60%+ returns in 2025: Here’s how AI-powered stock investing has changed the game

Is the bond bear market finally over? That is the question everyone is asking now that bond prices rallied sharply following the November FOMC policy meeting. As noted earlier:

“On Wednesday, Jerome Powell’s speech sparked a broad rally in stocks and bonds as market expectations for further rate hikes collapsed.

There was nothing new about the Fed’s recent policy announcement as they maintained that higher Treasury yields are doing their work in slowing economic activity and, ultimately, inflation.

However, they did, again, as expected, leave open the possibility of further rate hikes as needed.”

- POWELL: PROCESS OF GETTING INF. TO 2% HAS A LONG WAY TO GO

- *POWELL: FULL EFFECTS OF TIGHTENING YET TO BE FELT

- *POWELL: NOT CONFIDENT WE’VE REACHED STANCE FOR 2% INFLATION

“Given that the Fed did little to talk up the projections of further rate hikes, the market took this as meaning the Fed is likely done hiking rates. Of course, that means, from the market’s perspective, the subsequent actions will be ‘rate cuts.'”

With the more “dovish” tone of the Fed’s commentary, combined with a much weaker-than-expected employment report last Friday, expectations for higher yields collapsed, sending bond prices higher.

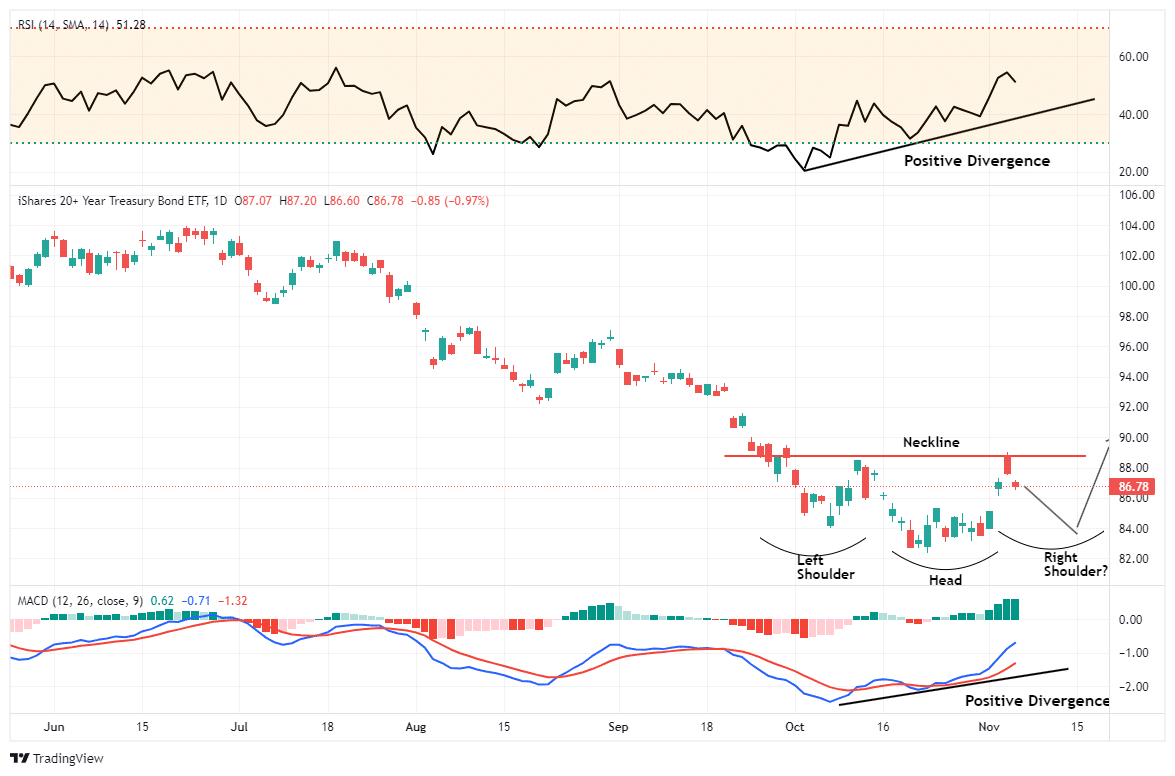

As shown, on a short-term basis, bond prices rally sharply to the “neckline” of a potential “head and shoulders” low. That technical pattern on iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT), which is bullish for bond prices if it completes, is supported by a positive divergence in both the MACD “buy signal” and the Relative Strength Index (RSI).

