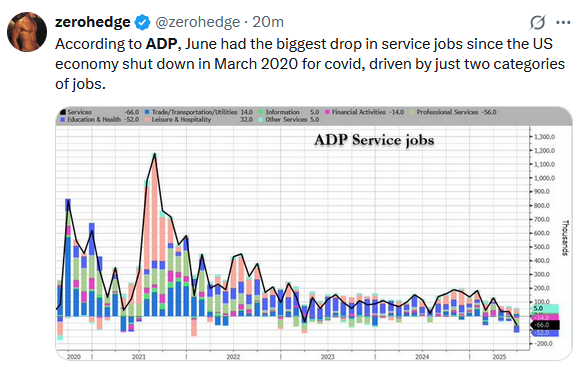

While it’s easy to blame tariffs for recent weakness, the Tweet of the Day, courtesy of ZeroHedge, below shows something more concerning. According to the ADP, June saw the largest decline in service sector payrolls (-66,000) since March 2020. While 52k of the losses came from education and health, which tend to be seasonally volatile, the trend is poor. The current estimate for the BLS is +100k. ADP data argues we could get a surprise catch down. Stay tuned!

What To Watch Today

Earnings

- No earnings releases today.

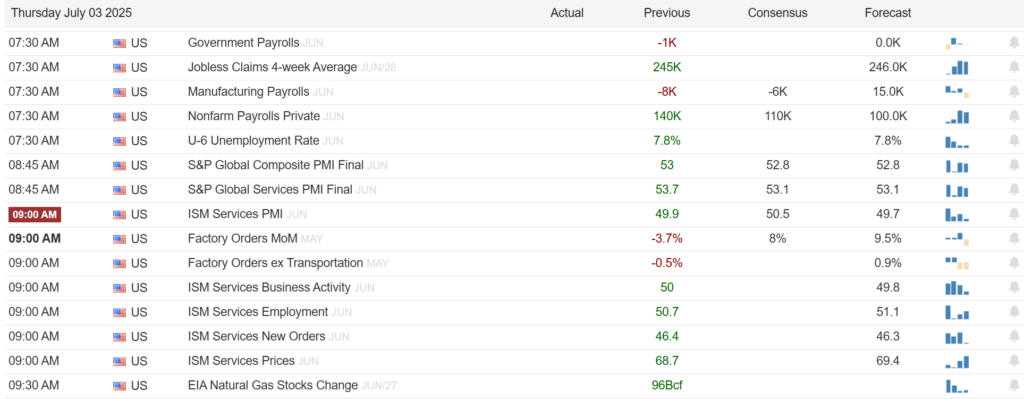

Economy

Market Trading Update

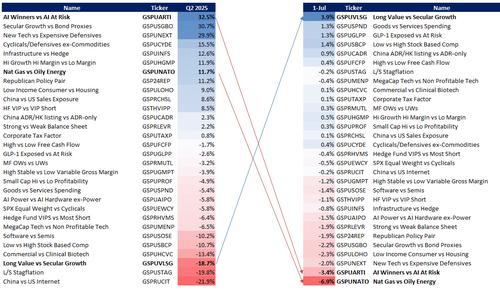

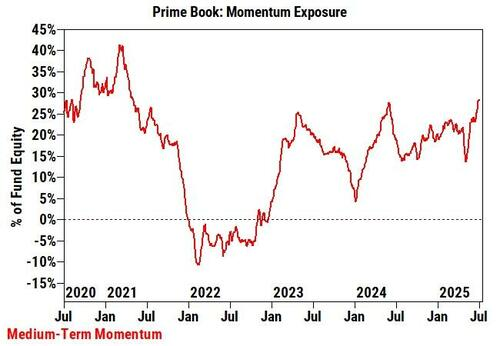

Yesterday, we presented the bull/bear case for the market. Interestingly, there was a sharp market rotation on Tuesday as momentum gave way to value stocks, as shown.

Yesterday, we saw the AI leaders lead the charge once again as managers added to those holdings heading into earnings season, which begins with the financials late next week.

Despite the more bearish commentators who keep looking for any catalyst for a pullback, the momentum trade continues to be the market driver from the “Liberation Day” lows.

With that stated, the market is indeed overbought on several levels, with the deviation from the 50-DMA becoming more extended. We will likely see a pullback towards the recent breakout levels to turn that previous resistance level into support. However, those pullbacks will likely be bought by professional investors still trailing the market and underexposed.

Continue to hold long exposure in portfolios as there are few catalysts for a pullback, particularly with expectations for earnings vastly lowered. We continue to think that the next potential for a more significant correction (3-5%) will not come until later this summer. However, as is always the case, the unexpected happens, so continue to manage portfolio risk accordingly.

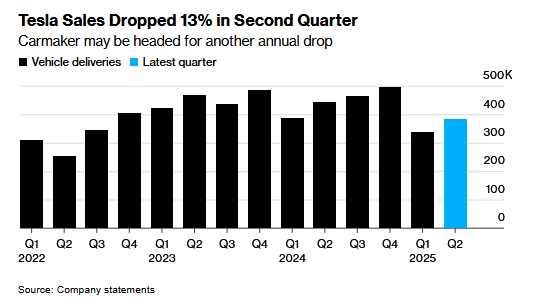

Tesla Car Sales Stagnate

Tesla (NASDAQ:TSLA) reported a 13.5% decline in global vehicle deliveries for the second quarter, with 384,122 vehicles delivered compared to 443,956 the previous year. The decline follows a similar 13% drop in the first quarter. As things stand now, Tesla is on course for a second consecutive annual sales decline.

Its weakness, as shown below courtesy of Bloomberg, is driven by a combination of factors, including an aging vehicle lineup, increased competition from other automakers, and, more recently, a backlash against CEO Elon Musk’s political stances.

To help improve its revenue, Tesla is rapidly advancing its robo taxi business and promises more affordable models. Neither has impacted sales to this point. While those may help on the sales front, new headwinds in the form of intense competition from China and the likely rollback of regulatory credits may offset any gains it can make.

The second graph below shows that the share price of Tesla has stagnated alongside its sales. That said, it still has much more expensive valuations than its chief competitors.

Behind The Meter Solutions- Investment Guide

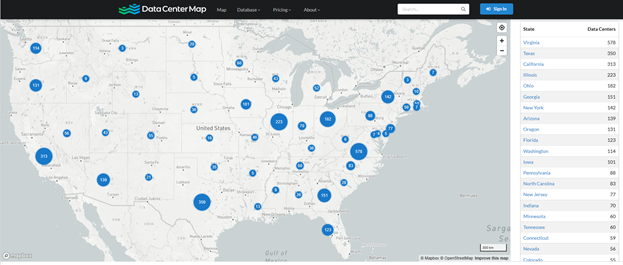

Part 1 of this article explained how data centers are leveraging the abundance and relative affordability of natural gas to fuel Behind the Meter (BTM) power generators. Part Two advances the discussion to investing in this promising innovation.

This article looks past the data center operators and focuses on the natural gas pipelines and the manufacturers of natural gas power plant equipment. We also highlight a couple of well-traded ETFs with exposure to behind-the-meter solutions and a company with a unique product for on-site power generation. Lastly, we address some key considerations and risks associated with such investments.

Tweet of the Day