FTSE 100 today: Edges higher as pound slips; Mitchells & Butlers jumps on results

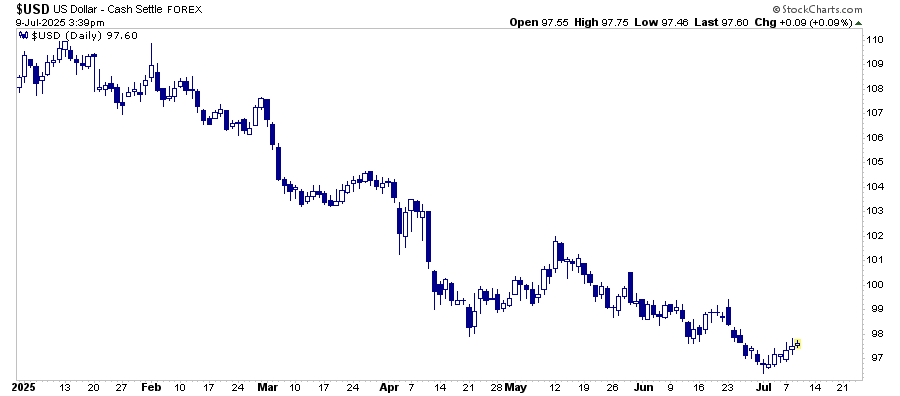

A recent CNBC article highlighted the US dollar’s worst first-half performance in 52 years. That alarming statistic fanned the flames for “dollar bears” calling for the greenback’s continued demise. Looking at the following chart, the angst is certainly justifiable.

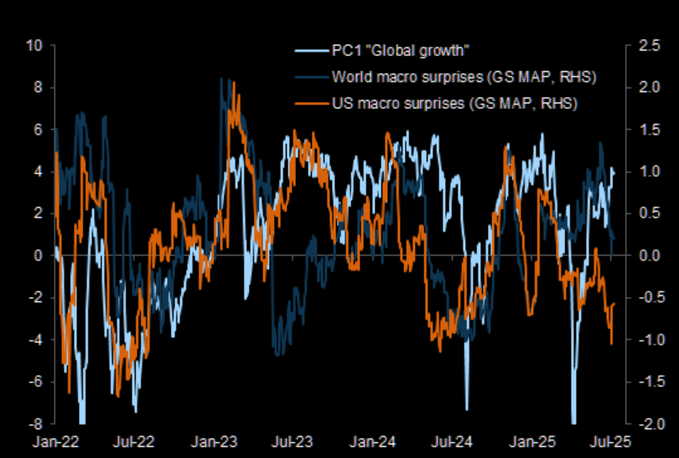

The article noted that slowing U.S. growth, narrowing interest rate differentials, and rising concerns about “de-dollarization” were the primary reasons why further downside is likely. However, that view is overly pessimistic and most likely premature.

Context Is Critical.

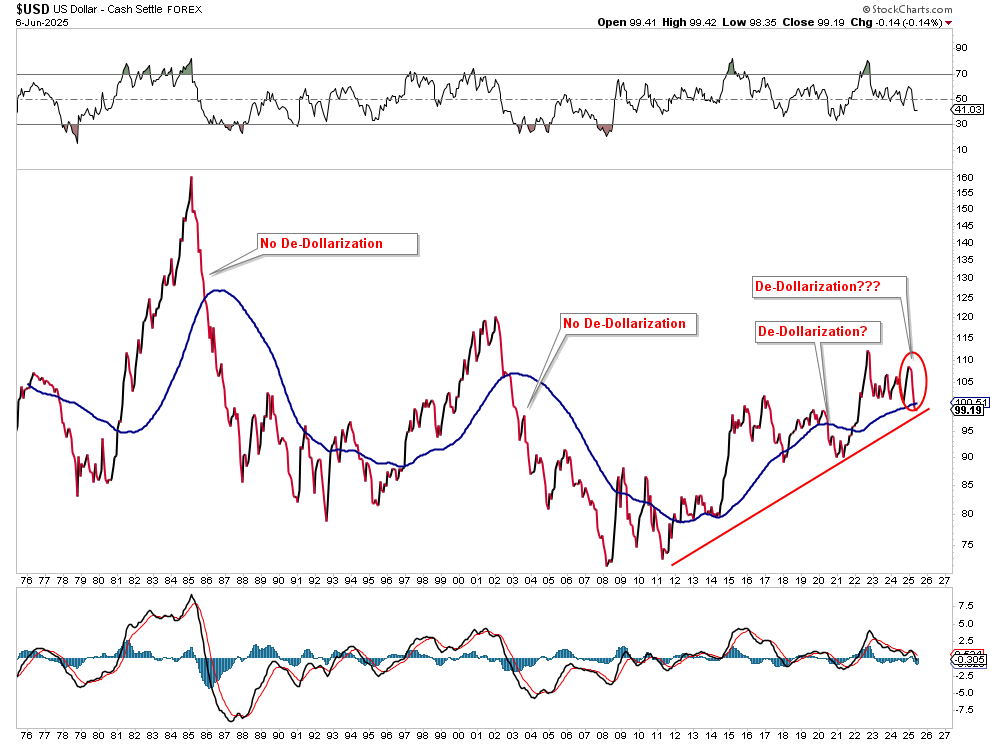

First, we previously wrote about the false claims of the “dollar’s death” in 2023 (see here, and here). While the recent decline in the dollar, relative to other currencies, has been significant, it is well within historical norms.

Notably, previous declines were much larger without the “fear-mongering” from the “experts of doom.” As shown, the dollar is trading at the same level as in 1976, and remains in a strongly bullish trend that started following the “Financial Crisis.”

For a deeper discussion about why the “Dollar’s Death Is Greatly Exaggerated,” we provide five fundamental reasons why the dollar will remain the reserve currency. Those reasons are:

- A lack of a viable alternative

- Strength of the US economy.

- Network effects and global inertia

- Limited scope of de-dollarization efforts

- Resilience amid policy changes

However, in the short term, the technical backdrop and a deeper fundamental analysis suggest that the dollar may be primed for a strong counter-trend rally in the months ahead.