However, while this rally has been very encouraging in the short term, there are many “trapped longs” that will be looking for an exit to sell holdings at higher prices. Such will apply pressure to the recent rally, as we saw profit-taking last Friday and again on Monday.

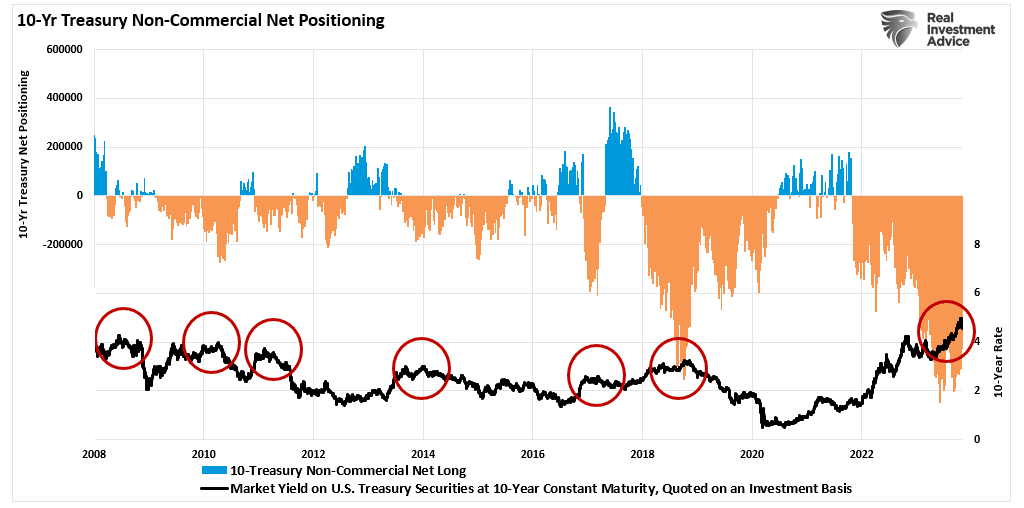

As shown above, a retracement that sets a higher low and then breaks the above the neckline would likely confirm the start of a “bond bull market.” Furthermore, the massive short-position on 10-year by professional hedgers will also support bond prices when they are forced to cover.

I would expect, over the next couple of weeks, that we will likely see yields remain in a more volatile trading range as the “Bond Bulls” and “Bond Bears” continue to “duke it out.”

But I agree with Jeff Gundlach’s recent point over the longer term (30-Year).

