SoFi stock falls after announcing $1.5B public offering of common stock

By using the Elliott Wave Principle (EWP) we observe an index’s price structure as it creates a limited set of predictable patterns that repeat at all time frames, i.e. fractals. This self-similarity then provides us with an anticipated path forward. And, since the stock market is probabilistic, we can then assign the most likely path forward, as well as provide an alternative. This is no different than a general preparing a battle plan or trading. A primary (trading) plan is laid out with a contingency (stop loss).

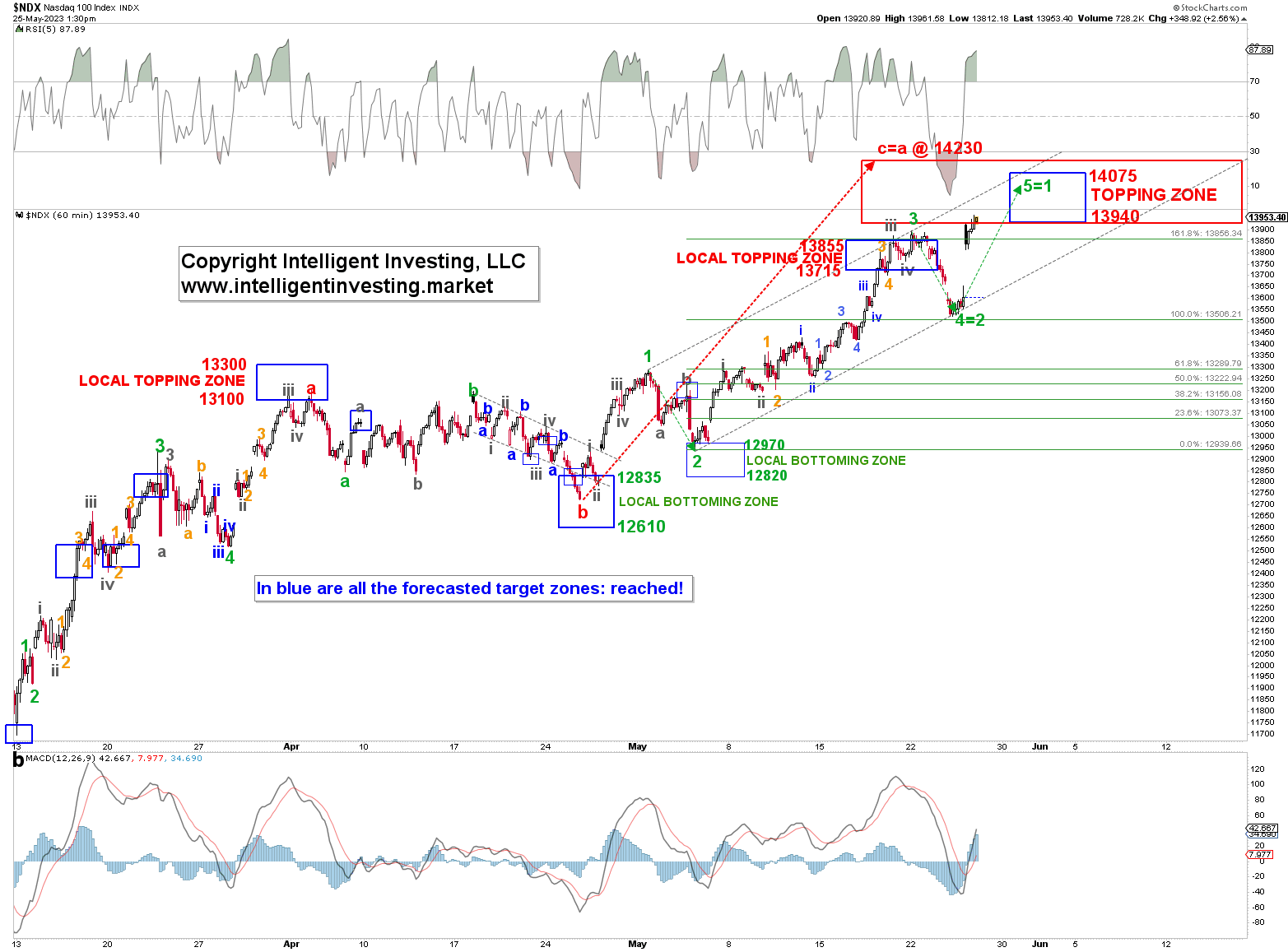

In this case, we are going to look at the Nasdaq 100 as it closed lower yesterday but broke back out today. Hence, many may have gotten caught on the wrong side of the trade. In Figure 1 below, we have the hourly-resolution chart of the NDX since the March 13 low.

Figure 1

As you can see, using the EWP one is consistently reliable and accurate on where the index should top and bottom. There will always be a few misses along the way, but that is to be expected as nobody is perfect, and the interpretation of the price action is often difficult. However, we can see the index has now reached a potential larger topping zone, which measures between $13940 and $14230. Thus, although today it may seem the sky is the limit, objective analyses using a time-tested and proven method is starting to suggest otherwise.

