EchoStar stock soars after SpaceX valuation set to double

This article was written exclusively for Investing.com

- Commodities are the strongest asset class once again, building on massive 2021 gains

- Energy’s strength has recently given DBC a significant boost

- Recession risks and resistance on the chart warrant a cautious view looking out through the rest of the year

China is re-opening, summer travel season is in full swing, and news on the Russia/Ukraine front is no better. All these factors are tailwinds for commodities. The Invesco DB Commodity Index Tracking Fund (NYSE:DBC) is perhaps the most popular way to play the broad commodity complex. While the ETF is most heavily weighted into energy-related commodities, you’ll get some agricultural and industrial metal exposure, too.

A Banner Year for Commodities... Again

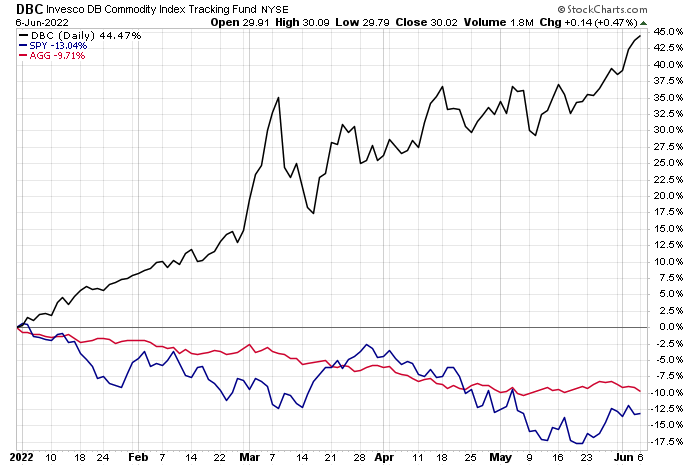

Year-to-date DBC is up a whopping 45% while stocks and bonds, as measured by SPY and AGG, are down 13% and 10%, respectively. Commodities, once dismissed as a legitimate asset class for investors to own, are crushing most traditional investments this year.

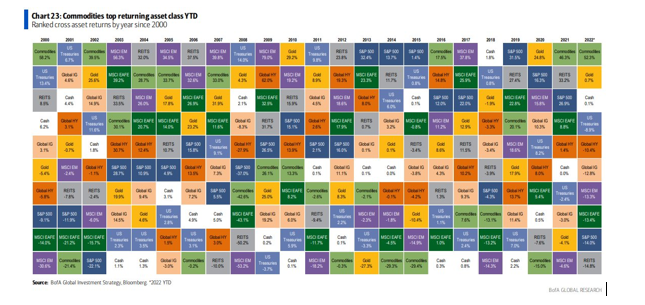

In 2021, commodities were the best-performing major asset class, too, according to Bank of America Global Research.

Commodities, Stocks, and Bonds Year-to-Date

Source: Stockcharts.com

Annual Asset Class Return Quilt: Commodities Going Back-to-Back in 2021 and 2022

Source: BofA Global Research

Impressive Momentum

DBC features excellent liquidity but comes at a somewhat steep expense ratio of 0.85%, according to Invesco. NY Harbor ULSD, gasoline, Brent crude, and WTI crude together make up more than half of the fund’s portfolio.

Not surprisingly, the ETF settled at a fresh 11-year high earlier this week as oil and gasoline prices keep ticking up. If momentum continues, it’s just a matter of time before DBC cracks to the highest prices since the 2007-08 commodity boom.

DBC Since 2007: Support at $26 from the 2014 Breakdown Point

Source: Stockcharts.com

Expecting a DBC Retreat

I think commodities might begin to struggle at some point soon, despite all the tailwinds mentioned earlier. We’ll get a key CPI report Friday morning, and it will likely support the narrative that peak inflation has indeed happened.

Moreover, economic growth concerns cascading across the globe should eventually become a significant headwind.

I concede that recent multi-year closing highs are nothing to scoff at—any technical analyst must acknowledge that. But history shows that commodities often succumb to recession risks when those arise.

The Play on DBC

On DBC, I believe a pullback to the 2014 breakdown levels will eventually happen this year. That’d be a drop of 15-20% on DBC to the $24-$26 range. On the upside, if DBC breaks out above the 2011 high at $32, then the all-time high in the upper-$40s could be in play over the ensuing years.

Understanding Commodity Pricing

Traders must also consider that the stock market is very much a forward-looking mechanism, whereas commodities trade in monthly contracts. That means those markets are much more near-term oriented.

Just take a look at the forward curves of key commodities like WTI, RBOB gasoline, and natural gas. All of them are heavily backwardated. Backwardation is when the prompt-month contract trades at a significant premium to future months.

That’s a bullish signature for the near term but might imply that prices six months or one year from now could be significantly lower.

The Bottom Line

Momentum is clearly on the side of the commodity bulls right now. I would use any additional strength to trim profits. Watch the $32 level for upside resistance and $26 for downside support.