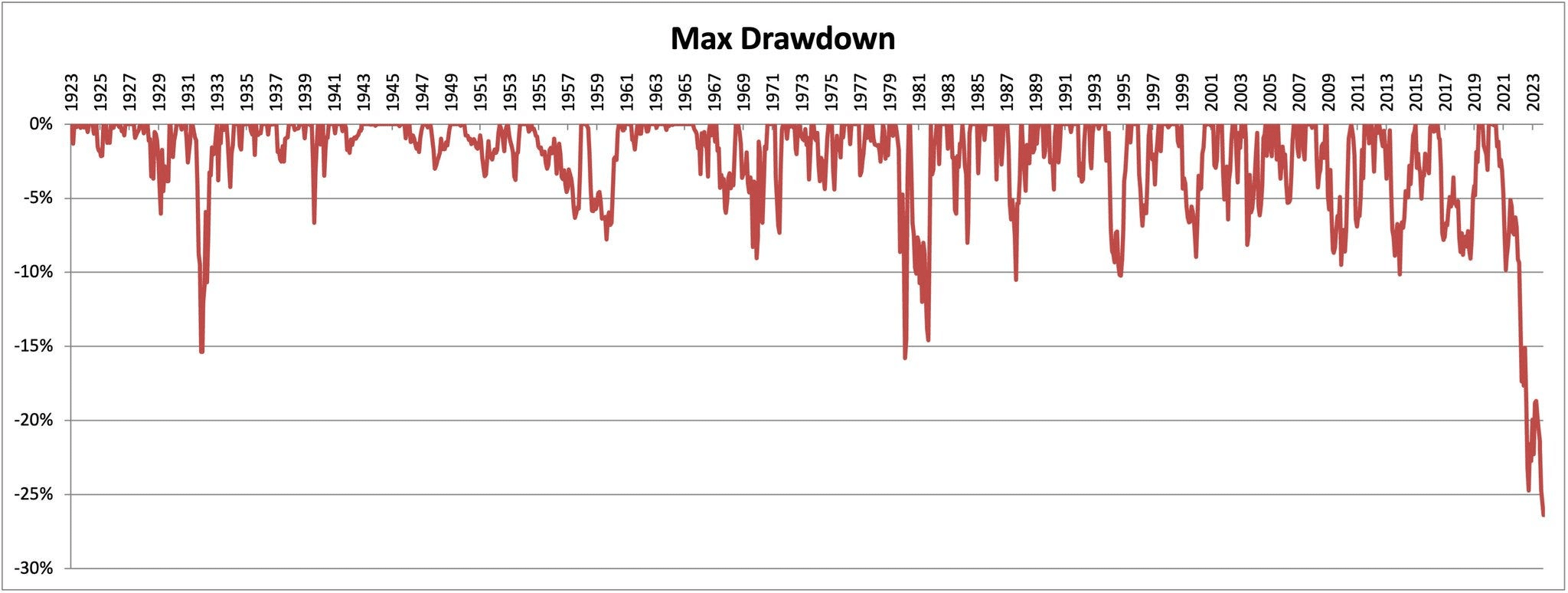

“We like long-term treasury bonds for the short-term trade going into a recession. The 30-year US treasury yield downtrend of the past four decades has completely reversed, skyrocketing nearly 400bps in under two years.

There has been about a 50% drawdown in the long bond, which means there is now potential for the long bond to increase in price.”

The technical setup for ending the “bond bear” market is in place.

Technical Setup For The End Of The Bond Bear Market

While in the short term, bond prices will likely pull back after the recent surge, the technical and fundamental backdrop for the end of the bond bear market is improving.

Let’s start with the technical setup.

First, as with everything, “what goes up must come down,” and vice versa. At the moment, bonds are in the worst drawdown ever.

From a purely contrarian point of view, when no one wants to own something because they believe that prices are “only headed in one direction, indefinitely,” such is often the time to become a buyer. Historically, buying when there is “blood in the streets,” as stated by Barron De Rothschild, has often been profitable.

