Eos Energy stock falls after Fuzzy Panda issues short report

Sterling liquidity conditions have remained broadly stable since the start of this year. A likely slowdown of QT and a strong uptake of liquidity facilities limit the draining of bank reserves. Money market instruments with maturities of less than one month are in high demand due to investment mandates and regulatory frameworks, pushing rates down

Path to Policy Normalisation Continues but Possibly at a Slower Pace

We still see the Bank of England (BoE) cutting rates once more this year, although investors have turned more sceptical. The market implied probability for another cut by the end of this year has dropped to around 50% on the back of sticky inflation numbers and relatively good economic data.

But the BoE landing zone is still priced at 3.5%, which means the money market curve offers a decent yield pickup for shorter maturities. From a strategy perspective, however, we prefer to position further out on the curve as we see scope for easing to 3.25%, below market expectations.

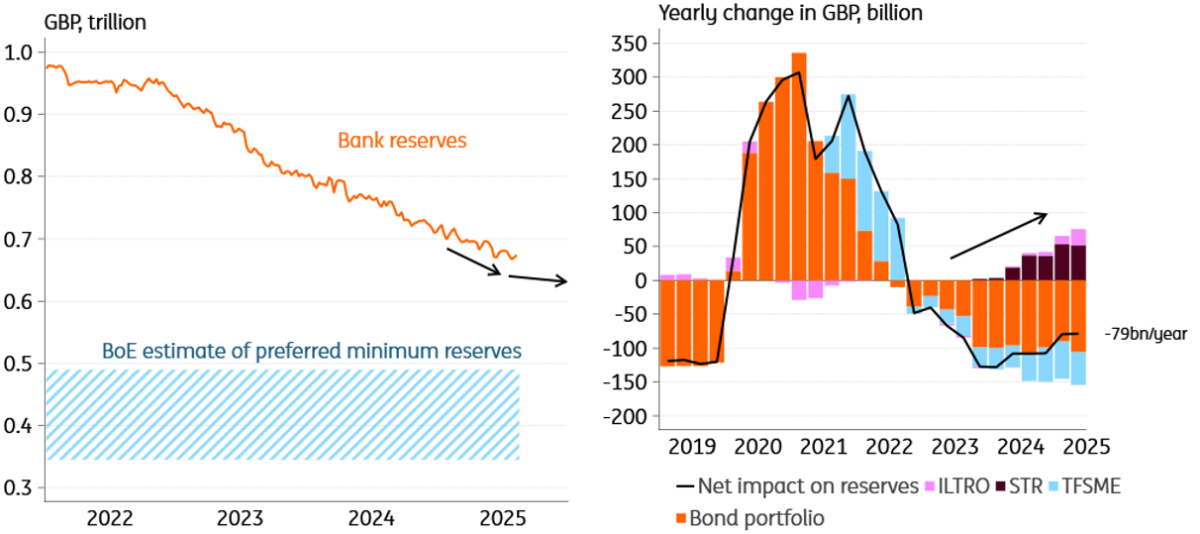

In the September meeting, the BoE will also decide on the pace of quantitative tightening (QT) going forward, which could have implications for liquidity conditions. Interestingly, the likely decision to lower the pace of the gilt portfolio unwind from the current £100bn per year seems more driven by the recent moves in longer-dated gilt yields rather than tighter liquidity. The 30Y gilt yield is already at new records and with (global) fiscal pressures pushing yields higher, the BoE wants to prevent excessive stress in the gilt market.

If the Bank of England reduces the pace of the unwind of the bond portfolio, then liquidity should remain ample for even longer. Whilst QT is draining bank reserves, the repo liquidity facilities, STR and ILTRO, are adding reserves to the system. In fact, over the past year, these two facilities added around £70bn of reserves, offsetting a significant portion of the QT impact. This should keep money markets in a relatively good place in terms of liquidity supply.