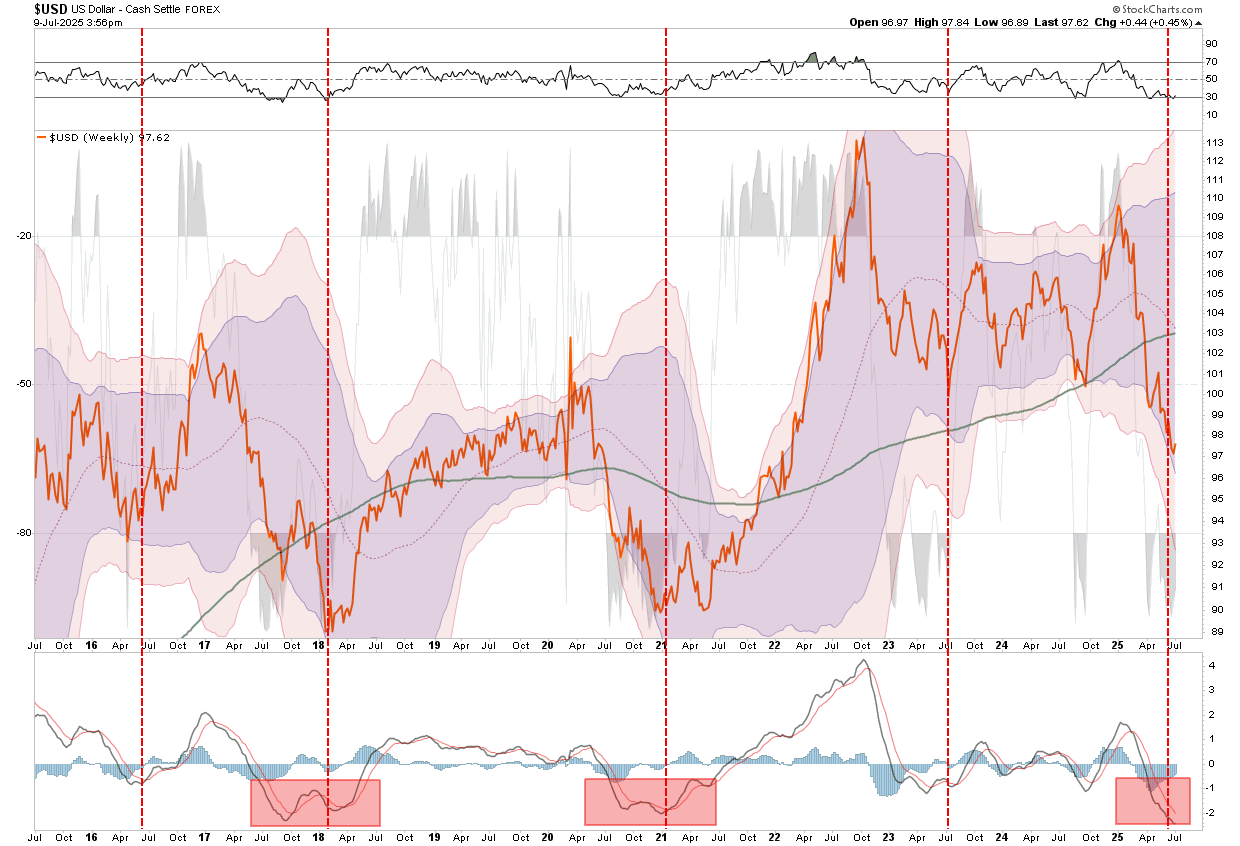

The Technical Setup

The US Dollar Index (DXY) has fallen sharply from its 2024 peak, but recent price action shows signs of exhaustion in the selling. The DXY is sitting near key support levels between $97 and $98, and multiple momentum indicators (such as RSI and MACD) are deeply oversold. As shown by the vertical red lines below, such previous conditions have allowed a bullish reversal. However, such is why when extremely bearish headlines, and a deluge of articles predicting the “death” of something, combined with deeply oversold technicals, such has almost universally been a contrarian “buy” signal.

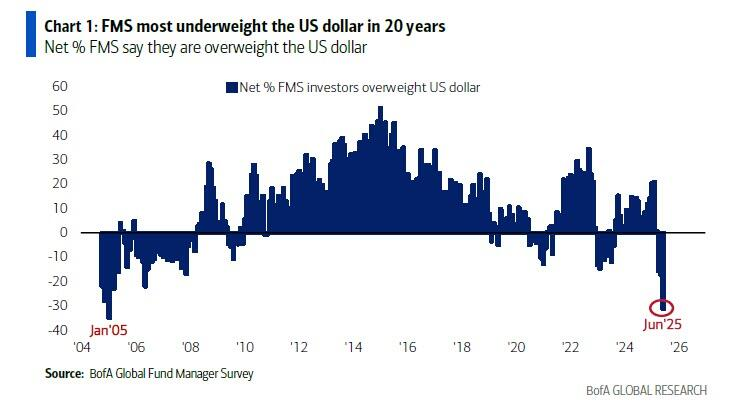

Moreover, positioning in futures markets shows that speculative traders are heavily shorting the dollar, which could set the stage for a powerful short-covering rally.

From a technical perspective alone, the dollar appears ripe for a retracement higher, but the fundamental backdrop also provides support.

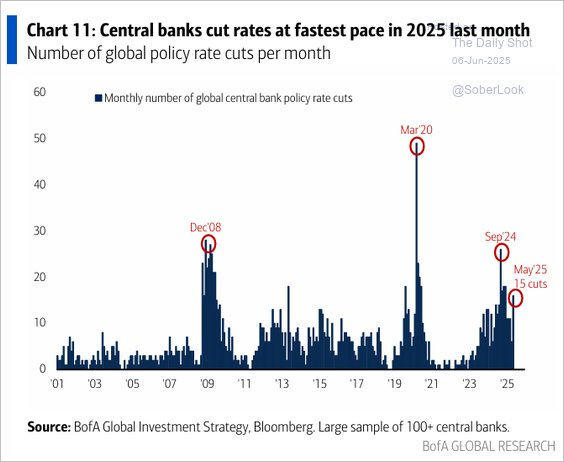

Despite weaker U.S. economic data in recent months, the U.S. still maintains a significant advantage in real yields compared to Europe and Japan. More importantly, the ECB has been aggressively cutting rates, eight times in this recent cycle, while the U.S. Federal Reserve remains on hold. The result is a divergence between U.S. Treasury bond yields and, for example, the German Bund. The critical point is that this would be an attractive set-up for sovereign governments, wealth funds, and foreign investors to capture higher bond yields, but also receive a double benefit of currency gains and higher bond prices (lower yields).

