ION expands ETF trading capabilities with Tradeweb integration

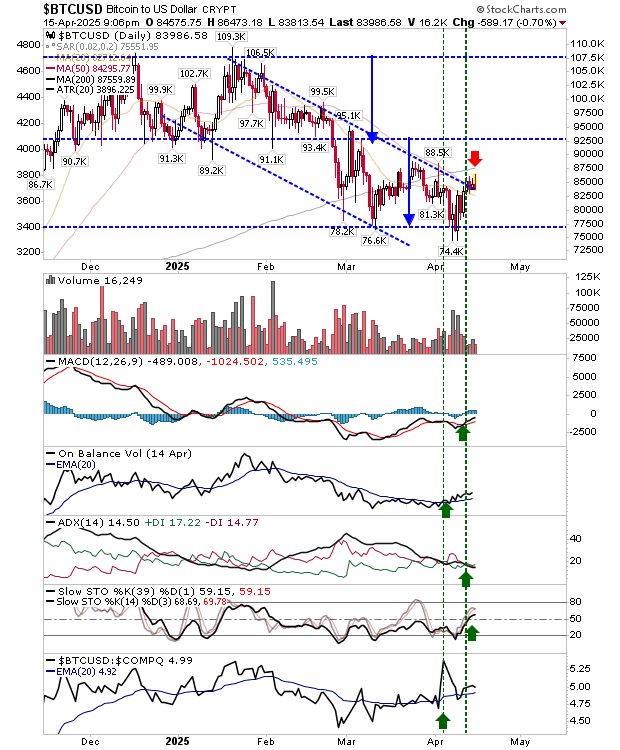

Indices are reaching an endpoint in their relief bounces, but the asset that is most likely to break lower is Bitcoin (BTC/USD). It’s generating spike highs at channel resistance with a significant drop in volume and 200-day MA overhead resistance. Technicals are net bullish but some way from reaching an overbought state, which may help it break the channel and catch shorts unaware, but I think this will head lower.

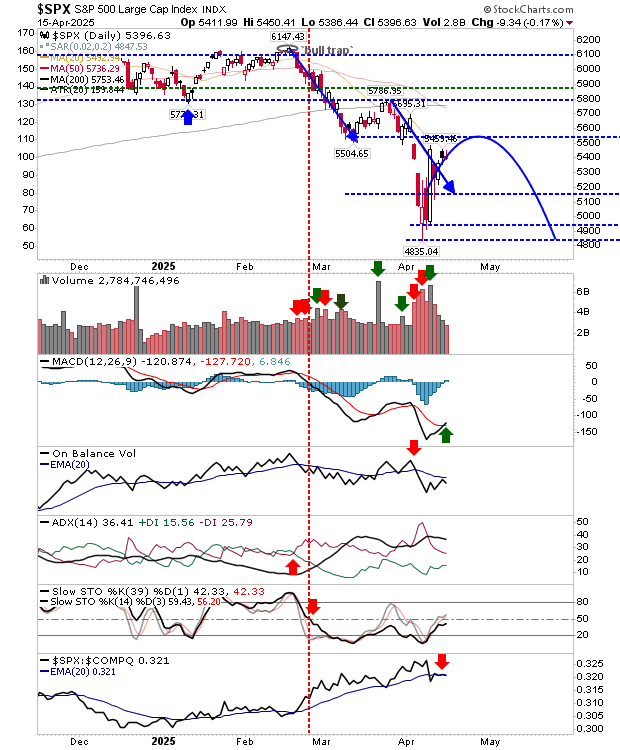

Indices had a bearish combo with a ’black’ candlestick yesterday and a doji yesterday. The S&P 500 managed a weak MACD ’buy’ from well below the bullish zero line.

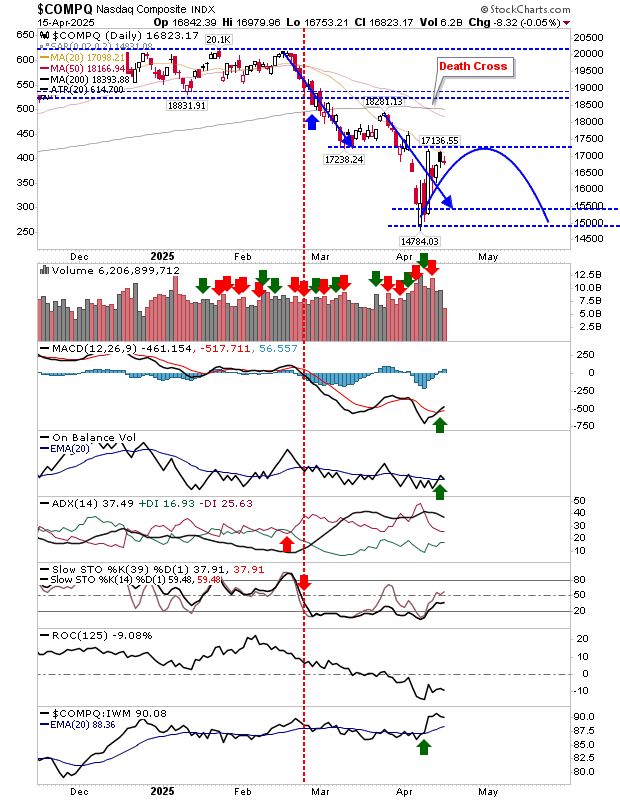

The Nasdaq likewise posted the bearish ’black’ candlestick at swing low and 20-day MA resistance. There are two ’buy’ triggers for the MACD and On-Balance-Volume to go with an acceleration in relative performance against the Russell 2000 (IWM).

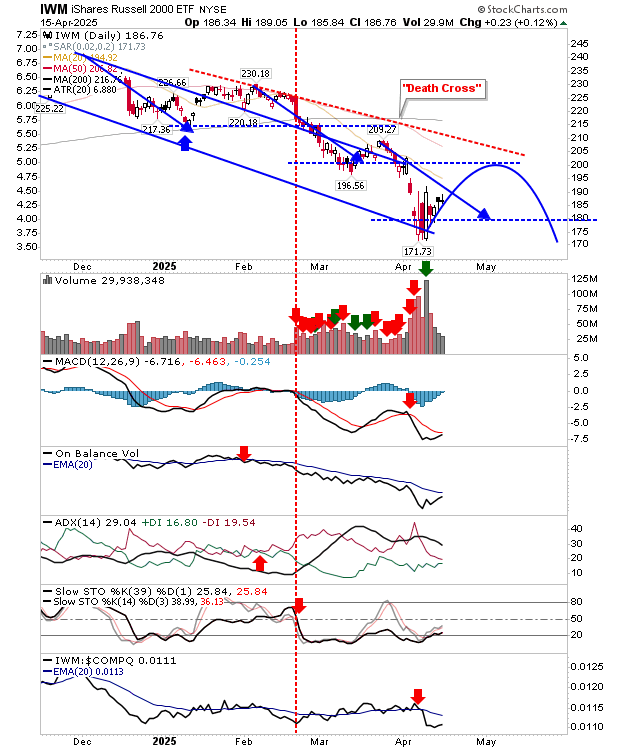

The Russell 2000 (IWM) also has the ’black’ candlestick/doji combo, but it’s well away from swing low and 20-day MA resistance. It’s vulnerable to sellers, but is already deeply oversold. It may be the quickest to retest the April swing low at $171 - watch closely.

For today, sellers are likely to make an appearance, although hopefully not the rout we saw on Trump’s tariffs announcement. Shorts can look to Bitcoin as a trade opportunity.