China’s Xi speaks with Trump by phone, discusses Taiwan and bilateral ties

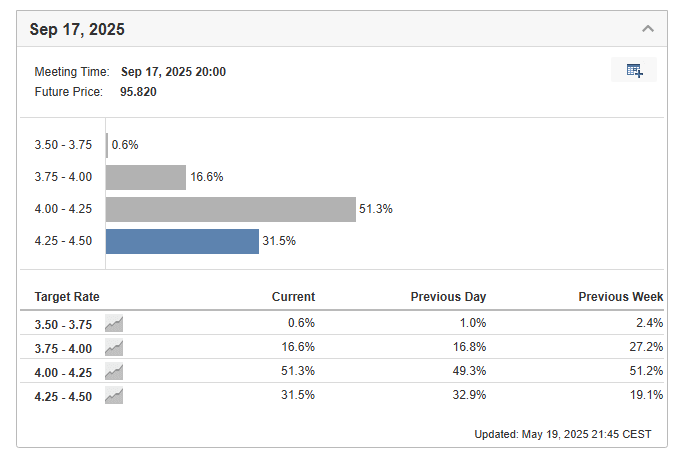

- Interest rate cut expectations shift from July to September as inflation proves stubborn and uneven.

- Moody’s downgrade and Trump’s attacks on Powell fuel short-term weakness in the US dollar.

- EUR/USD faces resistance at 1.13, but bullish pressure continues with eyes on 1.1380 next.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

Buyers were showing strong interest in the US Dollar at the start of last week, but that momentum quickly faded due to recent political and economic developments.

Most importantly, the expected timing of the next interest rate cut has been pushed from July to September. This delay is largely due to inflation falling too slowly and ongoing uncertainty in the economy, as noted by some Federal Reserve officials.

Another factor weighing on the dollar is the loss of the US’s top credit rating from Moody’s. On top of that, US President Donald Trump has renewed his public criticism of Fed Chair Jerome Powell. All these factors combined are putting short-term pressure on the US dollar.

Trump Administration Pushes Back on Credit Downgrade

Last weekend, it was reported that Moody’s downgraded the US credit rating from AAA to AA1. This move, which had been expected for some time, was mainly due to the growing national debt and the lack of a clear plan to reduce it. Moody’s warned that fiscal issues are starting to outweigh the strength of the US economy, and further loosening of fiscal policy could make things worse.

The agency also hinted that more downgrades could follow. The White House quickly responded, with spokesman Steven Cheung criticizing the decision.

At the same time, Trump is repeatedly targeting Federal Reserve Chair Jerome Powell. Although the President has tried to ease tensions with softer language, the possibility of another delay in cutting interest rates has reignited concerns. Any move that threatens the independence of the Federal Reserve weakens trust in the US dollar, and that is becoming increasingly clear.

However, Powell is not the only voice behind tighter monetary policy. Other Federal Reserve board members, including Bostic and Jefferson, have also taken a hawkish stance. Bostic has warned that inflation is easing too slowly and that the outlook remains uncertain, partly due to the ongoing tariff war.

Vice Chair Jefferson shares a similar view, highlighting the continued strength of the labor market—another reason why there is no urgent need to cut interest rates.

Technical Analysis of EUR/USD

The upward impulse observed over the past few days has slowed down in the 1.13 resistance area, where a supply reaction is visible. However, all indications are that the bulls are not letting up, and with continued pressure, further attempts should be successful.

The recent upward momentum has slowed near the 1.13 resistance level, where selling pressure has emerged. However, the overall trend still favors the bulls, and if the buying pressure continues, a breakout above this level seems likely.

If the 1.13 barrier is cleared, the next target would be around 1.1380. On the downside, the key support remains the upward trend line. A break below this line could signal a move lower, potentially toward the support area near 1.1140.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with a proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation, or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.