The argument that the dollar will lose its reserve currency status is more rhetoric than reality. While nations like China and Russia have promoted alternatives to SWIFT and encouraged settlement in non-dollar currencies, the dollar still accounts for nearly 60% of global foreign exchange reserves and over 80% of international trade settlement. That dominance is not easily displaced. The sheer depth, liquidity, and trust in U.S. capital markets remain unmatched.

As global investors reassess growth prospects and look for safety, capital often flows into U.S. Treasuries, supporting the dollar. If financial stress returns, the dollar could catch a strong bid, especially if economic weakness abroad is more pronounced than in the U.S. So, yes, while the first half of 2025 was historically weak for the U.S. dollar, that weakness may set the stage for a strong reversal.

For investors, writing off the dollar now may be a costly mistake.

S&P 500: Complacency Remains High Amid Stretched Valuations

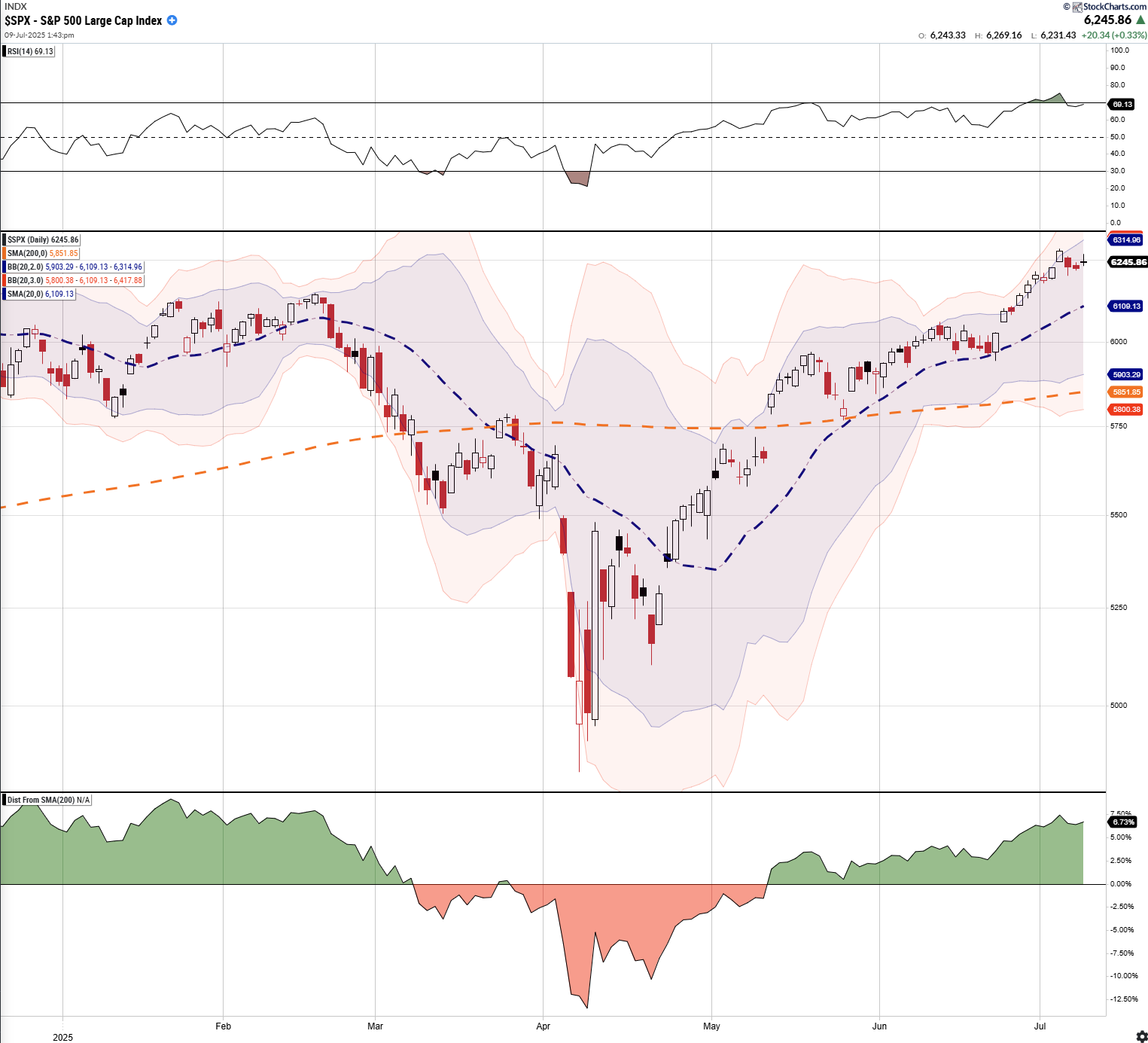

The S&P 500 closed the week in positive territory, marking another strong performance near record highs. While the index briefly hit new all-time levels midweek, the rally lost some steam on Friday as investors grew cautious ahead of key inflation data and Trump’s most recent tariff announcements. However, volatility remained subdued despite those announcements, as complacency remains high despite stretched valuations and upcoming catalysts.

Much of the week’s bullish tone was driven by renewed optimism that the Federal Reserve could cut rates as soon as September. Minutes from the June FOMC meeting revealed a growing willingness among policymakers to ease, contingent on continued disinflation. Fed Funds futures now reflect roughly a 65% chance of a September cut. Meanwhile, AI-related equities continued to lead the charge, with NVIDIA (NASDAQ:NVDA), Broadcom (NASDAQ:AVGO), and Arista Networks (NYSE:ANET) extending their gains as investor demand for AI infrastructure remains strong.

Notably, a rotation into cyclical sectors gained traction. Industrials and energy outperformed, signaling investors are beginning to broaden their bets beyond megacap tech. Sectors like utilities and consumer staples lagged. Looking ahead, all eyes are on next week’s CPI and PPI reports, which will provide critical insight into the inflation trajectory. In addition, Q2 earnings season officially kicks off Friday with results from major banks including JPMorgan, Citigroup (NYSE:C), and Wells Fargo (NYSE:WFC).

