ION expands ETF trading capabilities with Tradeweb integration

JPMorgan Chase (NYSE: JPM) plans to accept Bitcoin (BTC-USD) and Ethereum (ETH-USD) as collateral for institutional loans by the end of 2025. On the surface, this looks like another milestone in crypto’s march toward mainstream finance. But beneath the headline is a structural tension: a 24/7 global asset class interfacing with a banking system built for business hours. That mismatch creates new contagion pathways that didn’t exist before.

In traditional finance, collateral management operates on predictable schedules. Stock markets close. Settlement cycles are measured in days. Risk teams assess exposures overnight. Margin models assume market downtime for adjustment and response.

Crypto ignores all of that.

Bitcoin and Ethereum trade continuously across fragmented exchanges. A 10% intraday move (severe in equity markets) is common in crypto. When these assets back JPMorgan loans, the bank must monitor valuations in real time. A Sunday 3 a.m. flash crash could instantly push loan-to-value ratios out of tolerance, triggering automated liquidation mechanisms before human oversight even wakes up.

April 2025 offered a preview: nearly $1 billion in Bitcoin futures positions were liquidated in a single day, with long positions absorbing most of the damage. So far, those liquidation spirals have been contained within crypto markets. JPMorgan’s move changes that by linking crypto volatility to corporate credit lines, wealth management portfolios, and institutional balance sheets.

The Cascade Problem

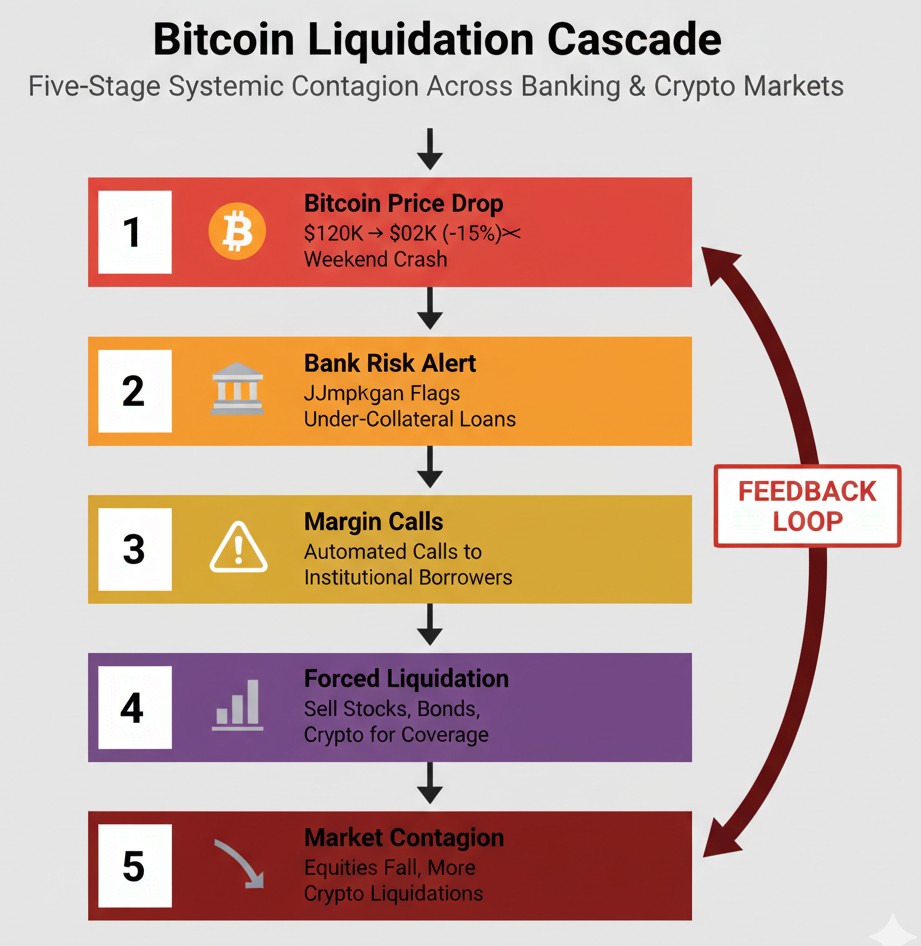

When crypto is used as collateral for traditional loans, price shocks ripple across markets rather than staying isolated.

- Bitcoin drops 15% over a weekend.

- Loan collateral values fall, triggering automated margin alerts.

- Borrowers sell assets (as stocks, bonds, or more crypto) to restore collateral ratios.

- Selling pressure pushes prices lower in both traditional and crypto markets.

- New margin calls trigger at other institutions.

Crypto liquidations drive crypto prices down. Equity liquidations drive stock prices down. The loop feeds itself.

We watched this dynamic during the 2022 crypto winter. Celsius, Voyager, and BlockFi collapsed as rehypothecated collateral chains unwound. Three Arrows Capital’s failure rippled through multiple lenders. The only reason the damage stayed “crypto-contained” was because major banks weren’t directly involved.

JPMorgan’s program means next time, they will be.

Five-Stage Liquidation Cascade: How a Bitcoin Price Drop Triggers Systemic Contagion Across Banking and Crypto Markets

Why Now?

The bank first explored Bitcoin-backed loans in 2022, then shelved the program during the crypto credit crisis. The key difference today is sentiment, not structure:

- Bitcoin recently hit new all-time highs

- Regulatory conditions have eased

- Institutional demand has grown

But none of the underlying fragilities exposed in 2022 have been resolved. They’ve simply been overshadowed by price momentum.

Academic research now shows crypto has shifted from a “shock absorber” to a “shock transmitter” since 2020, meaning volatility increasingly flows outward rather than inward.

The Basel III Constraint

Starting January 2026, Basel III rules will require banks to hold capital equal to the full value of most crypto collateral. That’s effectively a 100% risk weight.

If a bank must hold $100 in reserve to support $100 in Bitcoin collateral, the economics break down unless loan spreads widen significantly.

So JPMorgan is either:

- Betting these regulations soften, or

- Using this program to position strategically, not economically

Either scenario introduces regulatory uncertainty, another historical breeding ground for systemic risk.

The Custody Exposure

Because JPMorgan will rely on third-party custodians, this system inherits operational and counterparty risk.

Crypto custody failures are not hypothetical: Mt. Gox (2014), QuadrigaCX (2019), multiple exchange breaches since.

If a custodian holding pledged Bitcoin is hacked, the collateral disappears—but the loan remains.

This is precisely the trusted-intermediary concentration risk crypto was meant to eliminate.

What to Watch Going Forward

Correlation Between Bitcoin and Equity Markets: If Bitcoin increasingly moves in tandem with major equity indices during drawdowns, it suggests that crypto is no longer functioning as an uncorrelated asset but is instead transmitting risk into traditional markets. A rising correlation coefficient is an early signal of contagion channels forming.

Cross-Market Liquidation Clusters: Watch for periods where forced liquidations occur simultaneously in crypto derivatives and in traditional asset markets. These synchronized selloffs indicate that margin calls and collateral adjustments are propagating across both systems, which is the foundational condition for cascade dynamics.

Growth and Disclosure of Crypto-Secured Loan Books: As banks begin reporting the size and composition of crypto-backed credit facilities, the scale of exposure will become clearer. Small loan books imply idiosyncratic risk; large loan books imply system relevance. The inflection point is when disclosures move from footnote to headline.

Supervisory Guidance on Basel III Capital Treatment: The viability of crypto collateralization at scale depends heavily on how regulators ultimately enforce (or soften) the 100% risk-weighting provisions for Group 2 crypto assets. Any adjustment in policy will materially change lending economics, liquidity planning, and institutional willingness to expand exposure.

Two Systems That Don’t Speak the Same Language

Crypto and traditional finance run on fundamentally different clocks, assumptions, and risk models. JPMorgan is now attempting to connect them. This may represent the next stage of financial innovation. Or, it may be the next point of hidden fragility.

In fact, financial crises rarely announce themselves with obvious warning signs. They emerge from structural vulnerabilities that seem manageable until they’re not. Subprime mortgages in 2008. Long Term Capital Management’s leverage in 1998. Portfolio insurance in 1987.

And each time, sophisticated institutions convinced themselves they’d properly modeled the risks. Each time, the models failed when stress hit from unexpected directions and correlations that were supposed to stay low suddenly spiked to one.

Crypto collateralized lending at systemically important banks might prove perfectly safe. Or it might represent the next fragile node in a financial system that’s added complexity faster than resilience. JPMorgan’s decision to open this door after closing it in 2022 means we’re about to find out.

The question isn’t whether this specific program causes the next crisis. The question is whether anyone’s actually figured out how to manage 24/7 volatility using risk systems designed for markets that close at 4 p.m. and settle in two days. Based on how similar innovations worked out historically, there’s reason for skepticism.