Novo Nordisk, Eli Lilly fall after Trump comments on weight loss drug pricing

Over the past two years, Intel (NASDAQ:INTC) investors haven’t had much to cheer about, as smaller competitors took advantage of the company’s manufacturing failures and grabbed considerable market share.

Intel’s share price chart captures this failure very clearly. The California-based chipmaker fell about 7.5% during that period, while the benchmark Philadelphia Semiconductor Index more than doubled.

The company’s disappointing growth and production missteps allowed competitors to make significant market inroads by bringing their most advanced chips to customers. NVIDIA (NASDAQ:NVDA), for example, gained more than 300% in that period, while Advanced Micro Devices (NASDAQ:AMD)—a company which just a few years ago was struggling—surged about 200%.

However, at the start of the new year, Intel is offering a slight glimmer of hope. Early signs are that its turnaround under its new CEO, Pat Gelsinger, is on the right track.

At last week’s CES in Las Vegas, which is considered one of the most influential tech events, Intel executives announced a new line of chips in a bid to put the company back on top in the computer processor arena. The so-called 12th Generation Intel Core mobile processor line, which includes 28 new models, is as much as 40% faster than its predecessors.

Furthermore, top PC makers, such as Dell Technologies (NYSE:DELL) and HP (NYSE:HPQ), have already indicated that they intend to use the new line of processors in upcoming machines aimed at gamers.

Mobileye IPO

According to The Wall Street Journal, the California-based chipmaker also plans to take its self-driving car unit, Mobileye, public this year, aiming for a valuation of around $50 billion.

Mobileye specializes in chip-based camera systems that power automated driving features in cars. Intel would retain majority ownership of Mobileye, while allowing independent management from the self-driving-car unit’s current team.

A $50 billion valuation would be a hefty return for a business acquired in 2017 for about $15 billion.

Analyst Ratings

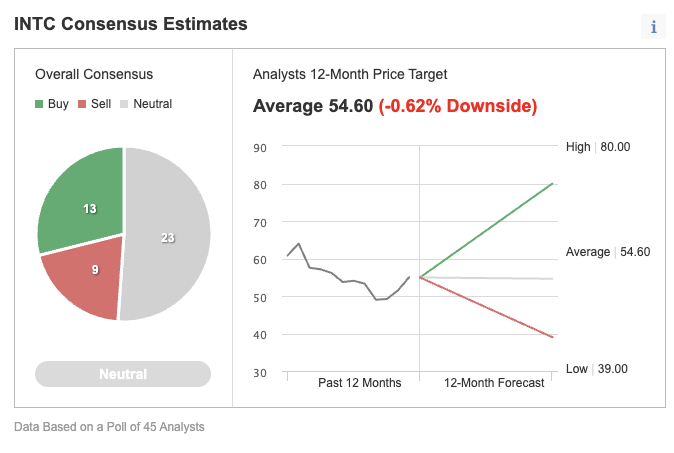

Despite these positive developments, most analysts covering Intel’s stock remain skeptical. Among the 45 analysts surveyed by Investing.com, the overall consensus is Neutral, with 23 polled giving the stock a neutral rating, 13 remaining a buy, and 9 providing a sell rating.

KeyBanc, in a recent note, downgraded Intel to sector weight from overweight, saying it sees limited catalysts over the near term. Its note said:

“While INTC does have an analyst event in February, we’re skeptical any announcement can change the bearish narrative on the stock. Given all the missteps over the last several years, we believe investors await demonstrable proof points.”

Another test to show whether the company is turning a corner under Gelsinger’s leadership will come later this month when Intel reports its full-year earnings. The company’s last three quarterly reports failed to impress investors, as they remain concerned about the high cost of these initiatives and their impact on the bottom line.

While outlining his plan to analysts in March, Gelsinger said Intel will rely more on outside manufacturers to produce some of its most cutting-edge processors, starting in 2023. He also announced a $20-billion investment to build two new chip-fabrication facilities in Arizona, called Intel Foundry Services (IFS), which will make chips designed by other companies.

Bottom Line

Intel seems to be getting traction in the new year, with its stock rallying about 8%. But this doesn’t mean that the company has suddenly become a better pick in the semiconductor industry, where other high-growth players offer a much better chance of capital appreciation. We continue to recommend a wait-and-see approach when it comes to buying Intel stock.