Wall St futures flat amid US-China trade jitters; bank earnings in focus

- Reports Q3 2022 earnings on Wednesday, Aug. 10, after the close

- Revenue Expectation: $20.99B; EPS: $0.9762

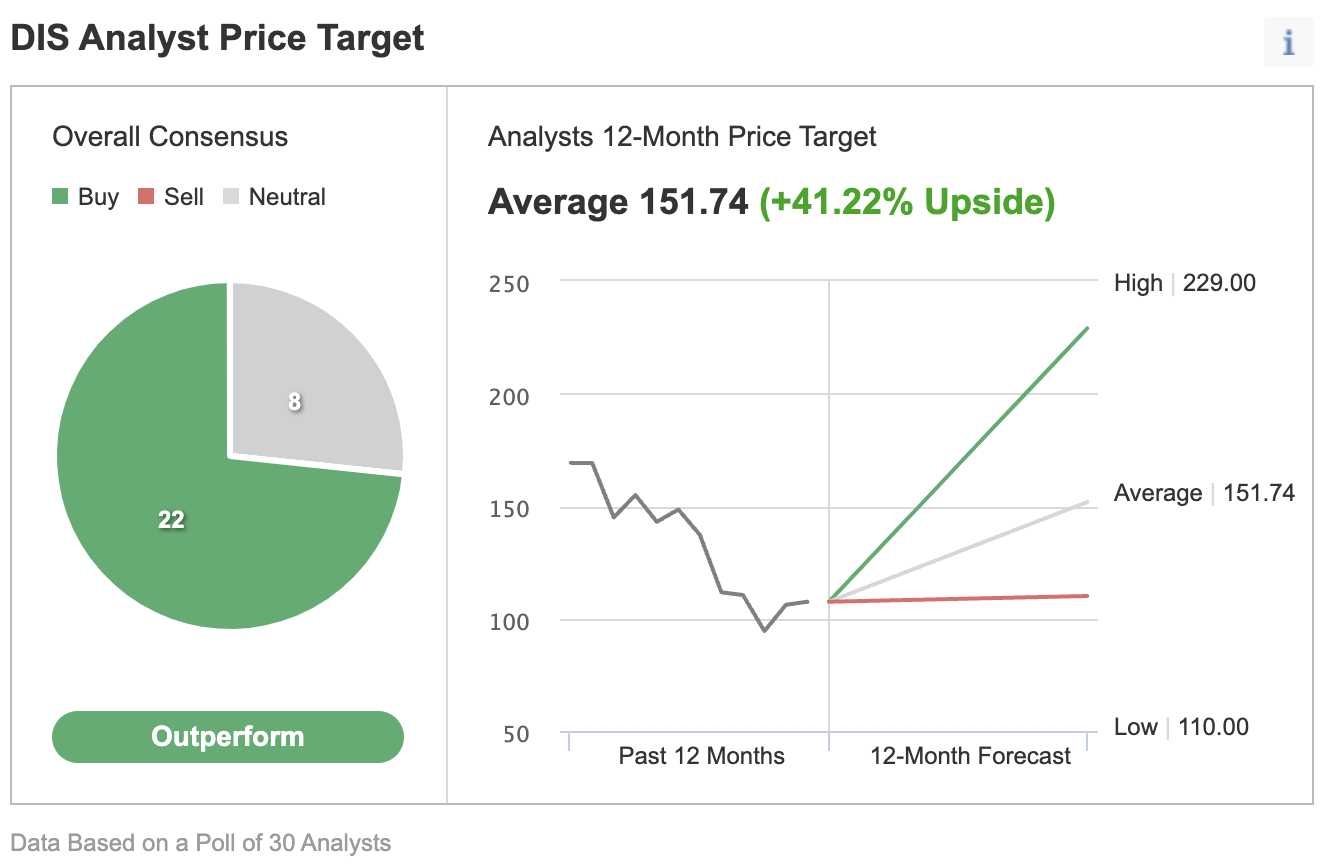

- Most analysts remain bullish on Disney’s stock, giving the stock a 41% upside potential

When the Walt Disney Company (NYSE:DIS) reports its latest quarterly earnings tomorrow, investors should see a combination of solid performance from the entertainment giant’s theme parks with slowing demand for its flagship streaming service.

Disney’s diversified business has helped the stock avoid the sharp pullback suffered by most stay-at-home darlings like Netflix Inc (NASDAQ:NFLX), Peloton Interactive (NASDAQ:PTON), and Zoom Video Communications (NASDAQ:ZM).

Shares of the Burbank, California-based entertainment giant are down about 30% this year, while Netflix has lost more than 60%.

Despite the current macroeconomic uncertainties and escalating operational costs, most analysts remain bullish on Disney’s outlook. Of 30 analysts surveyed in an Investing.com poll, 22 rate the stock as a buy with a 12-month price target implying a more than 41% gain.

Source: Investing.com

This optimism is justified, given the sharp rebound in its legacy businesses, including theme parks, cruises, and movie theaters, due to rising travel and leisure demand after the pandemic-related restrictions.

Resilient Business Model

Last May, Disney’s fiscal second-quarter results provided strong evidence of this trend. Revenue for the fiscal second quarter ended Apr. 2 rose 23% year over year, with operating income surging 50%, while domestic theme-park revenue nearly equaled the pre-pandemic peak for that segment.

Despite having a more resilient business model than its pure streaming rivals, Disney isn’t entirely immune to the economic headwinds that could gather pace if the economy slips into a recession. Amid the current macroeconomic environment, the company is also predicting softening demand for its streaming services in the second half.

However, even in the difficult streaming market, the House of Mouse seems to be excelling. While its main rival Netflix loses steam, Disney still adds customers and expands in new markets. The company added 7.9 million subscribers to its Disney+ streaming service in the previous quarter, 52% more than analysts had projected.

Streaming video is a key growth area for Disney which, like other media companies, is seeing a dwindling audience for traditional TV. In May, the entertainment giant told investors that it is on track to introduce Disney+ in 53 new markets by the end of June. The company will likely add 40 million subscribers this year, helped by a steady pace of new titles, local content, and added markets.

Analysts at Wells Fargo, while highlighting these risks to Disney’s outlook, said in a recent note:

“We remain DIS bulls and think upcoming catalysts include Disney+ net adds progressing ahead of investor expectations, as well as potentially launching ESPN+ fully à la carte.

But, it’s not all positivity, as we’re also making the necessary cuts to Disney+ subs and ads for recession. We think estimates need a reset that harmonizes them with the stock price.”

Despite trimming its stock price target for DIS to $130, Wells Fargo remains overweight on Disney, which it views as a growth company with a strong slew of content.

“We still think a lot more content = a lot more subs, and that will drive stock upside as investors have broadly written off DIS’s ability to generate more streaming hits.”

Bottom Line

Given the uncertain macro conditions, Disney’s Q3 earnings may not provide a clear direction for the stock’s near-term performance. Still, they will likely show that the company remains in better shape than most of its growth-oriented rivals.

Disclosure: The writer doesn't own shares of the companies mentioned in this report.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »