Tyson Foods to close major Nebraska beef plant amid cattle shortage - WSJ

This article was written exclusively for Investing.com

- Technology changes the nature of money

- Governments may resist, but companies are adapting

- Leading companies accepting Bitcoin

- Oakland A’s make luxury suites available for Bitcoin

- Growing acceptance will turbocharge the asset class’s market cap

Technology gave birth to the blockchain a little over a decade ago. Blockchain is the revolutionary public electronic ledger built around a peer-to-peer (P2P) system that can be openly shared among disparate users. The blockchain creates an unchangeable record of transactions, each time-stamped and linked to the previous one. Each digital record or transaction in the ledger is called a block.

Satoshi Nakamoto came up with the first blockchain in 2008 for Bitcoin. (The name is considered to be a pseudonym for the creator or group of creators who formulated the first digital currency as well as the technology that underpins it all.)

Blockchain has applications far beyond cryptocurrencies. It is hard to know if Nakamoto conceptualized Bitcoin or blockchain first. The question could be the ultimate chicken and egg enigma for Nakamoto’s work.

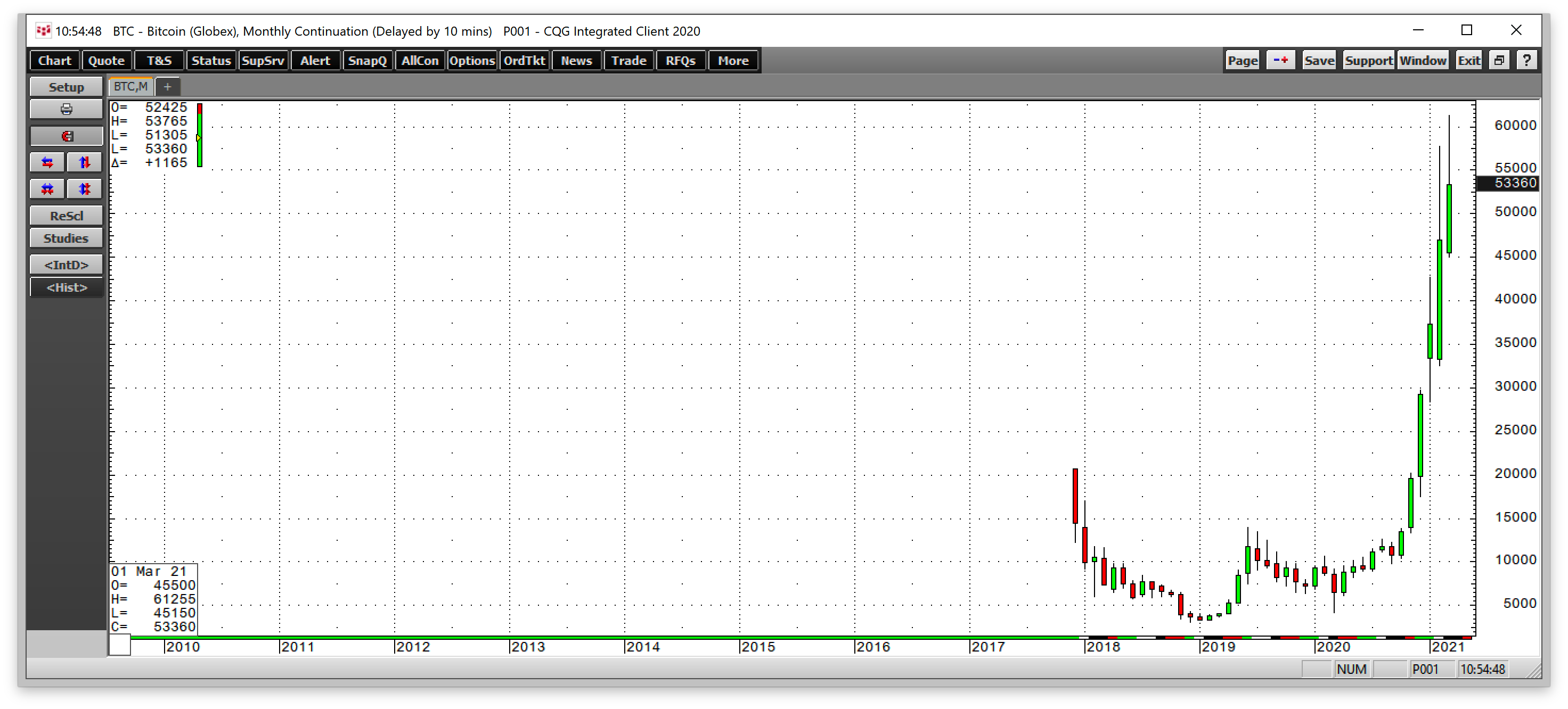

Blockchain has been embraced and is revolutionizing finance and other disciplines. All one has to do is look at a Bitcoin chart since 2010 to see the first cryptocurrency’s impact.

As of the end of last week, there were another 8888 digital currencies that are all Bitcoin’s children. Acceptance of digital currencies’ global role is growing each day, along with the value of the burgeoning asset class, which stood at over $1.73 trillion on Mar. 26. As acceptance increases, the market cap could rise exponentially. One is a function of the other. Bitcoin has given new meaning to exponential appreciation.