The bull case remains strong, but with the market priced for perfection, any catalyst from economic data or weak earnings guidance could trigger a pullback. Investors should prepare for increased volatility and continue monitoring sector leadership for signs of rotation.

3-Month Market Outlook

On Friday, during my discussion with Adam Taggart, I discussed the probabilities of market outcomes over the next 3 months based on current technical, fundamental, and economic underpinnings. While nothing is guaranteed, and the outlook could certainly change next week, the following is our current thinking.

Bull Case (Probability: 50%)

Drivers:

- Strong Q2 earnings, especially from tech (NVDA, AVGO, Microsoft (NASDAQ:MSFT)), confirm accelerating AI-driven growth.

- Fed cuts in September or November as inflation continues to trend lower.

- Global liquidity improves, with dovish policy shifts in Europe and China.

- Momentum chasing & FOMO remain strong; CTAs and retail driving advance.

- Seasonality, as July and early August tend to favor equities.

3-Month Outcome:

- Target (NYSE:TGT): 6,575 to 6,600 (+5%)

- Narrative: “The AI productivity boom + dovish Fed = bullish expansion”

- Volatility: VIX stays sub-15; equity risk premium compresses

Bear Case (Probability: 35%)

Risks:

- Inflation reaccelerates (CPI/PCE prints hot), delaying Fed cuts into 2026.

- Earnings disappointments outside of AI/tech.

- Bond yields spike → 10-year Treasury >5%, compressing P/E multiples.

- Geopolitical/election shocks: U.S. political risk premium rises into Q4.

- Overbought conditions unwind: RSI >70, stretched positioning, low put/call ratios.

3-Month Outcome:

- Target: 5,950 to 6000 (–5%)

- Narrative: “Market priced perfection — macro cracks are forming”

- Volatility: VIX spikes >20; sector rotation into defensives (healthcare, utilities)

Neutral Case (Probability: 15%)

Scenario:

- Fed remains data-dependent, avoiding cuts but not hiking.

- Earnings come in line; there are no upside surprises outside AI megacaps.

- Market churns sideways as investors digest valuation stretch.

- Rotation from tech to cyclicals, with financials and energy catching bids.

3-Month Outcome:

- Target: 6,135 to 6,390 (± 2%)

- Narrative: “Healthy digestion phase after a historic run”

While I have no idea what the next three months will bring, this is not a risk-free market. As noted in the Portfolio Tactics section below, now is a good time to implement risk management measures in your portfolio. Even if the 50% upside probability turns out to be correct, rebalancing risk in portfolios will not significantly impair forward returns.

