Sun Valley Gold sells Vista Gold (VGZ) shares worth $2.16 million

After a market has been trending strongly for a few months or longer, a piece of extremely bullish news (in the case of an upward trend) or bearish news (in the case of a downward trend) can be the catalyst that sets in motion a multi-day or multi-week blow-off move that at least temporarily marks the end of the trend.

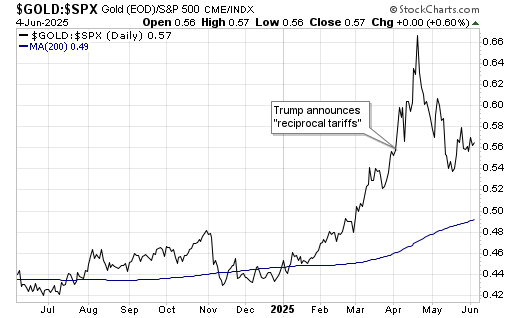

This appears to have been the case during April 2025 with the upward trend of the gold/SPX ratio (the US$ Gold price relative to the S&P 500 Index) and the corresponding downward trend of the SPX/gold ratio.

We remarked in the 21st April Weekly Update that the SPX’s sell-off in gold terms was much more severe than its sell-off in nominal currency terms, paving the way for the SPX to rebound in terms of gold as well as in nominal dollar terms over the ensuing weeks. It turned out that extremes for the SPX/gold ratio and the gold/SPX ratio were set on 21st April.

With reference to the following daily chart of the gold/SPX ratio, the news that appears to have set in motion a 2-3-week upside blow-off was Trump’s press conference regarding “reciprocal tariffs” after the close of trading on 2nd April. At this press conference, Trump held up the now-infamous board showing the tariff rates that would be imposed on imports from every country.

It quickly became apparent that these rates were based on a nonsensical formula and a nonsensical premise (the notion that if the US has a trade deficit with a country, then the US is being ‘ripped off’ by that country). This shattered any illusions that the Trump Administration was proceeding in a well-thought-out manner, prompting a panic out of US assets and a surge in the demand for gold.

As a result of the panic precipitated by the “reciprocal tariffs” announcement, the gold price gained about 20% relative to the SPX in only 12 trading days.

Although this price move could be viewed as reasonable given what was happening in the world, it was so dramatic in one direction that it set the stage for a significant move in the opposite direction.

We expect that the gold/SPX ratio eventually will move a long way above its 21st April high, but this high probably will hold for at least 3 months and could hold for up to 6 months.