Technology changes the nature of money

Technology is changing everything in our lives. The global pandemic highlighted those changes. During social distancing guidelines, we communicated with work associates, family, and friends using technological innovations. Those changes began long before COVID-19.

We are accustomed to shopping online and paying for goods and services using debit and credit cards. The role of traditional currencies is now shifting thanks to a new breed of global assets that transcend borders and operate in cyberspace.

Bitcoin is the first digital currency, but over 8960 other cryptocurrencies, not all of them 'children' of BTC, now exist. While many will fall by the wayside because they fail to gain the critical mass necessary to become a mainstream means of exchange, the leading digital currencies are changing the financial system.

Governments may resist, but companies are adapting

Governments issue the traditional legal tender that people earn in the workplace and use to invest and pay for goods and services. The dollars, euros, pounds, yen, and other currencies issued by governments grant them control of the money supply. Bitcoin, Ethereum, and other cryptocurrencies are alternatives that pose a threat to the government’s control of the money that circulates in the global financial system.

Government control of the money supply allowed for the monetary and fiscal stimulus that stabilized economies after the 2008 global financial crisis. The levels of liquidity and stimulus necessary during the worldwide pandemic have been far greater than in 2008. The ability to stimulate the financial system depends on expanding the money supply.

Government leaders have expressed concerns about the rise of the digital currency asset class. Janet Yellen, the US Treasury Secretary, and Christine Lagarde, the European Central Bank President, both warn that digital currencies support nefarious transactions because of the absence of regulation. However, they are more likely concerned that Bitcoin and the other over 8900 tokens diminish their power which comes from controlling the world’s purse strings.

Meanwhile, governments are falling behind as more and more businesses are embracing the future of digital currencies.

Leading companies accepting Bitcoin

Some of the leading retailers in the US now accept Bitcoin as payment.

Microsoft (NASDAQ:MSFT), Overstock (NASDAQ:OSTK), Home Depot (NYSE:HD), Whole Foods (NASDAQ:AMZN), and Starbucks (NASDAQ:SBUX) now accept Bitcoin as a payment for their goods. Tesla (NASDAQ:TSLA) accepts Bitcoin for purchasing the company’s EVs.

Still, using Bitcoin could lead to lots of questions from the US Internal Revenue Service and a substantial tax bill, an example of the government’s attempt to thwart or regulate cryptocurrency.

In 2021, Elon Musk’s Tesla purchased $1.5 billion of Bitcoin. Square (NYSE:SQ), a payments company founded and run by Twitter co-founder and CEO Jack Dorsey, bought $50 million worth of Bitcoin in late 2020 and another $170 million of the digital currency in 2021 at an average price of around $25,000 per token.

Those high-profile purchases mean that some of the most successful US companies are diversifying cash holdings with Bitcoin and other cryptocurrency investments. With Bitcoin over the $50,000 level, the successful investments are encouraging other businesses to follow.

Meanwhile, the investments amount to a small part of TSLA and SQ’s market caps. The $1.5 billion TSLA invested was only around 0.25% of its market value. SQ’s $220 million was an even smaller percentage of its valuation.

If Bitcoin went to zero, it would not impact either of the stocks. However, it is a sign that the payments company and Elon Musk’s carmaker, as well as other businesses, are preparing for a currency revolution, despite protestations and concerns from governments and regulators.

Oakland A’s make luxury suites available for Bitcoin

As the 2021 baseball season in the US gets underway, the Oakland A’s recently announced it had priced full-season, luxury suite packages for one Bitcoin. In dollars, the full-season suite package costs around $65,000, so the A’s are offering a discount to those paying with the cryptocurrency.

They are the first sports franchise to price their tickets in Bitcoin. Other sports teams, including Mark Cuban’s Dallas Mavericks of the NBA, accept Bitcoin as payments. The A’s have extended their Bitcoin offer until Apr. 1. As the token was trading at under the $54,000 level at the end of last week, it is a bargain.

Growing acceptance will turbocharge the asset class’s market cap

The ascent of Bitcoin has been nothing short of parabolic. A six-cent investment in 2010 would purchase a full season in a luxury suite cheering on the Oakland A’s during the entire 2021 season. For those not interested in baseball, one Bitcoin could buy a Tesla or lots of other goods and services.

Bitcoin futures began trading in late 2017. The CME futures contracts led to the first move above the $20,000 level.

Source: CQG

The chart shows that Bitcoin continues to break new ground on the upside. The limited supply and increasing acceptance and demand have pushed the price to lofty heights.

The upcoming Coinbase IPO that makes the trading platform a public and regulated company could mean higher highs for the asset classes’ market cap, which stood at the $1.73 trillion level at the end of last week. ETF and ETN products will only expand the addressable market as they would offer custody solutions via products that trade on the stock market.

Governments and regulators need to move fast to address their concerns; the cryptocurrency horse has left the barn and acceptance continues growing. Ironically, the stimulus that increased the money supply and deficits have weighed on fiat currencies’ values.

Government policy only increases the case for the asset class that provides means of exchange that cannot be manipulated by government excess. The value of digital currencies comes from prices where buyers and sellers meet in a transparent environment without government involvement.

Expect lots of volatility in digital currency prices as it remains the wild west of money. However, technology has been changing our lives over the past years, and the cryptocurrency revolution is a logical extension of the trend.