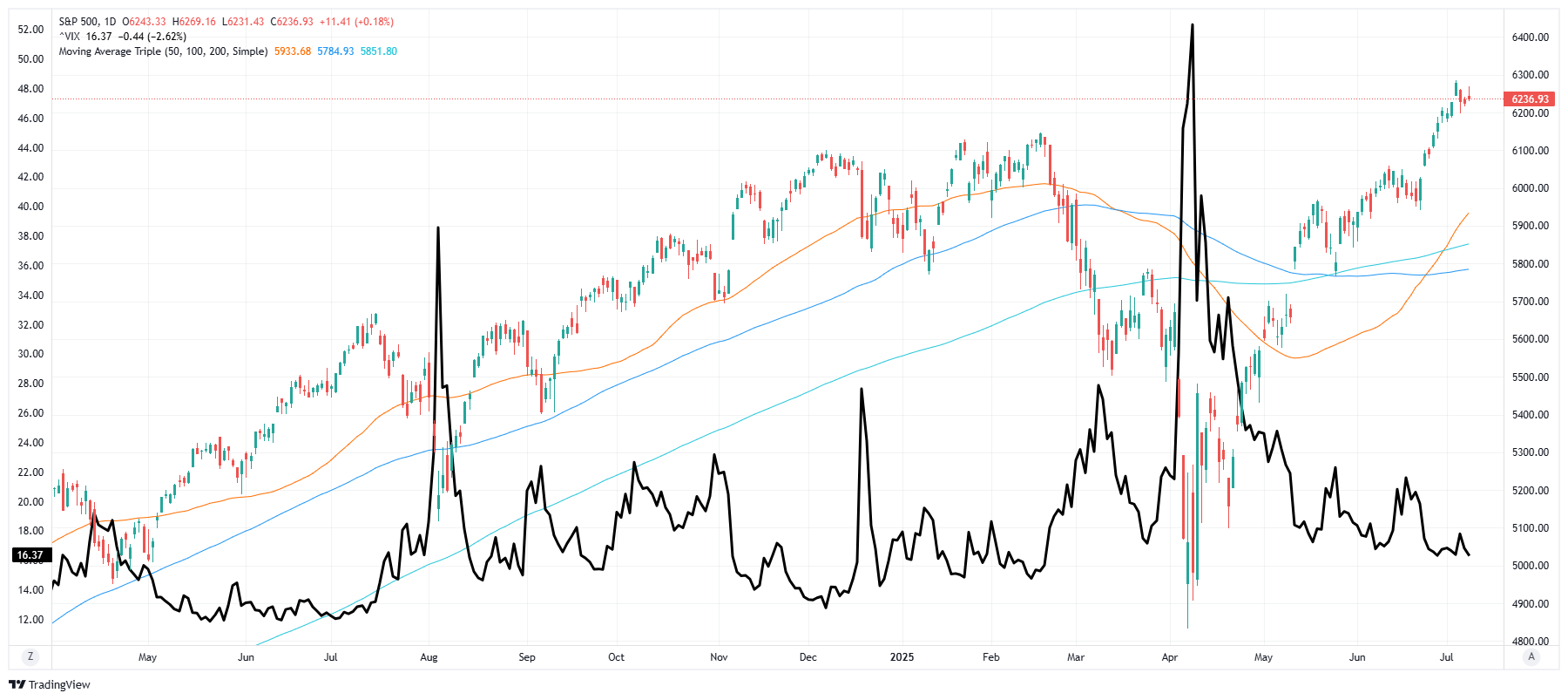

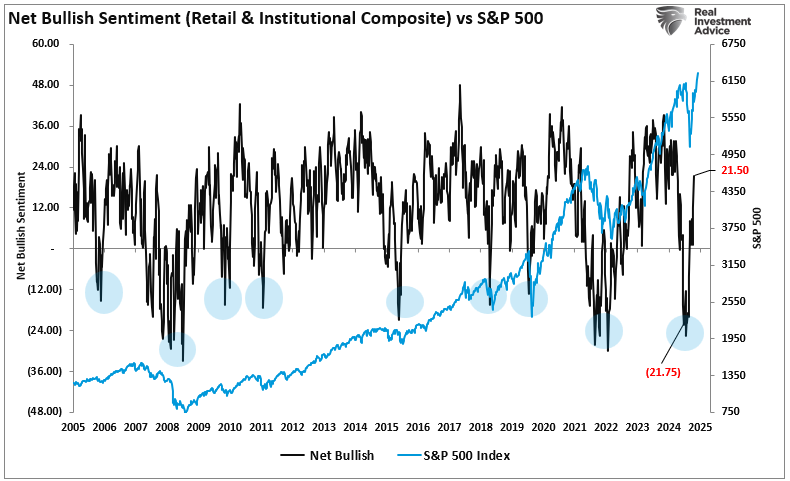

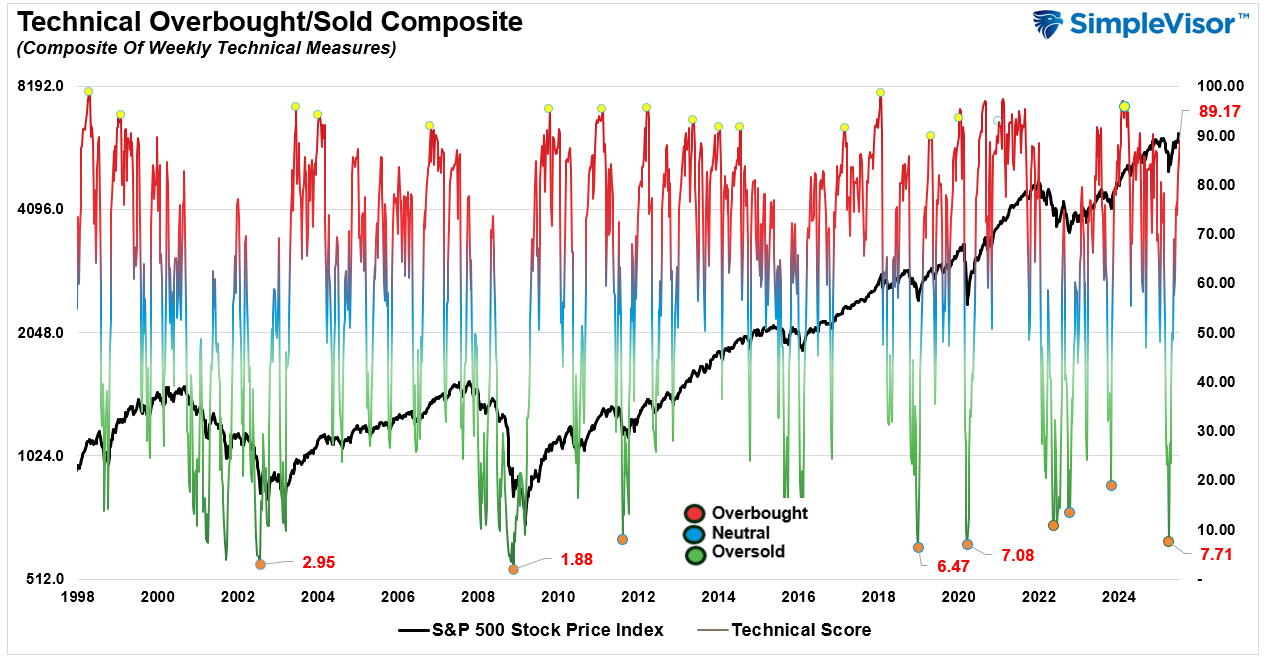

Zero Fear

On Wednesday, I discussed a growing risk in the financial markets stemming from extreme investor complacency and sharply overbought technical conditions. The nearly 25% rally from the April lows is one for the history books, but despite that strong performance, markets are reaching more unsustainable levels, both in price and sentiment. As noted, investor sentiment has surged higher in recent weeks as the quest to take on more speculative positions has increased. As discussed in that video, volatility has once again collapsed in the market as investors have become extremely complacent with market risk.

That complacency, combined with the S&P 500 trading well above its long-term moving averages, suggests the current rally is extended. Historically, such conditions often lead to a reversion toward mean support levels. Such a mean reversion would be about 6% from current levels.

Investor sentiment has become dangerously one-sided. According to sentiment surveys, bullishness is near peak levels, while volatility metrics like the VIX remain subdued.

This combination reflects a market narrative that assumes continued gains with little room for error. When too many investors are positioned for one outcome, particularly on the long side, any unexpected negative catalyst can cause a rapid reversal. That’s because there’s no marginal buyer left to support prices, and crowded trades begin to unwind simultaneously.

Most importantly, investors must remember that the fundamental backdrop does not fully justify current valuations. The current gap between economic and earnings growth is unsustainable, given that earnings are derived from economic activity.

If earnings growth faces challenges from slowing global demand, tighter monetary policy, and rising input costs, those issues are not priced into the market’s multiples. If corporate results or forward guidance disappoint, the current technical vulnerability could magnify the impact.

Ultimately, the market environment resembles many historical setups that preceded swift pullbacks. When markets are stretched, sentiment is euphoric, and fundamentals begin to soften, even a slight shock can trigger a much larger drawdown. Complacency often sets the stage for the following correction.

The time to manage risk is before it becomes obvious.

Portfolio Tactics

The building of exuberance in the market is part of the “bull market” process. However, when that enthusiasm reaches more extreme levels, it is also a contrarian signal often ignored by investors. The consequences of such are typically not conducive to wealth-building practices. The problem with the above analysis is that the “timing” of such a “mean-reverting” event is always tricky. Momentum in the market is difficult to stop, but it tends to do so quickly when it reverses.

With this in mind, investors should consider reducing portfolio risk BEFORE the event eventually materializes.

- Trim gains in extended positions, particularly in high-momentum tech and speculative trades (e.g., AI, leveraged ETFs, meme stocks)—Rebalance toward more fundamentally sound holdings.

