Oracle introduces AI Factory service to support business AI adoption

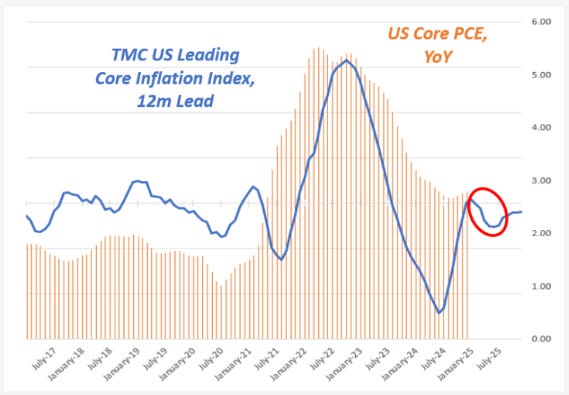

Our main macro thesis for the first half of 2025 is that another disinflationary wave will hit the US.

We expect core PCE to annualize at or below 2% in H1 2025.

Our Leading Inflation Indicator suggests we might be due for one last wave of disinflation in the first half of 2025:

To add some substance, this Leading Inflation Indicator is built using the 7 most statistically significant forward-looking indicators for core US inflation.

The most recent dip is mostly attributable to leading indicators of shelter inflation, which represents 30%+ of the core US inflation baskets.

As you know, official shelter inflation tends to incorporate on-the-ground rent growth with a delay due to its methodology and series like the Zillow) Rent Index have been used to predict where shelter inflation will go.

The CoreLogic single-family rent index is one of the best predictors of shelter inflation, and it just printed at the lowest level in 14 years:

Some weakness in the housing market is starting to emerge - as evidenced by other leading indicators as well.

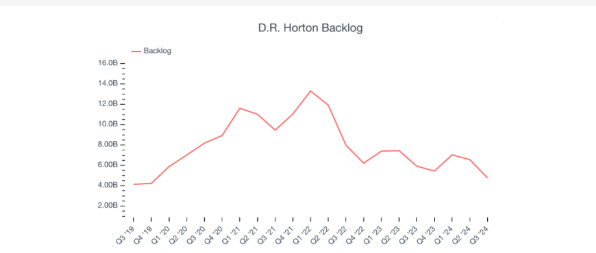

One of the main reasons why the housing market held up so well despite high mortgage rates was the gigantic backlog to work through.

During the pandemic, the demand for housing was super hot but supply bottlenecks and labor shortages lengthened the housing construction cycle - and this led to large backlogs which kept the housing market afloat.

Big US homebuilders like D.R. Horton are now reporting their backlogs have returned to 2019 levels, so this tailwind seems exhausted:

Additionally, Tuesday's JOLTS report shows that the job openings for the construction sector are shrinking fast (see chart below).

The construction sector is key to the US business cycle, and cyclical weakening there has always been an early signal of a broader softening in US growth conditions.

Just to be clear: construction workers aren't getting laid off yet.

But it seems that the conditions are in place for a slowdown in the housing sector, which also leads to disinflation through the rent of shelter component:

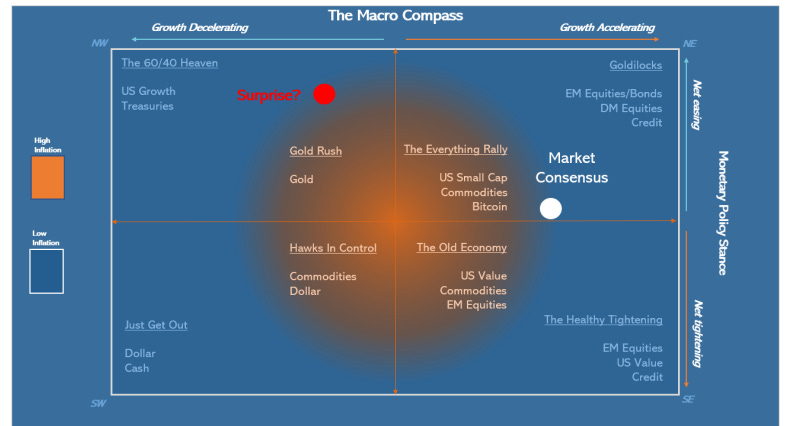

Incoming data on inflation, growth and the housing market suggest a disinflationary slowdown in growth could be ahead of us. In that case, the Fed could quickly switch to a quarterly pace of cuts and reassert the Fed Put.

This ‘’proactive risk management’’ dovish stance would ease financial conditions = stocks and bonds rally:

Looking at the relative valuations across stocks and bond markets, the best risk/reward lies in fixed income.

At the moment, this is what the market is pricing the Fed to do over the next 2 years:

The Fed is priced to be on hold in March, deliver maybe 2 cuts in total this year, and pretty much stop there.

The terminal rate is priced around 3.90% - and that’s where the Fed cutting cycle stops.

Given the odds of Fed hikes are relatively small as long as Powell remains Fed Chair until May 2026, bonds offer an interesting risk/reward if my disinflationary thesis proves correct.

This was it for today, thanks for reading.

***

This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds - check out which subscription tier suits you the most using this link.