Stock market today: Nasdaq closes above 23,000 for first time as tech rebounds

- Intel is undertaking massive restructuring under Chief Executive Officer Pat Gelsinger to reclaim its past glory

- Analysts, however, are sticking with their negative view of the stock as they believe Intel is fighting an uphill battle

- Intel’s shrinking margins pose a significant risk to the stock’s long-term growth

-

Looking for more top-rated stock ideas to add to your portfolio? Members of InvestingPro+ get exclusive access to our research tools, data, and pre-selected screeners. Learn More »

It has been a tough decade for investors in the US's largest chipmaker, Intel (NASDAQ:INTC). During that time, the Santa Clara, California-based company failed to bring the most modern chips to the market, losing significant ground to competitors such as Taiwan Semiconductor Manufacturing (NYSE:TSM) and Samsung Electronics (OTC:SSNLF) (KS:005930).

Intel’s share price, via its technical chart clearly illustrates this poor performance. INTC produced just roughly 20% gains during the past five years, while the benchmark Philadelphia Semiconductor Index surged more than 190%. INTC closed Tuesday at $43.53.

However, the company now seems to be taking its first steps toward change. Recently, Chief Executive Officer Pat Gelsinger took the helm and promised massive restructuring.

Results have already started to appear. The company is currently spending $20 billion on a chipmaking hub on the outskirts of Columbus, Ohio, which the Santa Clara, California-based chip producer expects to grow to become the world’s biggest semiconductor-manufacturing site.

The production facility will rely on the most advanced technologies, resulting in an increased American share of the global chip supply chain, bringing more production back to the US, counterbalancing Asia’s current manufacturing dominance.

Gelsinger also plans an expansion in Europe, making deals and ramping up research spending. Earlier this year, Intel agreed to buy Tower Semiconductor (NASDAQ:TSEM) for $5.4 billion, part of a push to make chips on a contract basis for other companies.

An Uphill Battle

Analysts, however, are sticking with their negative view of the stock. They believe Intel is fighting an uphill battle, especially when many of the company's biggest customers are now designing their own chips.

Apple (NASDAQ:AAPL) has already abandoned Intel parts in its Mac line of computers, relying instead on technology from Arm Ltd. Amazon (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT) are taking similar steps with their server processors.