- Maintain core exposure to broad indexes or quality growth names, but avoid chasing performance in overbought sectors. Instead, look to build or rotate into areas showing early signs of leadership (e.g., industrials, financials, energy).

- Focus on risk-adjusted returns, not absolute upside. With sentiment elevated, adopting a more selective and valuation-aware approach will provide better long-term results.

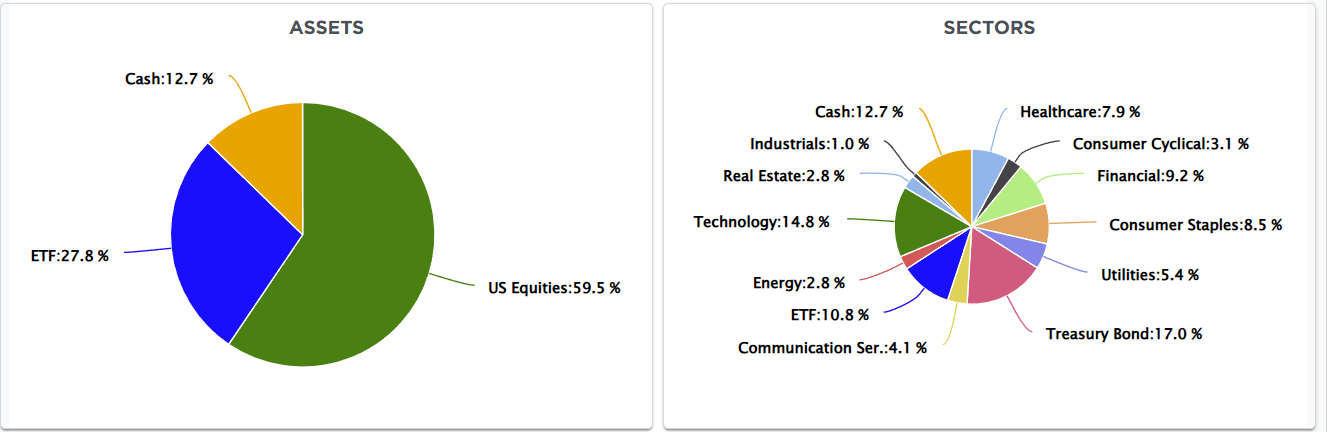

- Raise cash allocations modestly to take advantage of potential pullbacks in late July or August.

- Utilize trailing stop-losses on aggressive trades, particularly in leveraged ETFs or speculative names that have already seen sharp moves.

- Avoid overexposure to crowded trades, especially single-stock themes and high-beta names vulnerable to profit-taking.

- Monitor macro developments, including Fed commentary, PCE inflation data, and geopolitical headlines, as catalysts for sentiment reversal.

These actions should be done in “small” steps. Minor adjustments today can have a significant impact over time. However, the hard part is that amid a “bullish” market, the “fear of missing out” often overrides a more logical approach to risk management.

Trade accordingly.

From Lance’s Desk

This week’s #MacroView blog examines the kick-off of Q2 earnings season. Can corporate profits justify record-high market valuations, or will reality fall short of investor expectations? Our latest preview breaks down the key sectors, risks, and surprises to watch.

Market Statistics & Analysis

Weekly technical overview across key sectors, risk indicators, and market internals

