IonQ CRO Alameddine Rima sells $4.6m in shares

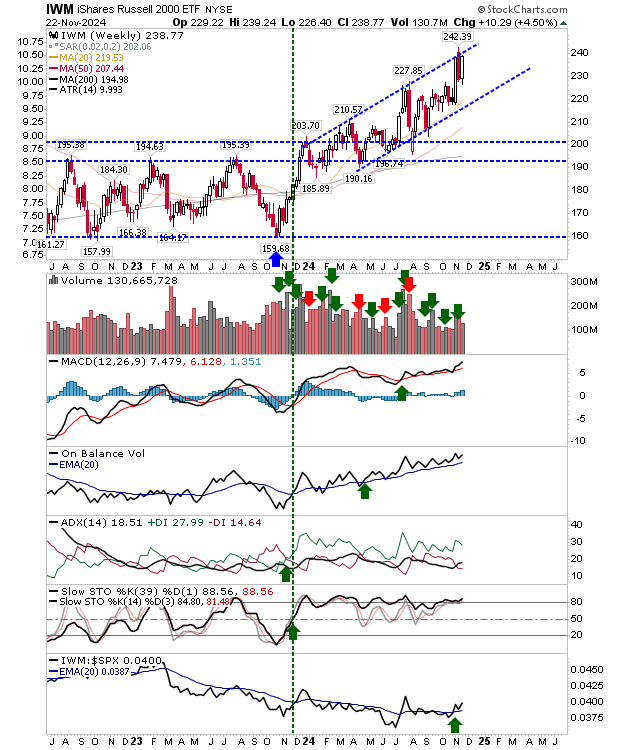

Since the successful test of 20-day MAs earlier last week it has been an uptrend for markets. The Russell 2000 (IWM) has been the clear winner, although the S&P 500 and Nasdaq have enjoyed more modest gains.

If we look at the weekly chart of the Russell 2000 ($IWM) we see a real-body candlestick recovery of all of the prior week's losses with only the spike high to go.

With the existing upward channel dating back to 2023 still intact, we can now look for an accelerated move higher to take the index out of this channel and into a new phase for its bull market.

Support for this move comes from an upside trend in On-Balance-Volume and strong (stochastic) momentum. There is also an uptick in relative performance over the S&P.

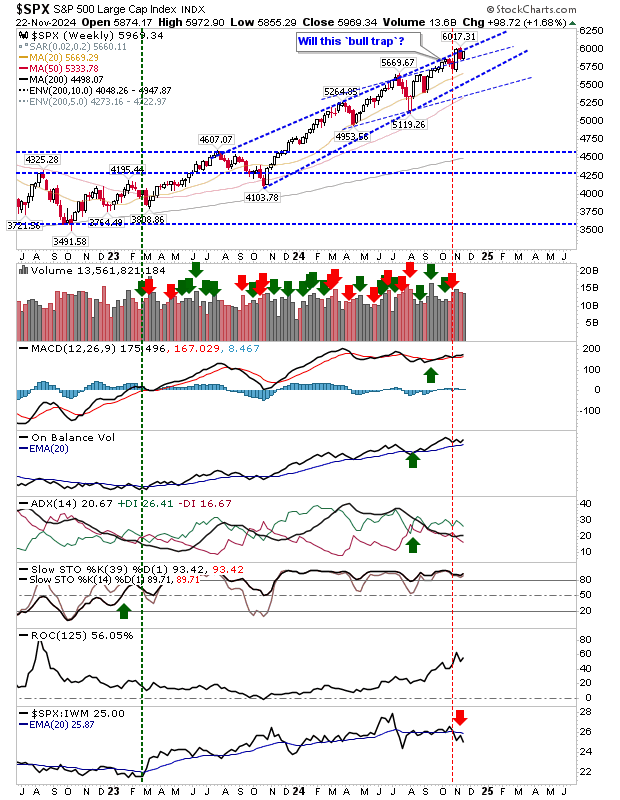

The S&P has already emerged from one channel resistance and is finding itself up against another; break that, and it's in fresh air.

Technicals are in good shape, particularly On-Balance-Volume, which has been rallying steadily since 2023. This is an important time for the index and could set a bullish precedent for 2025.