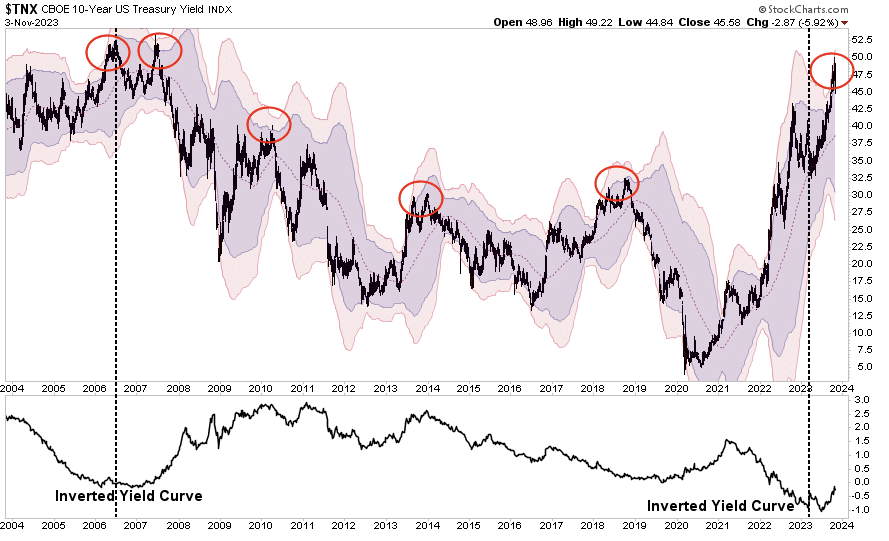

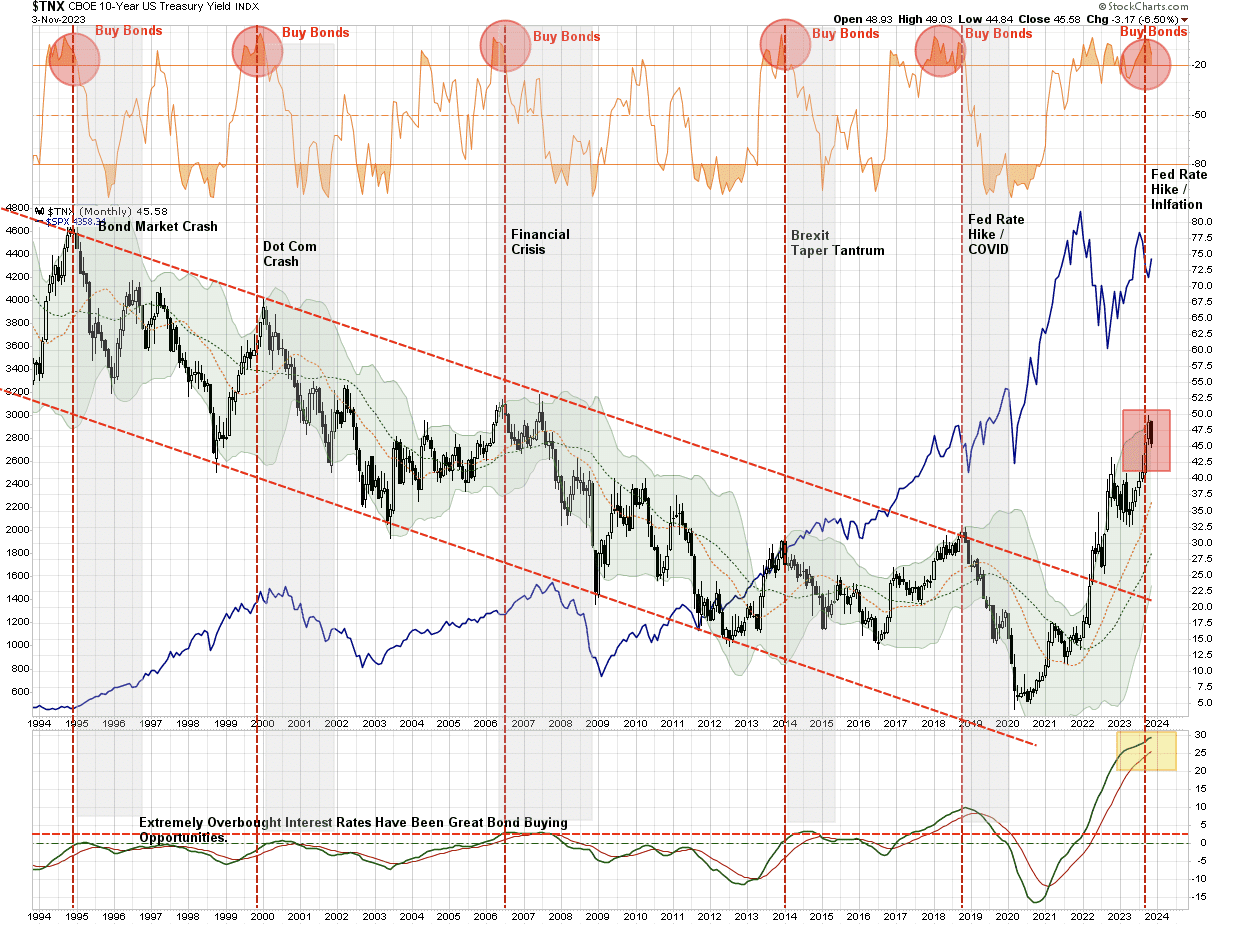

Secondly, once we step away from the daily volatility caused by hedgers and traders, a longer-term view also supports a potential reversal in bond prices. Historically, when interest rates traded at “2 standard deviations” above the 1-year moving average, a reversal occurred.

Such was due to a financial event, economic strain, or other outcome caused by higher interest rates on a leveraged economy. Currently, rates are “3 standard deviations” above that mean. From a purely technical perspective, such extensions are unsustainable, suggesting an eventual reversion will occur.

But, if we push our analysis out further, using MONTHLY data, we see the same extreme deviations from the norm. Going back to 1994, whenever rates were highly overbought and deviated from long-term means, such were good buying opportunities for bonds. This time is unlikely to be different, and the failure of Citizens Bank this past weekend is further evidence of the financial strain on the economy.

