Berkshire Hathaway reveals $4.3 billion stake in Alphabet, cuts Apple

After reviewing the movements of gold futures in different time charts, amid shifting policies of global central banks, the news flow from various parts of the world this week is likely to confirm this policy shift.

As I explained in my last analysis https://www.investing.com/analysis/gold-breakdown-below-3765-could-accelerate-bearish-momentum-this-week-200667485, the reasons behind the advent of a selling spree in gold are due to shifting global central banks being more focused on rising inflation and weakening currencies.

Now, the BOJ kept the short-term rate at 0.5% but signaled it would scale back purchases of exchange-traded funds and real estate investment trusts while two members of the board dissented, calling for a hike to 0.75%. The minutes reinforced the expectation that the BOJ is slowly tilting toward a more hawkish stance, even as global growth risks remain a concern.

Now, the Reserve Bank of Australia can slow its pace of easing, as after monthly rate cuts, economic growth picked up in the second quarter, and the jobless rate has held relatively steady.

Undoubtedly, the RBA will likely keep its cash rate at 3.60% next week as Australia’s monthly consumer price index (CPI) rose 3.0% in August from a year earlier, accelerating from 2.8% in July.

On Thursday, surprisingly, US economic data could make the Federal Reserve more cautious about cutting interest rates next time in the coming months, while Fed Chair Jerome Powell has already said this Tuesday there was “no risk-free path” for policy, warning of the risks of cutting too quickly or too slowly.

Undoubtedly, the precious metal has also benefited from its traditional status as a safe-haven asset during times of uncertainty, and investors face no shortage of reasons for caution.

Ongoing conflicts in Ukraine and the Middle East, persistent inflationary concerns, and political risks in the US have all contributed to this rally between November 2024 – September 2025, have pushed the gold futures to test record highs but the persisting selling pressure looks evident enough here to reverse this rally back as some central banks look more keen to shed some extra part of gold from their reserves at this level.

Now, the question is whether the global central banks are still buying gold at the current price or if they look reluctant to add more gold to their reserves? Or they have started to offload some overbought portion of their gold reserves at such a higher price level where the yellow metal has already lost its safe-haven potential.

I anticipate that the answer lies in the surging selling pressure in gold futures, as some countries have already created short positions in gold futures, as they could make a profit by selling futures at the current levels, and as they can afford to give delivery from the overbought portion of their gold reserves.

Secondly, some countries are trying to lessen their dependence on the US dollar by adopting de-dollarization, like the use of petroyuan by China to purchase oil from the Middle East countries, by facilitating them to trade gold on its commodity exchange by using petroyuan, which they earn from selling oil to China.

Thirdly, a desperate buying spree by China’s central bank in 2024-25 pushed the gold futures to test record highs, but this resulted in surging weakness in the Chinese Yuan, and the same phenomenon applies to the other countries too, whose central banks were also busy buying gold during this period.

Undoubtedly, this panic buying resulted in a surge of inflation and stagnant global growth amid growing concerns over the possible economic impact of Trump’s trade tariffs in the near future, as these policies not only deflated the global growth but also had a denting impact on the U.S. economic growth too.

I anticipate that selling an extra part of gold reserves seems to be the only way to strengthen global currencies while global inflation is going upward.

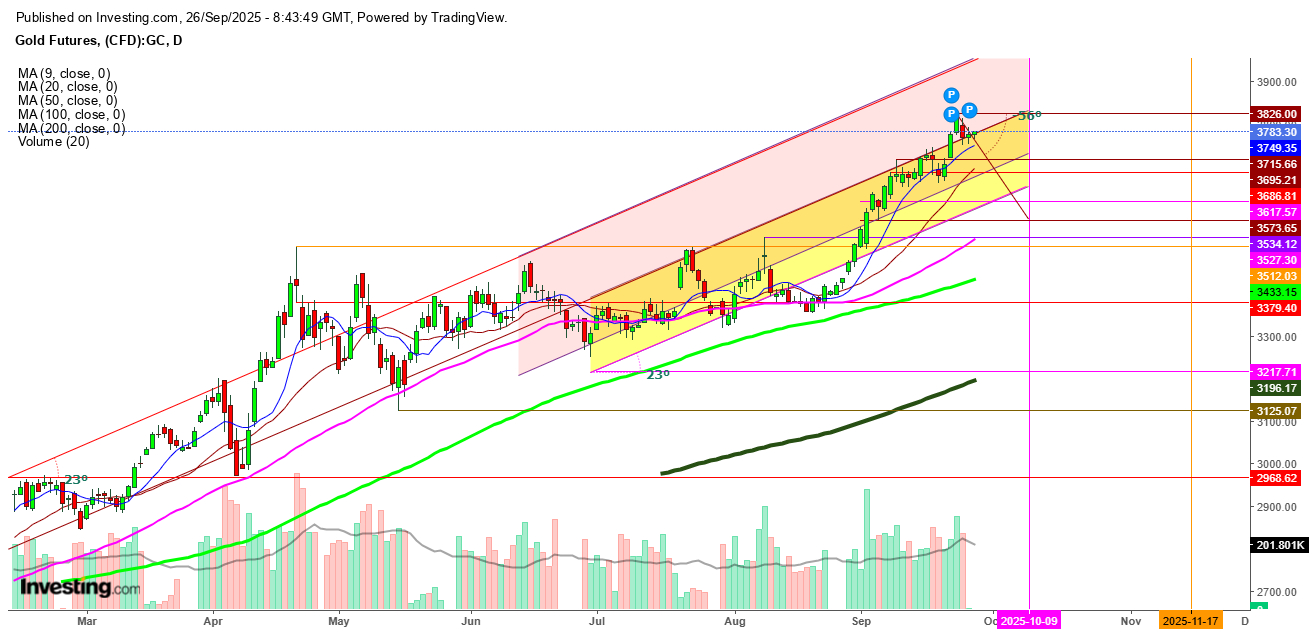

Technical Levels to Watch

In a monthly chart, gold futures look ready to see exhaustion this month, as after testing a high at $3824.55 have come down to $3779 currently. This shows that their reversal looks evident enough to show the absence of buyers even at the current levels, and I expect this month’s closing below the immediate support at $3744. Undoubtedly, if the gold futures close this month below this level, exhaustion is likely to accelerate next month.

In a weekly chart, gold futures could not test the significant resistance at $3883, and at the current levels, surging bearish pressure could push the futures to close this week below the significant support at $3744.

In a daily chart, gold futures are constantly facing selling pressure at the current levels despite bouncing back from the significant support at $3752, during the last two trading sessions, but I find that if the gold futures can’t sustain at the current level, the next support at the 9 DMA at $3749 could be tested before this weekly close.

In a 1-Hr. Chart, gold futures are constantly facing resistance at the 100 DMA at $3781.86 despite the formation of an extremely bearish crossover as the 9 DMA, 20 DMA, and the 50 DMA have come below the 100 DMA, which could result in the advent of a selling spree any time in today’s trading session.

Disclaimer: Readers are advised to take any position in gold at their own risk, as this analysis is only based on observations.