Uber stock surges after Nvidia partnership announcement

-

Fed’s dovish tilt raises hopes for multiple cuts, but markets remain unconvinced.

-

US GDP and PCE inflation reports this week could spark volatility in currency markets.

-

EUR/USD stuck in range; breakout direction may hinge on Fed signals and data.

- Looking for actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners for up 50% off amid the summer sale!

With no real updates on Russia-Ukraine peace talks, investors turned their focus to the Fed Chairman’s speech at the Jackson Hole conference. His comments were seen as dovish, raising expectations for as many as three interest rate cuts of 25 basis points each this year. The US dollar initially reacted, but yesterday’s trading erased much of Friday’s move, showing that markets remain unsure if the Fed will really ease policy that much.

Outside of monetary policy, the US continued to pressure India over its purchases of Russian oil. Washington warned it could raise tariffs on Indian exports to as high as 50% by the end of the month.

Fed Alters Risk Assessment as Growth Slows

Federal Reserve Chair Jerome Powell suggested the Fed is now putting more weight on signs of a slowing economy than on inflation staying above target. Weakness in jobs, consumer spending, and GDP are seen as bigger risks. He also noted that part of the recent inflation is being driven by higher tariffs, which is likely a temporary effect.

This marks a clear shift from recent months, when Fed officials repeatedly emphasized inflation as the main obstacle to cutting interest rates.

Right now, markets see two main possibilities: either two or three interest rate cuts of 25 basis points each before year-end. Investors lean slightly toward expecting two cuts, but given the Fed’s dovish tone and shifting stance, larger or faster cuts can’t be ruled out.

Key US Economic Data in Focus This Week

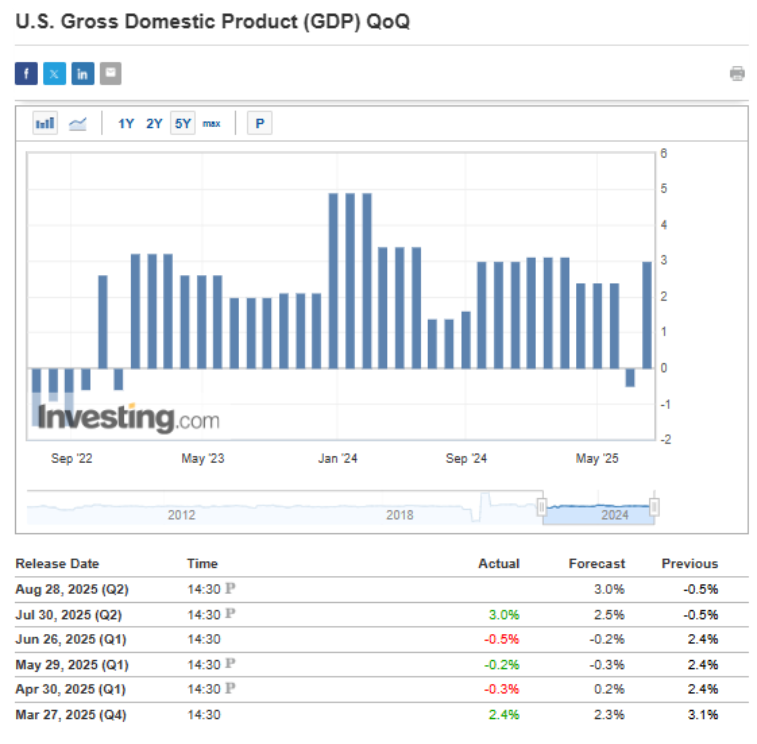

This week’s economic calendar could bring plenty of volatility to the currency market. On Thursday, new GDP data will be released. If the quarter-on-quarter growth meets expectations, it would show that last month’s weak numbers were just a blip and that the U.S. economy is not close to a recession. That outcome, however, would contrast with the Fed’s recent message that growth is slowing.

On Friday, the key data release will be the Fed’s preferred inflation gauge, the PCE index. Based on past trends, it’s unlikely to show a big surprise, which means inflation is expected to stay above the Fed’s target.

EUR/USD Technical Analysis

On Friday, stronger demand briefly pushed EUR/USD out of its tight 1.16–1.1740 trading range. But the move was quickly reversed, keeping the pair stuck in sideways trade and signaling that investors remain unconvinced about the Fed’s dovish shift.

A potential downside breakout could trigger a move lower, with the first target near the uptrend line. Conversely, an upward move from here could set the stage for a test of the long-term highs around 1.1830.

****

InvestingPro provides a comprehensive suite of tools designed to help investors make informed decisions in any market environment. These include:

- AI-managed stock market strategies re-evaluated monthly

- 10 years of historical financial data for thousands of global stocks

- A database of investor, billionaire, and hedge fund positions

- And many other tools that help tens of thousands of investors outperform the market every day!

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.