Missed the webinar? Here are Investing.com’s top 10 stock picks for 2026

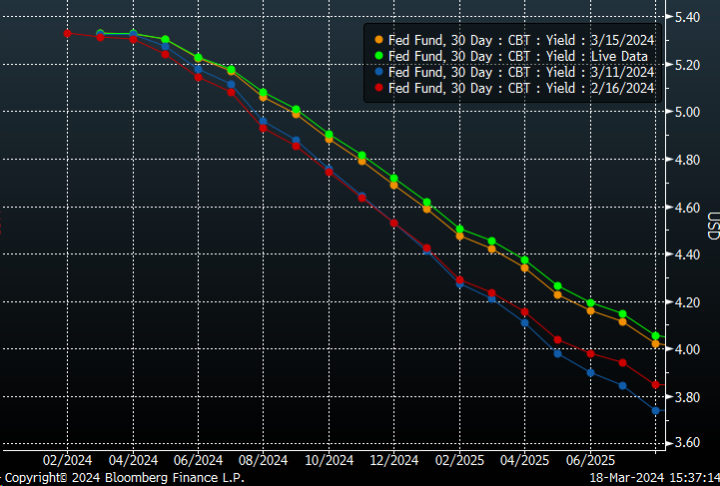

Stocks rallied on Monday, ahead of an eventful two days. Meanwhile, the market is also busy repricing its rate path for the Fed policy, with Fed Futures now seeing fewer than three rate cuts in 2024.

This appears to be due to a change in the market outlook for inflation, with 1-year inflation breakevens now at their highest since July 2022 and 1-year inflation swaps continuing to move higher today by 1.1 bps to 2.635%.

It looks mainly like this results from gasoline pushing higher again to $2.74.

Alongside that, this also stems from oil moving up and clearing that consolidation zone at around $82.

Surprisingly, the US 10-year yield has behaved nicely, still below the 4.35% level.

Remember that what matters most about the Fed and rates is that the market is repricing the path of monetary policy, and monetary policy works through financial conditions.

As the market reprices and adjusts, those conditions will tighten, and the tightening of conditions will impact the stock market.