Slower QT and Liquidity Facilities Limit Drain of Reserves

Source: ING, Bank of England, Macrobond

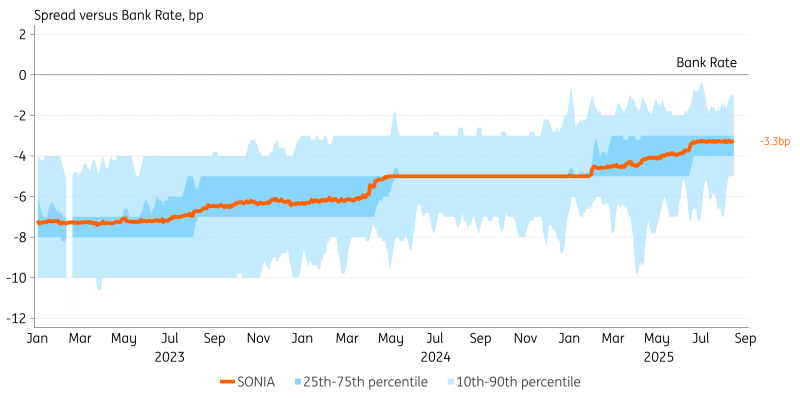

Having said that, as bank reserves are declining, we’re still seeing subtle signs of tightening liquidity conditions, but we may be closing in on a more steady state. SONIA is now at 3bp below the Bank Rate and can probably stay there for some time. As we pointed out above, the draining of bank reserves may follow a slower path going forward. This should put less upward pressure on the price paid by banks to attract deposits.

Banks Pay Slightly More to Attract Deposits as Reserves Are Drained

Source: ING, Bank of England, Macrobond

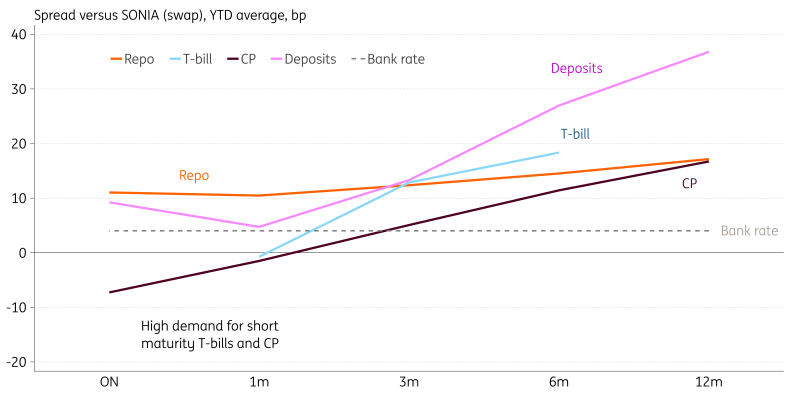

Relatively Low Returns on Shortest Maturities Due to Strong Demand

When looking at the broader universe of money market instruments, we don’t see many signs of tightening since the beginning of this year. The spreads on treasury bills and commercial paper (CP) have remained fairly rangebound. An interesting observation remains the structurally strong demand for T-bills and CP with a maturity of one month or less. The demand for these pushes those rates below the SONIA swap curve.

Certain investors have a strong preference for very short maturity instruments, which distorts the price for these short assets. For example, some central banks are mandated to only buy GBP money market instruments with a maturity of one month or shorter. Similarly, some corporate treasurers can only invest up to three-month maturities. From a risk-reward perspective, investing in repo markets could be more attractive, but some players are not mandated to do so or are not operationally ready.

Further out on the money market curve, we see wider spreads for deposits. Whereas repo is a form of secured borrowing and lending, deposits are unsecured and therefore should in theory bear higher rates. This is the case for longer maturities, but not for those of less than 30 days. Deposits with a maturity of 30 days or less negatively impact banks’ Liquidity Coverage Ratio and are therefore not as attractive as longer tenors, driving the rates down.

Investment Mandates Increase the Demand for Short-Term Instruments

Source: ING, Bank of England, Macrobond

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more