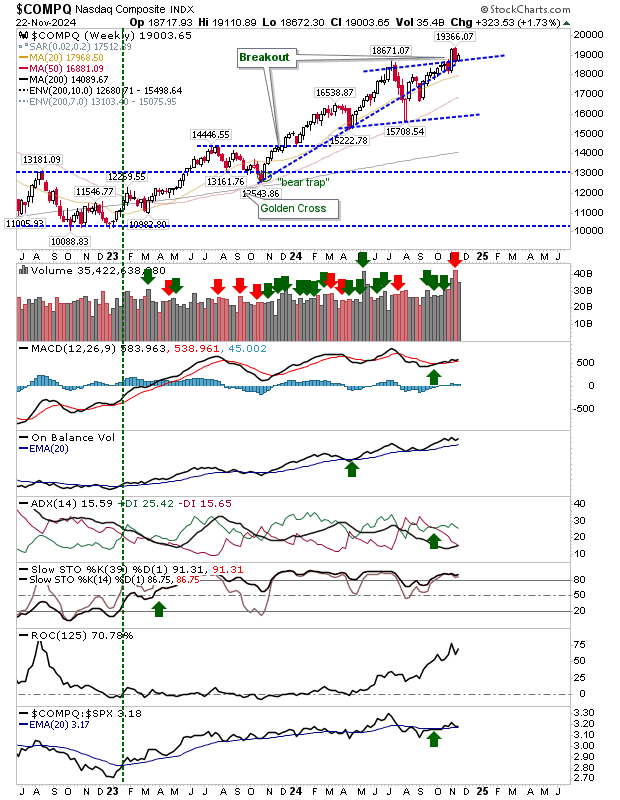

The Nasdaq had set up for a bear squeeze in the early part of November but has managed to break the squeeze. Last week's action counted as a successful support test. This gives bulls another index to work with.

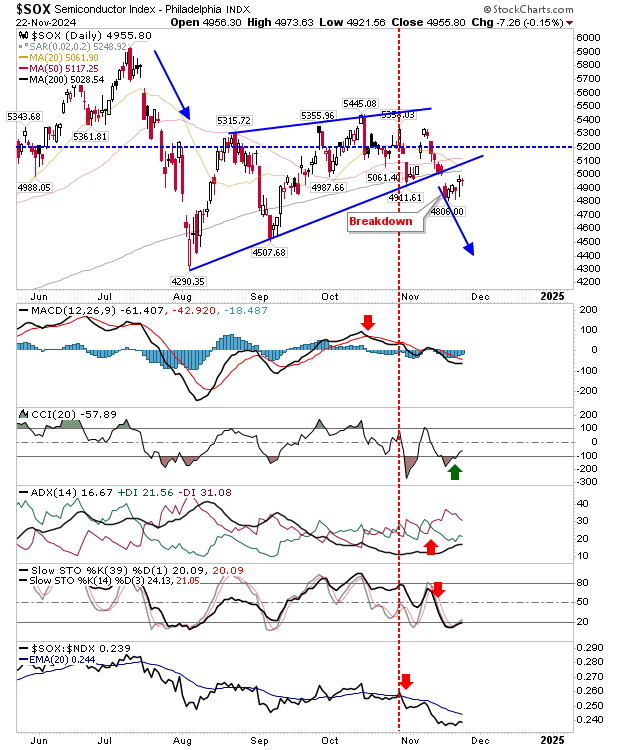

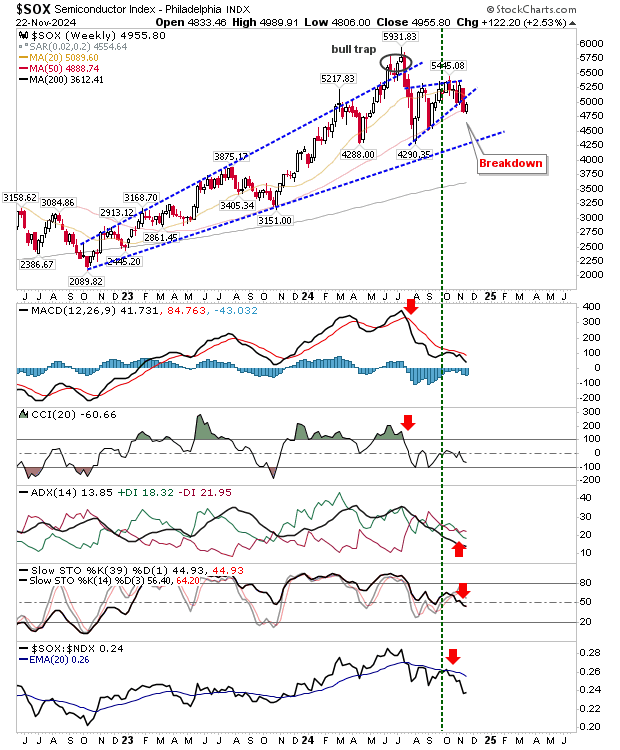

The trouble starts with the Semiconductor Index. Its struggles haven't changed despite last week's gains for indices. The gap down from the bearish wedge hasn't closed, and moving averages remain overhead resistance.

The 2022-24 trendline remains the most likely target should losses continue in the Semiconductor Index.

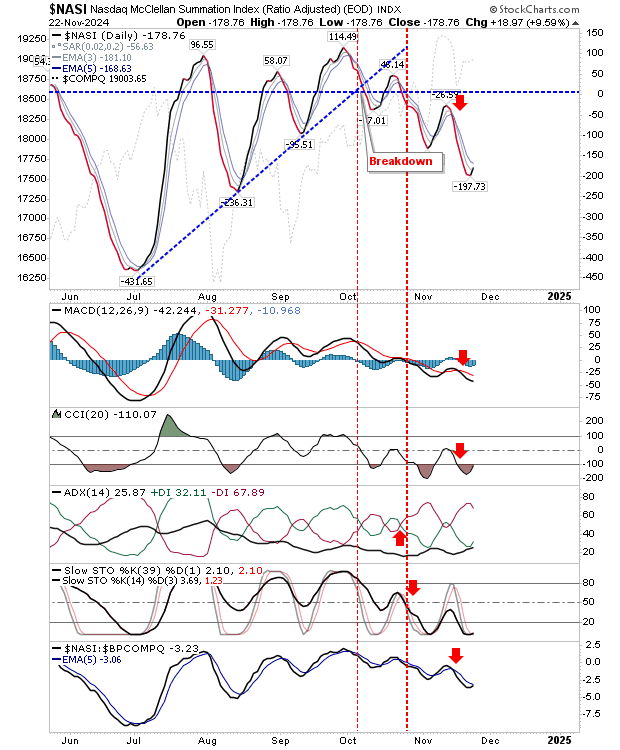

Nasdaq breadth metrics are no better. The Nasdaq Summation Index has been struggling since October and last week's gains didn't change that.

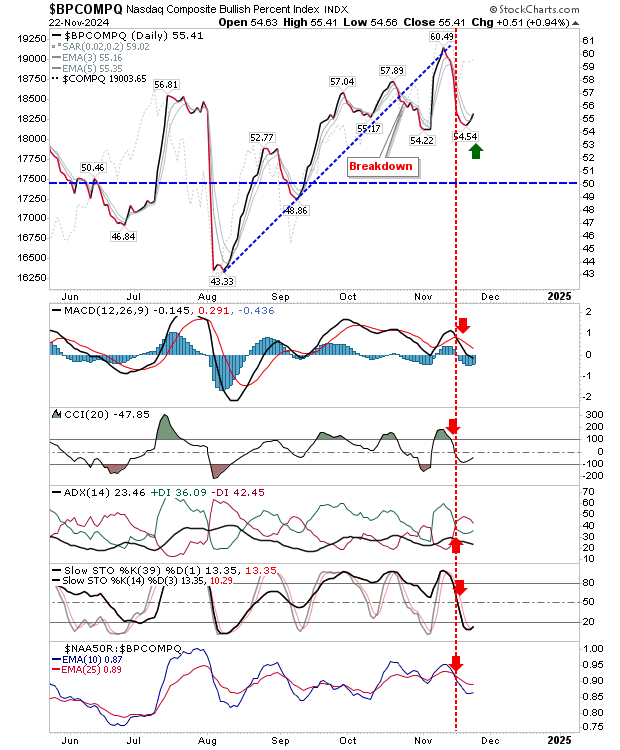

Likewise, bullish percentage of Nasdaq stocks on a point-n-figure 'buy' signal has also stalled a little after its trend breakdown.

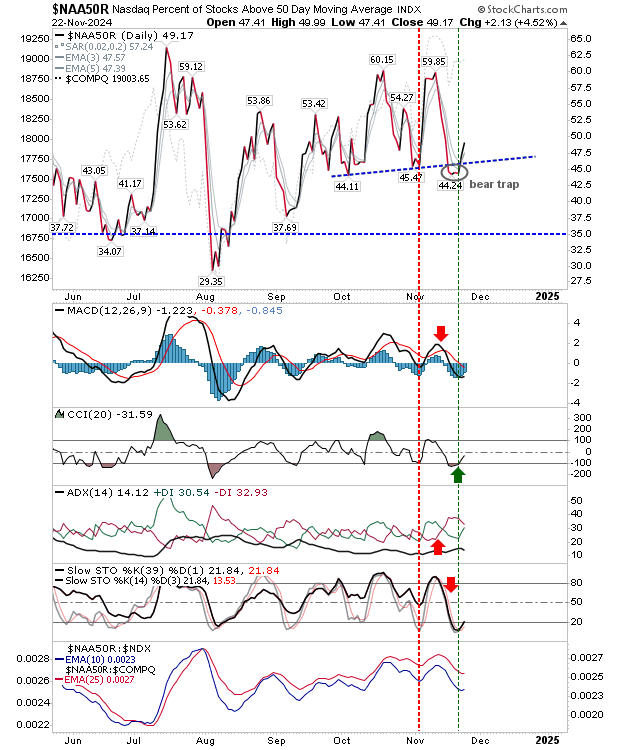

Although we may have a possible 'bear trap' in the percentage of Nasdaq stocks above their 50-day MA; this might be the silver lining that feeds into the next stage of the rally.

There is still seasonal good will to look forward to as we head into holiday season. I'll be watching for rallies to accelerate, while the media fits a story around whatever comes next.