ION expands ETF trading capabilities with Tradeweb integration

The Federal Reserve remains data dependent, as the central bank’s chairman Jerome Powell likes to say, and perhaps that’s especially true now as policymakers weigh the prospects for when (or if) to start cutting interest rates this year.

Recent economic data has again raised doubts about the timing for the arrival of a dovish policy bias.

Notably, the January consumer inflation report was hotter than expected, pushing expectations for the first rate cut further ahead – June, by current estimates, based on Fed funds futures.

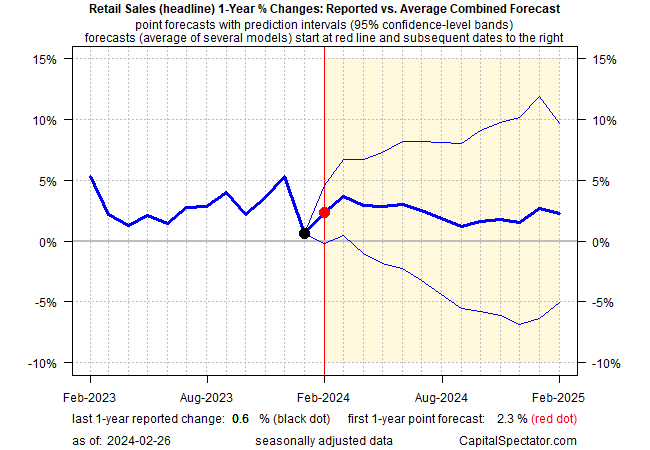

Offsetting the stronger-than-expected rise in last month’s CPI was a softer-than-forecast retail sales report for January as spending posted a substantially deeper slide than projected.

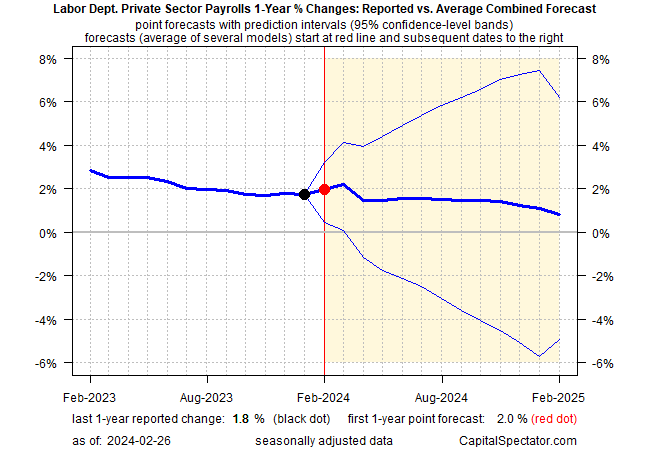

US payrolls, however, continued to surprise on the upside in January, suggesting that the economy will remain resilient in the near term.

Interpreting the mixed messages in recent economic data is no easy task, but the key questions are obvious. Is the slide in inflation slowing, or perhaps reversing?

Is the consumer finally running out of steam? Will payrolls continue to outperform the darker forecasts that still see recession risk rising?

No one knows, of course, but it helps to run basic modeling for some perspective, if only as a baseline for managing expectations.

On that front, The Capital Spectator has a preference for a proprietary combination forecasting model that draws on various econometric techniques to develop estimates for the near term.

It’s not a silver bullet, but it’s a reasonable way to begin thinking about what the next round of economic news may bring.

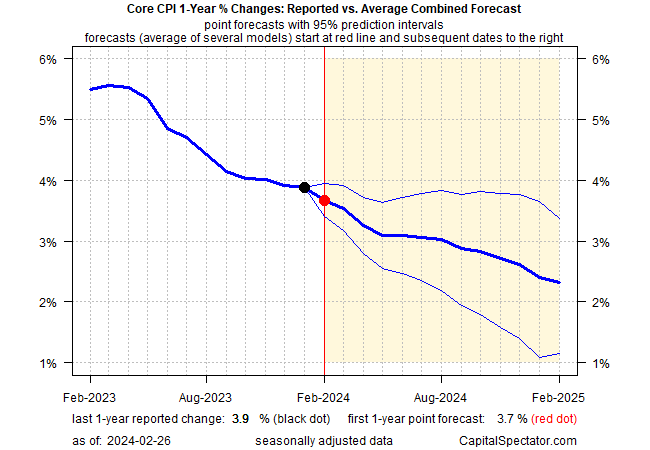

Let’s start with the outlook for the year-over-year change in core consumer inflation.

The one-year change was on the sticky side in January, holding steady at 3.9%, which is still well above the Fed’s 2% inflation target. But the average point forecast for February suggests that disinflation will revive.

In the consumer sector, the one-year trend in retail sales is projected to recover in February following January’s stumble.

Meanwhile, private payrolls look set to strengthen in February vis-à-vis the one-year trend.

The point forecasts above paint an upbeat profile for the US economic outlook in February. The combination of more disinflation and firmer consumer spending and hiring point to an economy that’s still humming.

Forecasts should viewed cautiously, of course, but if the point estimates above are more or less correct, the case may continue to fade for Federal Reserve interest rate cuts in the near term.

Indeed, the argument that lower interest rates are necessary is weak tea if consumers are spending, businesses are hiring and inflation is still easing.