Gold prices rebound after sliding below $4,000/oz amid safe-haven demand

US and Chinese officials have concluded two days of trade negotiations in London, reaching a preliminary agreement aimed at easing ongoing trade tensions.

The agreement outlines a framework to implement consensus points from the previous round of talks held in Switzerland on 10–11 May. If ratified by both presidents, it could pave the way for a renewed flow of sensitive goods between the world’s two largest economies.

Key components include improved US access to rare earth minerals and magnets, and resumed Chinese imports of semiconductors, chip design software, jet engine parts, chemicals, and nuclear materials.

Mixed Bag in the FX Market, While GBP Underperformed

The US dollar remained range-bound, as the Dollar Index continued to consolidate between 98.60 and 99.40, hovering near its 20-day moving average resistance at 99.50.

In the FX market, the pound sterling was the notable underperformer on 10 June, falling 0.4% against both the US dollar and the euro following weaker-than-expected UK labor market data.

Gold’s Intraday Losses Trimmed

Meanwhile, Gold (XAU/USD) has shown signs of safe-haven demand ahead of the upcoming US CPI data release. Recent intraday declines since 9 June have found support around its 20-day moving average near US$3,296, suggesting potential upside risk if inflation data disappoints.

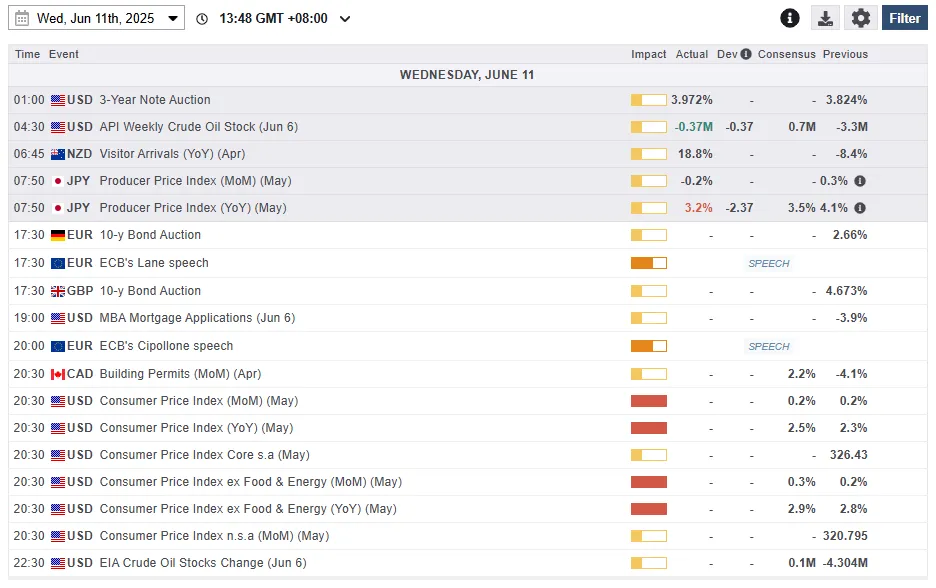

Economic Data Releases

Fig 1: Key data for today’s Asian mid-session (Source: MarketPulse)

Chart of the Day – Minor Bullish Breakout in EUR/GBP

Fig 1: EUR/GBP minor trend as of 11 June 2025 (Source: TradingView)

Yesterday, 10 June, the price actions of the EUR/GBP have staged a bullish breakout from a bullish reversal “Inverse Head & Shoulders” configuration above its former neckline resistance at 0.8440, likely putting an end to its prior medium downtrend phase from 11 April 2025 to 29 May 2025.

The hourly RSI momentum indicator has just exited from its overbought region, where it suggests the risk of EUR/GBP to stage a minor pull-back at this juncture before it may resume another leg of a bullish impulsive up move sequence.

Watch the key short-term pivotal support at 0.8440 on the EUR/GBP with the next intermediate resistances coming in at 0.8490, 0.8510, and 0.8540.

On the other hand, a break below 0.8440 invalidates the bullish breakout scenario to reignite a choppy corrective decline sequence to expose the next intermediate supports at 0.8410, and 0.8380/8360 (also the 200-day moving average).