Street Calls of the Week

- The Federal Reserve’s May FOMC meeting arrives at a crucial moment for the market.

- While borrowing costs are forecast to remain unchanged, investors will scrutinize comments from Fed Chair Powell for his views on rate cuts and inflation amid President Trump’s disruptive trade policies.

- As the Fed navigates these challenges, its communication will be critical in shaping market expectations and guiding investor sentiment.

- Looking for actionable trade ideas to navigate the current market volatility? Subscribe here to unlock access to InvestingPro’s AI-selected stock winners.

The Federal Reserve faces a classic "lose-lose" scenario at this week’s FOMC meeting as new tariffs under President Donald Trump create a precarious balancing act between inflation risks and growth concerns.

The U.S. central bank is widely expected to maintain current interest rate levels at the conclusion of Wednesday’s policy meeting, while carefully monitoring how tariffs impact both inflation and the labor market.

Internal divisions are emerging among FOMC members, creating a policy dilemma that will likely dominate discussions. Fed officials are grappling with a fundamental question: Will tariff-driven price increases be temporary or persistent?

This distinction is crucial for the Fed’s policy decisions. Officials appear inclined to wait for clear signs of economic deterioration before cutting rates, prioritizing their inflation-fighting credibility over short-term economic support.

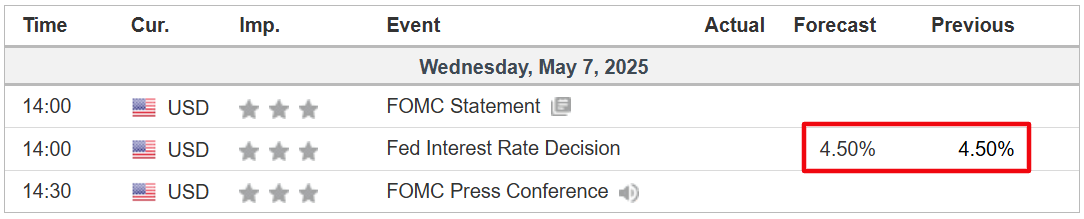

Expectations for the May Meeting

Source: Investing.com

- Interest Rates: The FOMC is widely expected to hold the federal funds rate steady at 4.25%–4.50%. Interest rate traders assign a 96% probability to no change, as per the Investing.com Fed Monitor Tool, underlining the Fed’s wait-and-see approach.

- Policy Statement: The Fed’s statement is likely to reiterate increased uncertainty around the economic outlook and attentiveness to risks to both inflation and employment. It may note declining private sector confidence and acknowledge tariff-driven inflationary and growth risks, while emphasizing stable labor market conditions.

- Balance Sheet: The Fed has already slowed quantitative tightening (QT), reducing the monthly cap on Treasury securities runoff to $5 billion from $25 billion starting in April 2025, while maintaining $35 billion for agency mortgage-backed securities. No further changes to QT are anticipated at this meeting.

- Press Conference: Fed Chair Jerome Powell is expected to maintain a cautious tone, avoiding firm commitments on rate cuts while emphasizing data dependency. Any shift in tone toward a more hawkish or dovish stance could move markets.

Key Themes To Watch

- Tariff Impacts: The Fed is grappling with the inflationary effects of Trump’s trade policies, which could raise import prices, and their potential to slow economic growth. Powell’s remarks on whether the Fed will “look through” tariff-driven inflation, as suggested by Governor Christopher Waller, will be critical.

- Rate Cut Timing: While the FOMC’s March 2025 projections indicated two 25-basis-point cuts by year-end, market expectations lean toward July as the earliest cut, with a 68% probability. Some analysts project three cuts (June, September, December), as a sharper economic slowdown could prompt earlier action.

- Fed Independence: Concerns about political pressure, particularly from the Trump administration’s push for lower rates, could unsettle markets if Powell signals any perceived erosion of autonomy.

Market Implications

Markets are braced for volatility, particularly if Powell’s comments deviate from expectations. The Fed’s cautious approach suggests investors should prepare for rates to remain higher for longer than previously anticipated.

This stance could create headwinds for growth stocks and rate-sensitive sectors while potentially supporting the US Dollar.

Amid this backdrop, investors may consider the following strategies to navigate these turbulent times:

- Diversify Your Portfolio: A well-diversified portfolio across various asset classes, including stocks, bonds, commodities, and alternative investments, can help mitigate losses during market swings.

- Consider Safe-Haven Assets: Allocating a portion of your portfolio to safe-haven assets like gold and other precious metals can provide a hedge against market volatility. Gold has historically maintained its value during economic downturns and is currently experiencing a surge in demand.

- Buy The Dip: Despite the recent turmoil in tech stocks, the long-term growth prospects of the sector remain strong. Selecting quality names with solid fundamentals could offer attractive returns once the market turns back up.

Conclusion

The Fed’s May FOMC meeting is unlikely to deliver surprises, with rates expected to hold steady as policymakers assess the evolving economic landscape. However, Powell’s press conference will be pivotal, as markets seek clarity on the Fed’s reaction to tariffs, inflation, and potential growth slowdowns.

Investors and consumers alike should brace for continued uncertainty, with the Fed walking a tightrope between its dual mandate and external policy pressures.

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now and instantly unlock access to several market-beating features, including:

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.