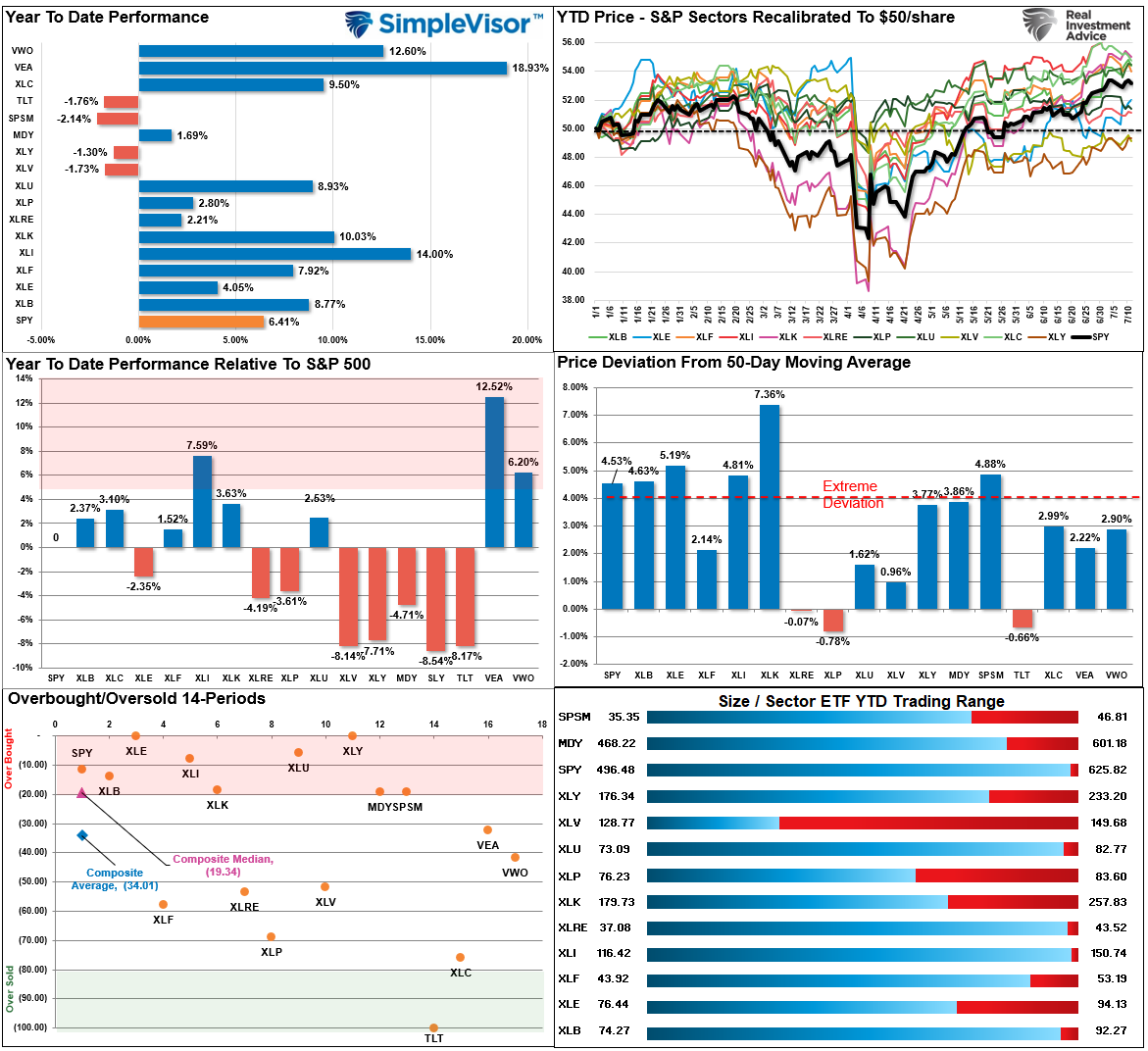

Market & Sector X-Ray: Overbought But Correcting

While the market traded mostly flat this past week, the sloppy trading action did reduce some of the more extreme overbought conditions from last week. The YTD returns of International and Emerging Markets, along with Industrials, are overdone, and we should expect a rotation from the momentum trade to more conservative holdings later in the summer. Take profits and rebalance accordingly.

Technical Composite: 89.17 – Very Overbought, Risk Rising

Markets are pushing into more overbought territory, and pullbacks to support are likely.

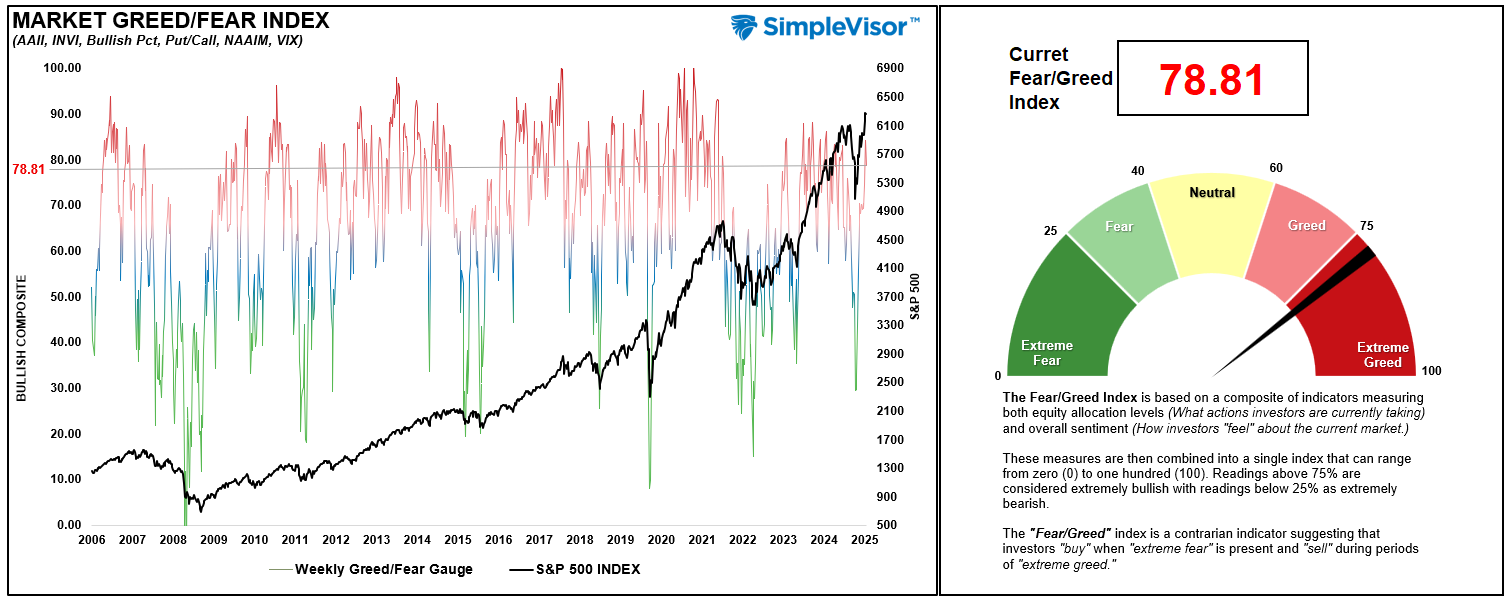

Fear/Greed Index: 83.34 – Extreme Greed, Risk Warning

Investor psychology and risk appetite surged this past week into extreme greed territory. Current readings are at levels that suggest risk management is more important than chasing further gains.

