Wall St futures flat amid US-China trade jitters; bank earnings in focus

XAU/USD futures suddenly took a sharp bearish tone on Wednesday, soon after President Donald Trump stepped back from threats of firing Federal Reserve Chair Jerome Powell, which was also supportive of the U.S. dollar’s recovery.

Undoubtedly, a sharp rise in the U.S. dollar index on Wednesday was evident enough to provide relief to investors, while optimism around the global trade deals lifted weakened sentiments as the markets grappled with the notion that the Fed’s independence could be under threat if President Trump continues to interfere in the Fed’s work beyond a limit.

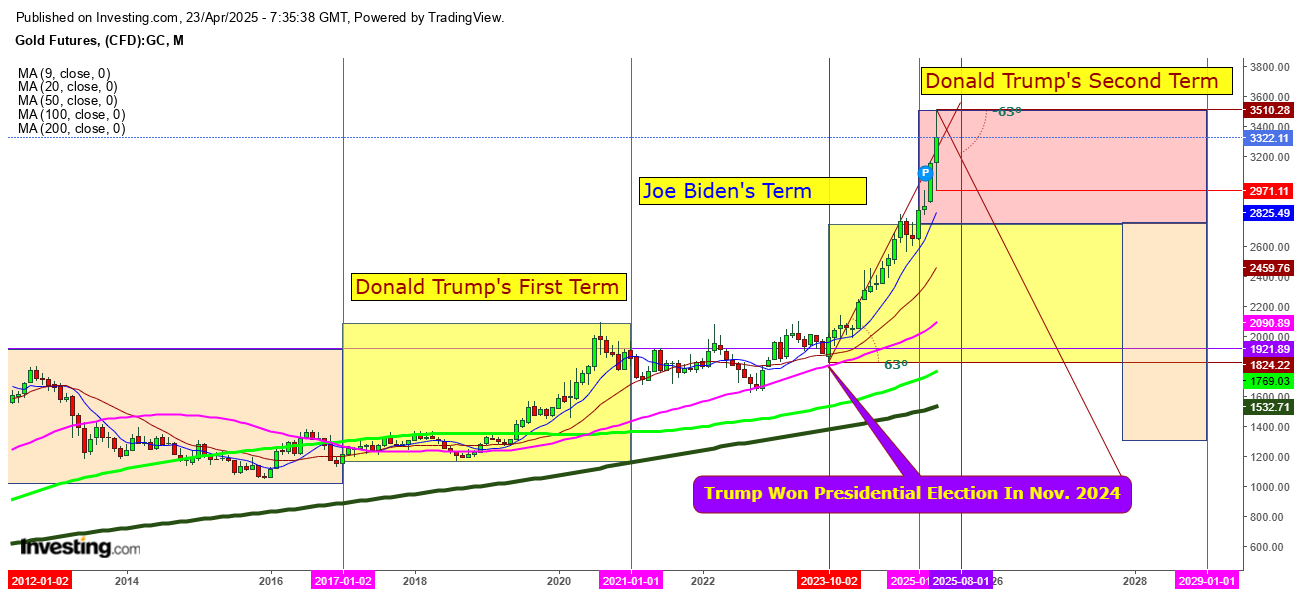

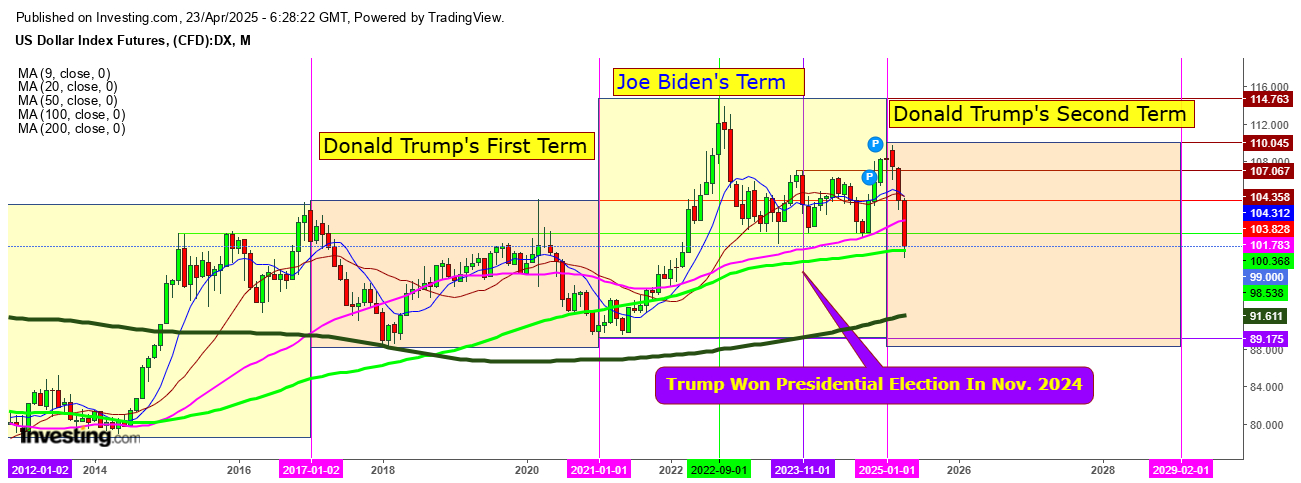

Indecisive moves by the gold futures and the U.S. dollar compel investors to find the compelling reasons behind surging volatility around the world as the changing economic policies under the different U.S. Presidents since Jan. 2017 when President Trump came into power first time.

Perhaps, the investors were aware of the current economic upheavals as President Trump ensured the world to make America Great Once Again while he started his election campaign, and after winning the election in Nov. 2024 he indicated an overhaul of US economic policy to fulfill his dream.

If we analyze the movements of the U.S. dollar index and gold futures in monthly charts, we can see how both the U.S. dollar index and gold futures started their directional moves in Nov. 2024.

I anticipate that U.S. President Donald Trump could not asses the destructive nature of its tariff trade policies in advance as the implementation proved fatal jolts the global economic policies which finally extended the fear of global economic recession in 2025.

Undoubtedly, Trump realized this on Wednesday as he never wanted to weaken the U.S. dollar and he has done now.

I anticipate that Trump’s habit of making sudden economic moves without having a consultation with an economic expert is likely to keep the scenario full of suspicion this year despite a reversal in the weakening dollar and surging gold prices.

On analyzing, the movements of the gold futures in a monthly chart, I anticipate that the gold futures have started to reverse from this year’s high, and a breakdown below the immediate support at $2971 will confirm the advent of a bearish trend in the yellow metal.

Inversely, if the gold futures try to move upward, immediate resistance will be at $3373.

On the other hand, if the gold futures do not hold the immediate support at $2971, the next target could be at the 9 DMA at $2825.

The U.S. dollar index is trying to hold significant support at 100 DMA at $98 after a reversal from this month’s high at $104, and a breakdown below this significant support could push the dollar index to test the next support at 200 DMA at $91.61.

Disclaimer: Readers are advised to take any position in gold and the US dollar at their own risk, as this analysis is based only on observations.