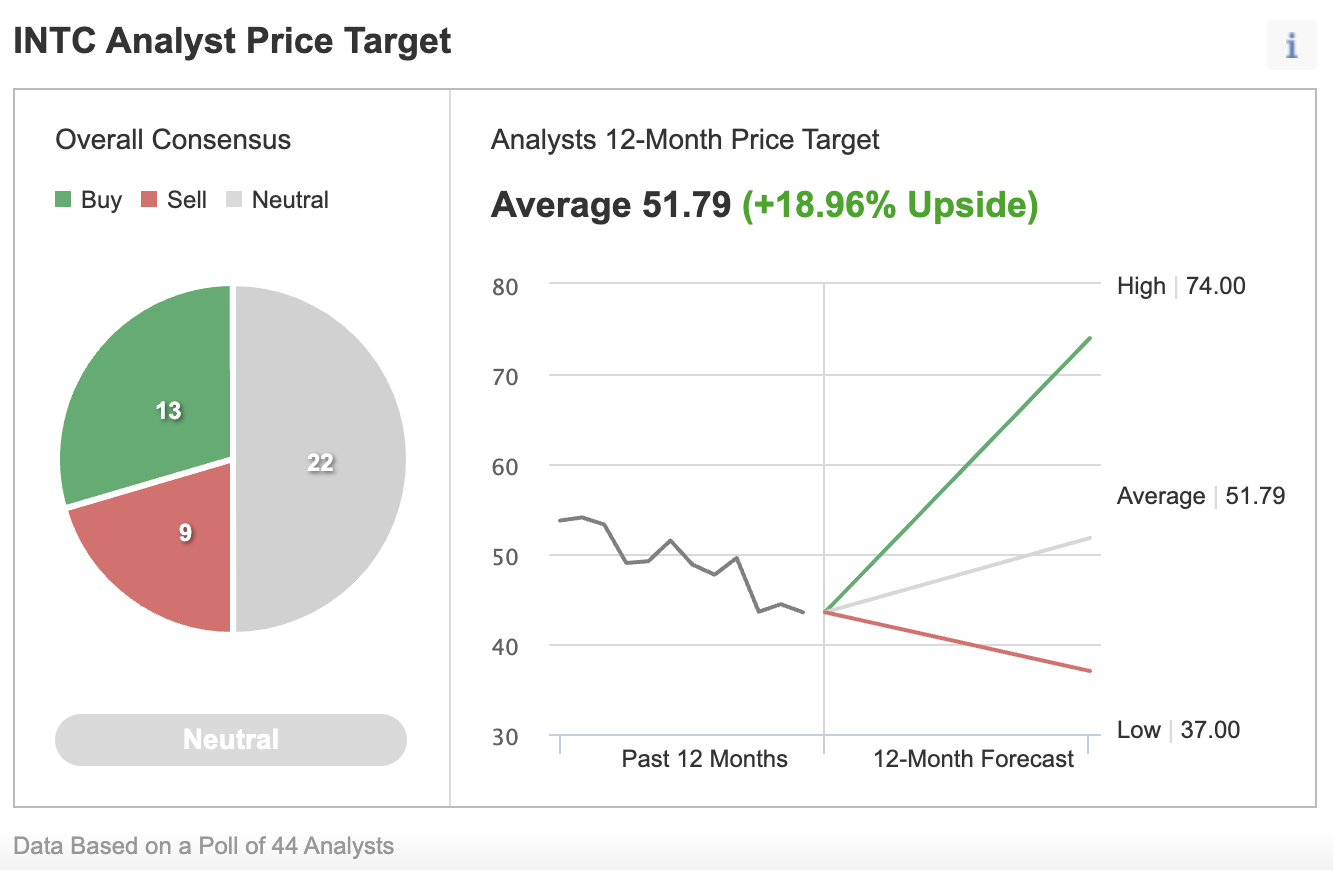

Among the 44 analysts surveyed by Investing.com, the overall consensus is Neutral, with 22 giving the stock a neutral rating, 13 a buy, and 9 providing a sell rating.

Source: Investing.com

In a note titled “Clash of Chips,” Morgan Stanley’s analysts excluded Intel from their list of stocks offering a buying opportunity in the recent market downturn.

Their note said:

“At the leading edge, we expect TSMC and Samsung to continue to dominate advanced semiconductor manufacturing in the next decade, capitalizing on the large and rapidly growing foundry opportunity.”

Intel’s role, according to them, is “less certain.”

TSMC and Samsung are the only other two companies operating foundries to fabricate leading-edge semiconductors and count the likes of Apple, Qualcomm (NASDAQ:QCOM), and NVIDIA (NASDAQ:NVDA) among their biggest customers.

Another setback that could keep Intel stock depressed is the company’s shrinking margins. Intel’s gross margins—the percentage of revenue remaining after deducting the cost of production—a key sign of health for a manufacturing company, is expected to be about 52% this year.

That figure would be pretty attractive for other industries, such as automotive, but it’s 10 percentage points below Intel’s historical levels. It’s also below those of some peers. Texas Instruments (NASDAQ:TXN) is close to 70%, and Advanced Micro Devices (NASDAQ:AMD)—not known for its fat margins in the past—expects to make 51% this year.

Another test to show whether the company is turning a corner under Gelsinger’s leadership is how it protects its earnings from any cyclical downturn that many analysts predict within the next 12 months.

In April, Intel gave a disappointing second-quarter sales and profit forecast, indicating weaker demand for its chips. This weak outlook comes amid escalating concern that overall demand for consumer PCs—Intel’s largest source of revenue—is slowing following a boom fueled by pandemic-related working and studying from home.

Bottom Line

Intel is on a long road to recovery, consuming a significant portion of its resources and hurting margins. Wall Street remains reluctant that the chipmaker will succeed in reclaiming its past glory.

We recommend a wait-and-see approach for those looking to buy Intel stock.

***

Looking to get up to speed on your next idea? With InvestingPro+, you can find:

- Any company’s financials for the last 10 years

- Financial health scores for profitability, growth, and more

- A fair value calculated from dozens of financial models

- Quick comparison to the company’s peers

- Fundamental and performance charts

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »