Oracle stock climbs on TikTok deal progress, OpenAI fundraise talks

- Nasdaq 100's H1 2023 rally was the fastest rise since 1999

- Interest rate cuts unlikely this year in the US

- So, where will the index's ongoing rebound end?

- InvestingPro Summer Sale is on: Check out our massive discounts on subscription plans!

The Nasdaq 100 achieved remarkable gains of nearly 37% in the first half of the year, marking its best performance in over 20 years since 1999. This raises concerns about a potential repeat of the dot-com bubble, and this time primarily because of the Artificial Intelligence (AI) boom. Despite the absence of market panic, several factors suggest the possibility of a continued correction.

The Federal Reserve's firm stance on maintaining hawkish monetary policy is worth noting, with a potential interest rate hike expected in July. Additionally, there has been a significant outflow of capital from technology companies since June 21, reported by Bank of America at $2 billion, representing the largest drop in 10 weeks. Furthermore, upcoming U.S. economic data at the end of the week could significantly influence the Federal Reserve's decision.

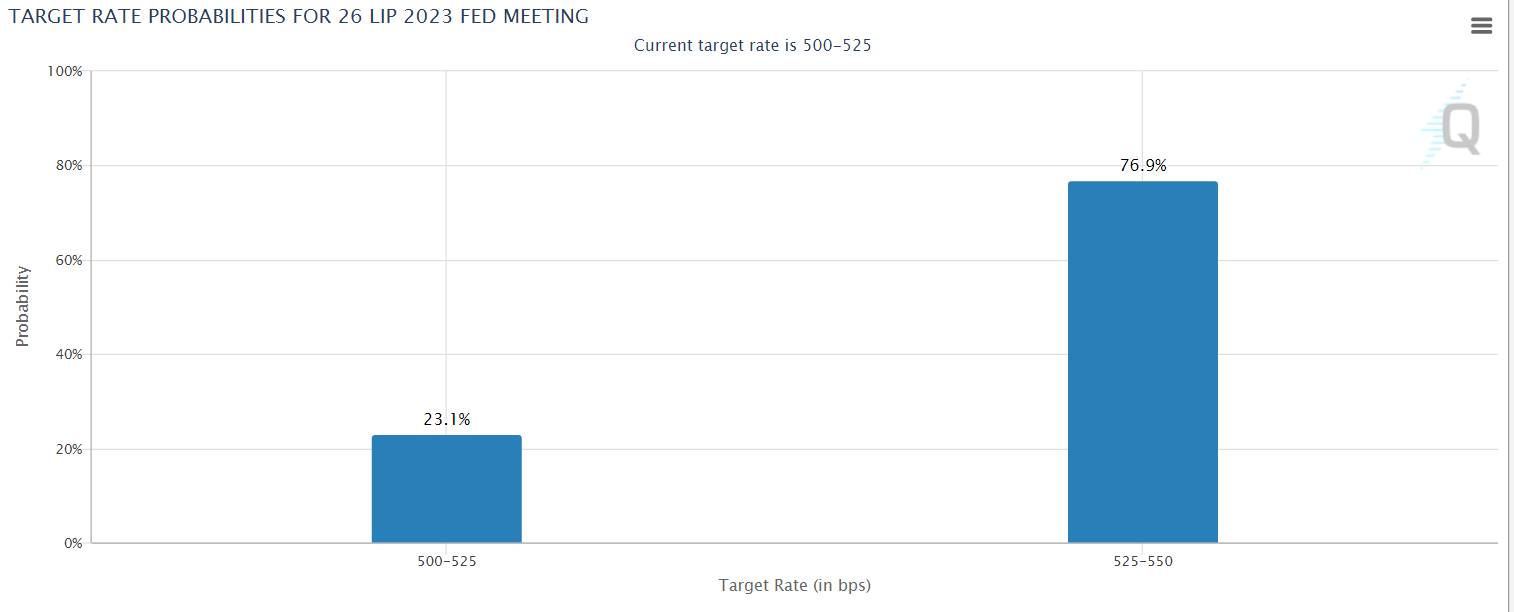

The primary threats to market bulls are the Federal Reserve's actions and declining liquidity. The market currently indicates an approximate 80% probability of a 25bp interest rate hike at the next Fed meeting, which is considered the baseline scenario. Predictions also suggest maintaining interest rates between 5.25% and 5.55% until the end of the year.

Declining liquidity, often linked to capital outflows from the stock market, could also contribute to the declines. This time, the primary competition for risky assets may come from U.S. government bonds as they seek to address budgetary requirements following a deadlock over raising the debt limit.

Considering the ongoing balance sheet reduction, the Federal Reserve might be hesitant to boost liquidity solely to sustain gains on Wall Street.

GDP, Consumer Spending Price Index on Investors’ Radar

Investors will closely monitor the upcoming release of important macroeconomic data from the U.S. economy. Of particular importance is the GDP data, including associated indicators, scheduled for Thursday.

If the consensus of a 1.4% quarter-on-quarter growth rate is realized, it would indicate a continuation of the declining economic growth observed since the beginning of the year. Fed expects that the U.S. will avoid a recession in 2023.

On Friday, PCE inflation, Fed's preferred inflation gauge, will come out.

Current predictions do not appear very optimistic, as they assume the absence of a disinflationary impact. This could provide a convincing argument for Jerome Powell and his colleagues to consider raising interest rates.

Nasdaq 100: There Is Room for Further Declines

The Nasdaq 100 index is going through a corrective phase and forming a flag pattern.

If the price remains within the formation and the sellers can break through the local support around 14900, the downward movement would likely continue. Sellers are targeting the area around 14200-14100, which is a confluence of the equality of corrections and a demand zone.

However, a strong upward breakout from the top of the channel would invalidate the downward scenario and potentially lead to an attempt to reach new highs.

Access first-hand market data, factors affecting stocks, and comprehensive analysis. Take advantage of this opportunity by visiting the link and unlocking the potential of InvestingPro to enhance your investment decisions.

And now, you can purchase the subscription at a fraction of the regular price. So, get ready to boost your investment strategy with our exclusive summer discounts!

As of 06/20/2023, InvestingPro is on sale!

Enjoy incredible discounts on our subscription plans:

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

Don't miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the Summer Sale won't last forever!

Disclaimer: This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest, nor is it intended to encourage the purchase of assets in any way.