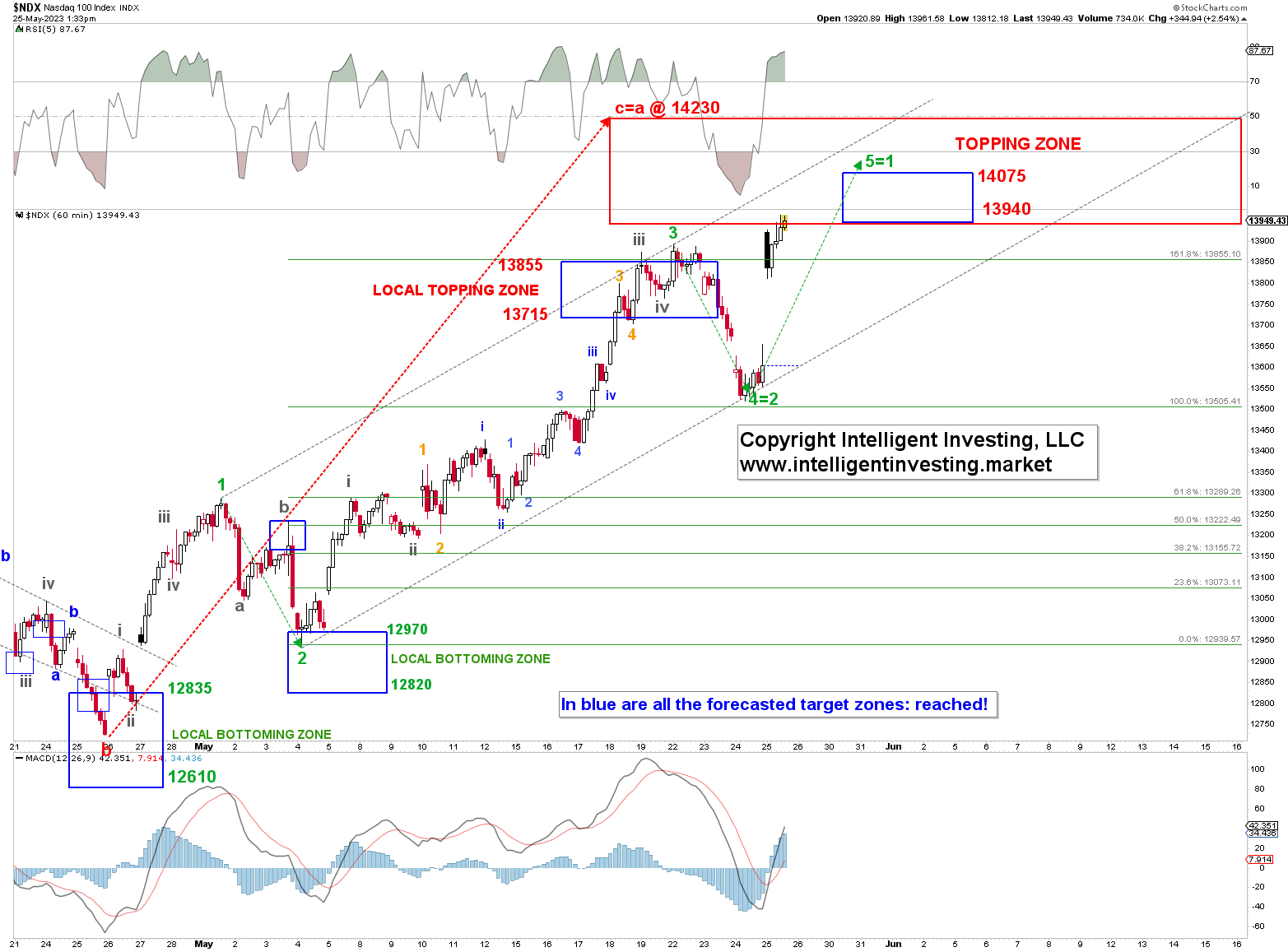

Thus, we are going to focus on the rally since the late-April (red W-b) low for more clues. See Figure 2 below.

Figure 2

It follows that the NDX did five grey waves up from the April 25 low to the April 28 high to establish green W-1, followed by a clear three waves lower to complete green W-2. In a standard Fibonacci-based impulse pattern, we know that

- The 3rd wave then often reaches the 138.2-161.80% extension of W-1, measured from the W-2 low. This is shown by the blue “local topping zone”.

- The 4th wave then often retraces back to the 123.60-76.40% extension of W-1.

- The 5th wave then often extends to the 176.40-200.00% extension of W-1 ($13940-14075).

- Moreover, in a standard impulse pattern wave-2 = wave 4 and wave 5 = wave 1. Note, these relationships are not set in stone, but a great rule of thumb. As long as W-3 is not the shortest wave and W-2 and W-4 do not overlap, extensions and truncations can always happen.

And indeed, the index peaked earlier this week only slightly above the 161.80% extension, then bottomed out yesterday only slightly above the 100% extension. Today -thanks to NVIDIA's (NASDAQ:NVDA) earnings as the catalyst, the index has already reached the ideal W-5 target zone.

Thus, although the ideal W-5=W-1 extension targets ~$14085, and the red c=a relationship targets $14230, and we can thus allow for somewhat higher prices still, the NDX has now reached our bigger topping zone. One may argue against this thesis based on a myriad of other facts and opinions, but the mere fact that we have been able to forecast over 10 times where the index should be top and bottom over the last two months using the EWP must be respected. As such, although we have no signs of a top being in place, which would be a drop below yesterday’s low, we do know that the index has reached a next larger milestone, and from a trading perspective appropriate measures should be taken. The index will have to trade above $14230 to tell us an extension of the red W-c and therewith the green W-5 is underway.