The surge in bond yields has created another historic opportunity to buy bonds at a deeply discounted price. Just as investors don’t want to buy stocks at the bottom of “bear markets,” they don’t want to buy bonds for the same reason.

However, as shown above, history has repeatedly shown that some of the best bond-buying opportunities have come when investors are sure “this time is different.” The reality is that rates can’t rise much before the impact on economic growth leads to a crisis, recession, or bear market. Such is the problem of a heavily indebted and leveraged economy.

However, a drop in yields and the subsequent rise in asset prices is a problem for the Fed.

A Problem For The Fed

The end of the bond bear market in the short term is a problem for the Fed, but it is inevitable in the long term. In recent speeches from Federal Reserve officials and Jerome Powell himself, they specifically noted that higher yields on Treasury Bonds are acting as “defacto rate hikes.” Such is why they have “paused” on further rate hikes despite inflation still above their 2% target.

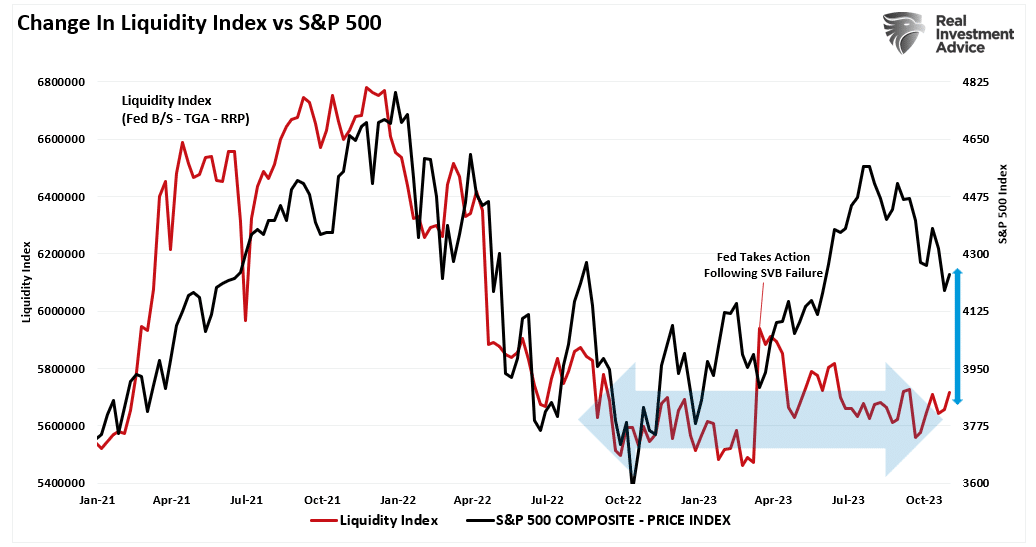

However, falling yields and rising stock prices undermine that objective by loosening financial conditions.

