Gold prices dip as December rate cut bets wane; economic data in focus

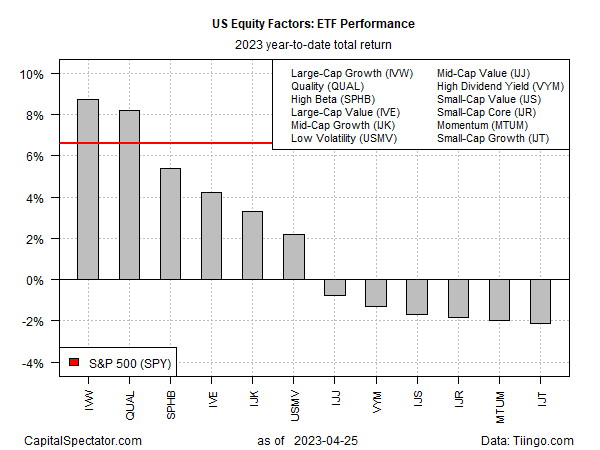

Big-cap growth is back. After taking a back seat to various flavors of small-cap and value factors earlier in 2023, the large-company growth risk factor is again leading the horse race based on year-to-date returns for a set of ETF proxies through yesterday’s close (Apr. 25).

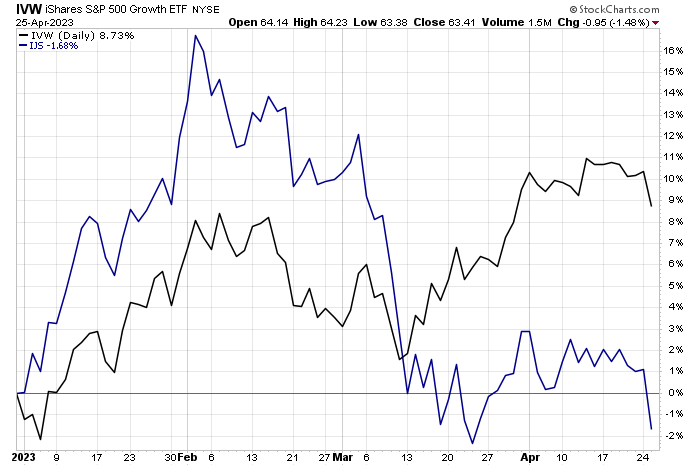

A month ago, it looked like the long-running domination of big-cap growth was faltering, inspiring a new round of forecasts that small-cap and value stocks would lead. But the tide has turned again, and iShares S&P 500 Growth ETF (NYSE:IVW) is the top performer so far this year.

After stumbling earlier in 2023 while small-cap-value stocks surged (IJS), big-cap growth has rebounded and is currently the top factor performer for 2023 with an 8.7% return. Meanwhile, small-cap value (IJS) has again fallen on hard times after a solid start to the year.

A close second to big-cap growth is iShares MSCI USA Quality Factor ETF (NYSE:QUAL) for year-to-date factor results. The fund, which targets companies with positive fundamentals, such as high return on equity and stable year-over-year earnings growth, is up 8.2%, just fractionally behind IVW.

Half of the factor opportunity set is in the red in 2022. The small-cap and momentum factors are suffering the most. Small-cap growth (IJT) is currently posting the biggest loss via a 2.1% decline so far this year.

The broad US stock market, based on SPDR S&P 500 (NYSE:SPY), is up a solid 6.6% year to date.

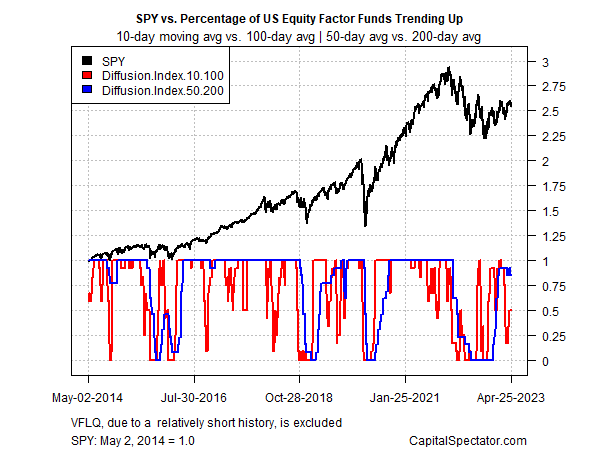

The recent upside momentum for factor funds has turned mixed lately, based on a set of moving averages that aggregate trend behavior for all the factor funds listed above. After a bullish recovery in short- and medium-term momentum, the short-term trend has fallen sharply, which suggests the market has turned cautious on the near-term outlook.