TSX futures subdued as gold rally takes a breather

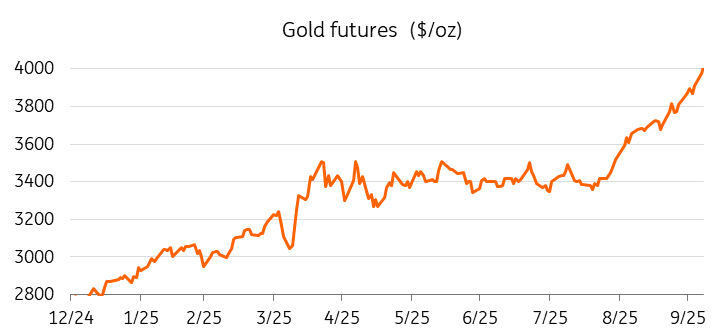

December futures in New York, the most active contract, surpassed $4,000 for the first time as the US federal government shutdown dragged on into its second week.

December futures in New York, the most active contract, surpassed $4,000 for the first time as the US federal government shutdown dragged on into its second week. Meanwhile, gold edged closer to $4,000/oz, hitting a fresh record high on Tuesday above $3,991/oz.

The US shutdown has delayed key payroll data, further clouding an already uncertain economic outlook. With official data delayed, traders are relying on private reports for economic insight, while the central bank faces challenges in making monetary policy decisions. Still, markets are pricing in a quarter-point cut this month, which would further benefit gold, as it doesn’t pay interest. Policy uncertainty and growing bets on Federal Reserve easing are keeping safe-haven demand strong.

Investors are adding gold ETFs at a rapid pace. Last week, gold-backed exchange-traded funds expanded again, taking the total gold ETF holdings to the highest level since September 2022. There is still room for further additions, given the current total remains shy of the peak hit in 2020. More inflows could push gold even higher.

Gold has staged a historic rally, doubling in less than two years, spurred by central bank buying as it diversifies away from the US dollar, President Donald Trump’s aggressive trade policy and conflicts in the Middle East and Ukraine.

Looking ahead, central banks are still buying – the People’s Bank of China extended its gold buying streak in September for an 11th consecutive month despite record high prices – Trump’s trade war is still pressing on, geopolitical risks remain elevated, and ETF holdings continue to expand while expectations of more Fed rate cuts intensify. All of this suggests that gold has still further room to run.

***

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more