“Higher asset prices represent looser, not tighter, monetary policy. Rising asset prices boost consumer confidence and act to ease the very financial conditions the Fed is trying to tighten. While financial conditions have tightened recently between higher interest rates and surging inflation, they remain low. Such is hardly the environment desired by the Fed to quell inflation.” – Real Investment Advice

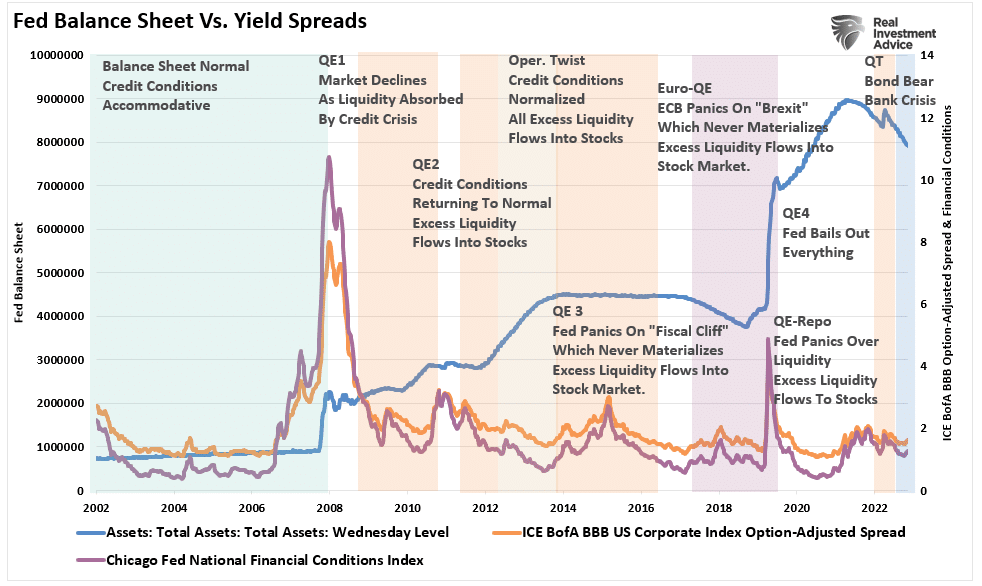

The FOMC needs substantially tighter financial conditions to slow economic demand and increase unemployment, lowering inflation toward target levels. Tighter financial conditions are a function of several items:

- A stronger US dollar relative to other currencies (Check)

- Wider spreads across bond markets (No, See below)

- Reduction in liquidity (Quantitative Tightening or QT)

- Lower stock prices. (Check, but only a minor correction)

However, despite evidence that financial conditions are tightening, they are not shrinking drastically. As shown, liquidity has remained primarily neutral over the last year. Last week’s surge in stocks and bonds is reflected in a recent uptick in liquidity.

The problem for the Fed is that increased liquidity, higher asset prices, and lower yields remove the pressure from consumers. If consumer confidence improves, then so does consumption. That increased demand then fosters higher prices, which is not what the Fed wants, at least not yet.

The Fed’s challenge is potentially a trap of their own making. On the one hand, they want falling asset prices and weaker economic data to quell inflation. However, the Fed does NOT want an economic event destabilizing the financial system. Unfortunately, the Fed may soon face a very tough decision. Either allow a deeper recession to take hold, quelling inflation, or cut rates to keep a banking crisis from spreading.

We will likely know the answer sooner than later.

However, I believe that Treasury bonds will be the asset class of choice.