U.S. approves sale of 70,000 AI chips to UAE and Saudi Arabia, WSJ reports

What we (NFTRH) viewed as a bullish but frothy sector – the precious metals, which had led the post-March broad rally into late October – has finally taken the haircut it needed. Or to use another turn of phrase, the precious metals correction, and especially gold stock correction, is sanitizing the sentiment and momentum profiles.

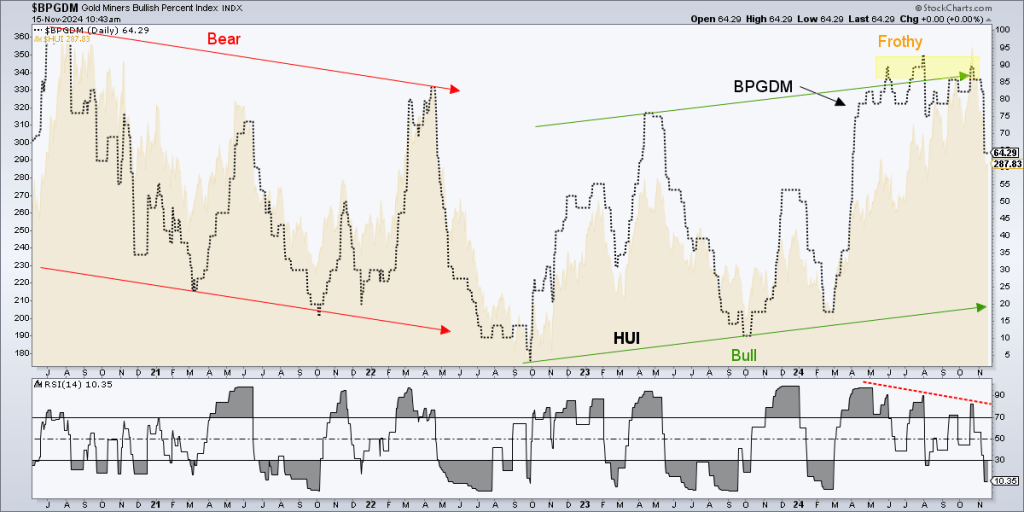

The Gold Miners Bullish Percent index (BPGDM, not a sentiment gauge, so much as a momentum gauge) has indeed taken a haircut off the frothy top. Depending on the duration or severity of the correction, the BPGDM may or may not be done declining. But importantly, it means that a good number of miners’ charts have triggered point & figure chart “sell” signals. That is momentum draining out of the sector, day by day.

I have added RSI to the chart if for no other reason than it appears RSI, if not the index itself, provided a good negative divergence signal as gold stocks (HUI) continued rising while BPGDM’s RSI diverged. Now RSI is getting toward oversold levels that have – with much grinding and volatility – marked gold stock correction lows. At the very least, BPGDM tells us the sector is well in the process of a healthy correction (ref. the bull market trend in BPGDM noted on the chart).

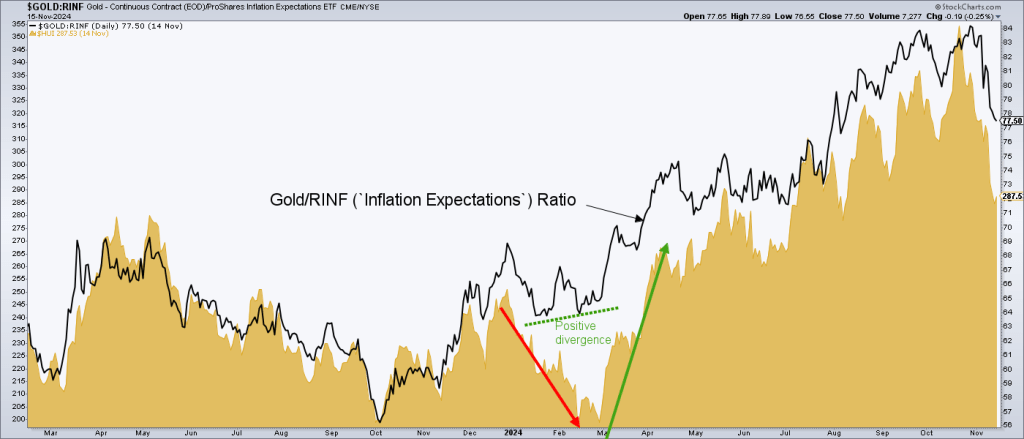

Moving on, let’s look at the corrective progress HUI is making vs. the Gold/RINF ratio, a gauge of gold’s performance in relation to inflation signals and expectations.

Aside from continually proving wrong those who believe in and tout gold stocks as a way to hedge inflation (as many do in the public and in the gold stock analysis community), this chart shows that as gold has been dropping lately in relation to inflation signals, the miners are doing the right thing and also dropping.

As you can see, the gold stock correction is dropping HUI harder than the ratio. It is another sign that the sector is getting cleaned of the wrong kind of investors, err, speculators, inflationists, momo freaks, and hangers-on.

A divergence like the one we noted (in real time) last February that preceded the rally, may or may not develop here, giving a buy signal. It is possible that the sharp decline by HUI relative to Gold/RINF could do the trick with no follow-up divergence building. In other words, this could be more of a flash event than an extended process.

Bottom Line

The gold stock correction has made very good technical progress by hitting levels we noted ahead of time. While the correction is not yet clearly indicated to be over and there are potential targets lower, much price and sentiment risk has come out of the sector to this point. If gold continues to decline in relation to inflation signals, the going could get rougher. If at some point the Gold/RINF ratio stabilizes the miners would have a tailwind developing.

As a side note, the above are just two of several ways to view gold stocks’ internal situation. This is by no means an exhaustive article on the matter.

We have managed the gold stock correction since before it began (noting the frothy BPGDM above and the high risk profile of the gold price, among other things), traders will have sold, investors will have realized that it is likely a correction within a bull market and I personally trimmed holdings, hedged a couple times and am feeling like scouting opportunity rather than praying the correction will end.