TSX gains after CPI shows US inflation rose 3%

US inflation was softer than predicted in September, with the tariff effects remaining limited. That should gradually change, but it gives more time for disinflationary forces such as energy, housing and weaker wages to mitigate them. In any case, the Fed’s more pressing concern is the cooling jobs market as it looks to optimise policy for its dual mandate.

US Inflation Undershoots Expectations

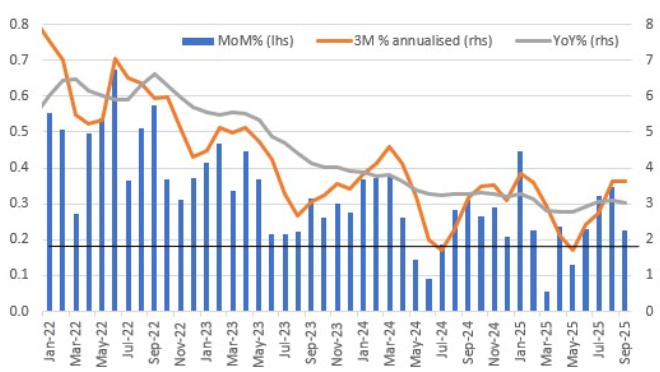

US September inflation was softer than expected, rising by 0.3% month-on-month /3.0% year-on-year for headline inflation and 0.2%MoM/3.0%YoY for core (ex food & energy). The consensus forecast was for a 0.4%MoM headline print and 0.3%MoM core.

As such, we have a green light for a 25bp Fed rate cut next week, even though the core month-on-month rate (blue bars) continues to track above the 0.17%MoM rate we need to average to bring the annual rate of inflation down to the 2% target.

Source: Macrobond, ING

The details show core goods rose just 0.2%, but modest auto inflation helped dampen the story. Core goods ex autos increased 0.34% to 2 dp with apparel rising 0.7%MoM. Used car prices fell 0.4% and medical care commodities fell 0.1% while new car prices rose only 0.2%.

Housing was benign, with owners’ equivalent rent rising just 0.1% and primary rents up 0.2%. The biggest upside numbers were airline fares (+2.7%MoM), tobacco (+0.6%) and gasoline (+4.1%MoM). But with global energy prices falling fairly broadly in recent months, we think both gasoline and airline fares should be softer again soon.

Tariff Impact Remains Limited

In terms of the tariff effects, July and August customs revenue and goods import numbers imply a realised tariff rate of around 10%, well below the 18% rate estimate based on announced country and sector tariffs. The September customs revenue showed no sign of an acceleration, so it appears that there is a strong substitution effect already coming through – US companies switching to lower-tariff countries for their product sourcing, with the composition of imports shifting.

The result is that companies are better able to absorb these more modest than feared cost increases, and there has been less impact on inflation than predicted so far. In time, we expect the realised tariff rate to rise and goods prices to be more heavily impacted, but we continue to argue that tariffs will be a one-off step change in prices rather than something that will lead to more persistent inflation. Moreover, a slower tariff pass-through gives more time for disinflationary factors to provide some mitigation.

Disinflation Forces Build Elsewhere With 100bp of Rate Cuts to Come

Energy costs, slowing housing rents, and a weakening jobs market will all contribute to softer inflation as we move into 2026. Remember that core goods – the component that is exposed to tariffs – only has a 19% weighting within the inflation basket. Housing has a 33% weight, and house prices have now fallen for five consecutive months, and private rents are slowing sharply with today’s CPI housing components offering encouragement for our view. Services do indeed dominate, and outside of housing it tends to be wages that drive inflation here and they are slowing quickly now that there are more unemployed Americans than there are job vacancies.

Tariff-related inflation will remain a concern in the near term, but it is the jobs market that is becoming the more pressing issue for the Fed, with a clear chance that the “low hire, low fire” economy becomes a “no hire, let’s fire” story. This jeopardises the “maximising employment” goal of its dual mandate, which could in turn create a weaker economy and risk it undershooting the 2% inflation target over the medium to longer term.

We continue to look for a 25bp rate cut next week, with a further 25bp move in December and 50bp of cuts in early 2026.

***

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more