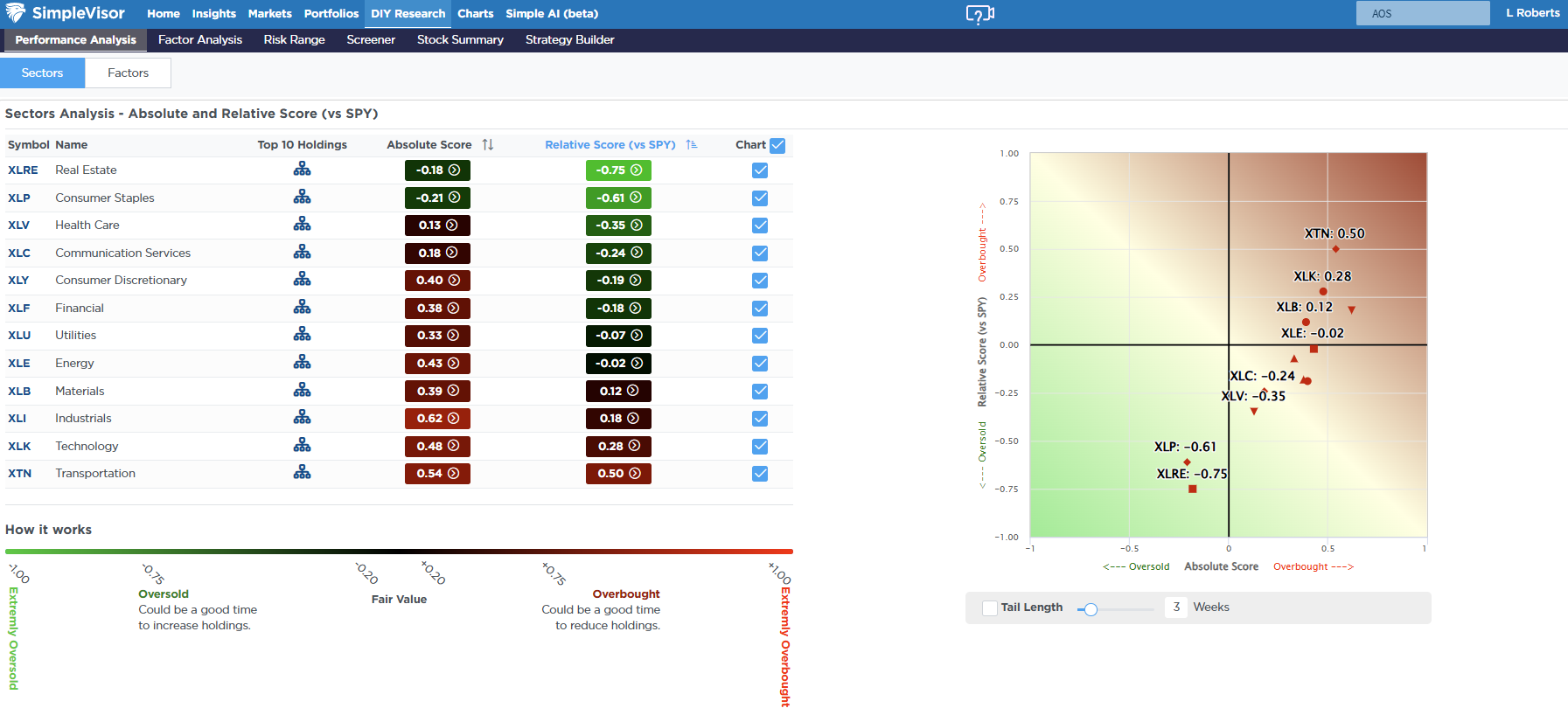

Relative Sector Performance

Real Estate, Staples, and Healthcare underperformed the most this week as investors chased Technology, Materials, and Transportation. With the leaders in more extreme overbought territory, a rotation to Staples and Healthcare is likely.

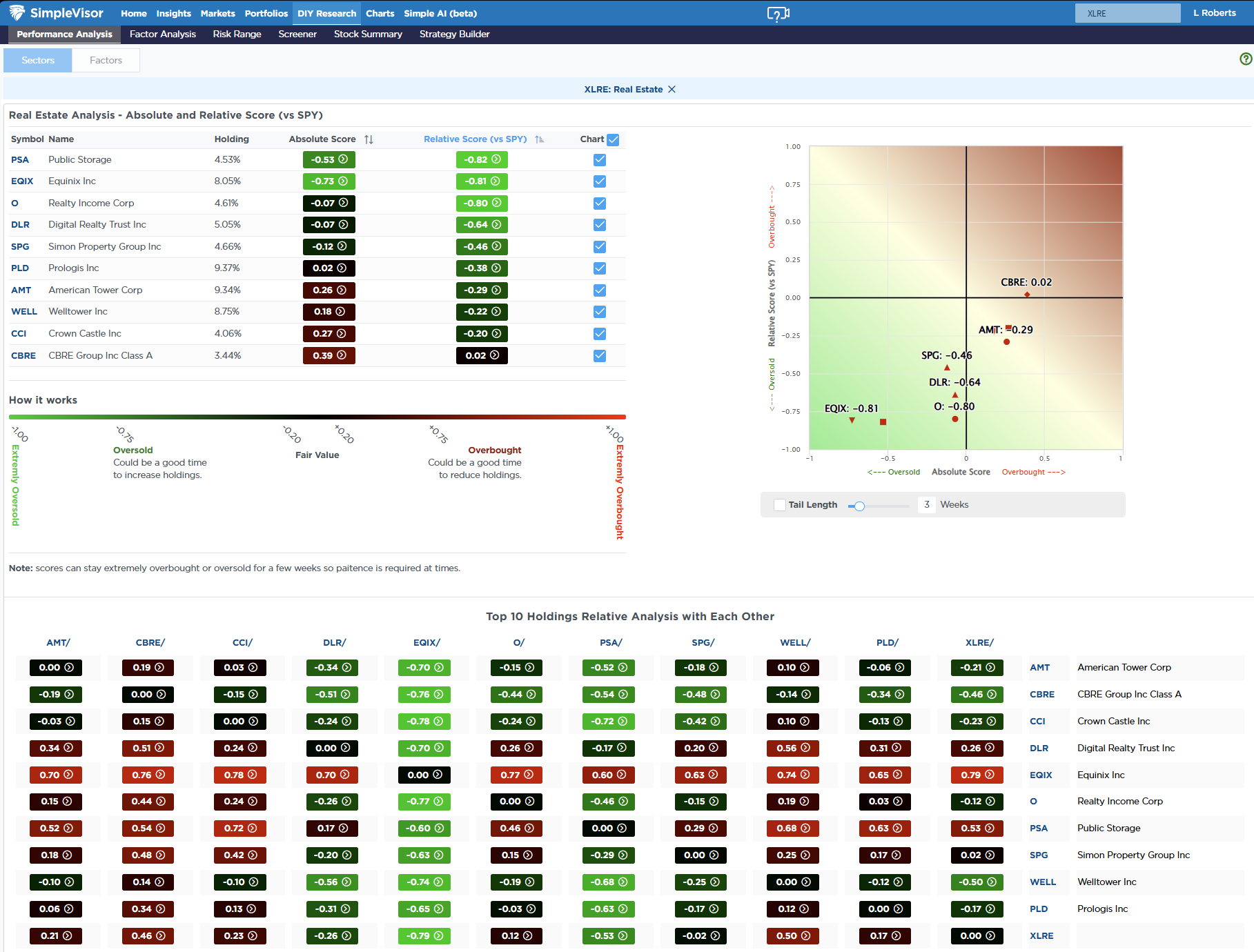

Most Oversold Sectors

Real Estate is currently the market’s most oversold sector, which could catch inflows from a risk-off rotation. PSA, EQIX, and DLR are presently oversold and provide an interesting opportunity for REIT investments.

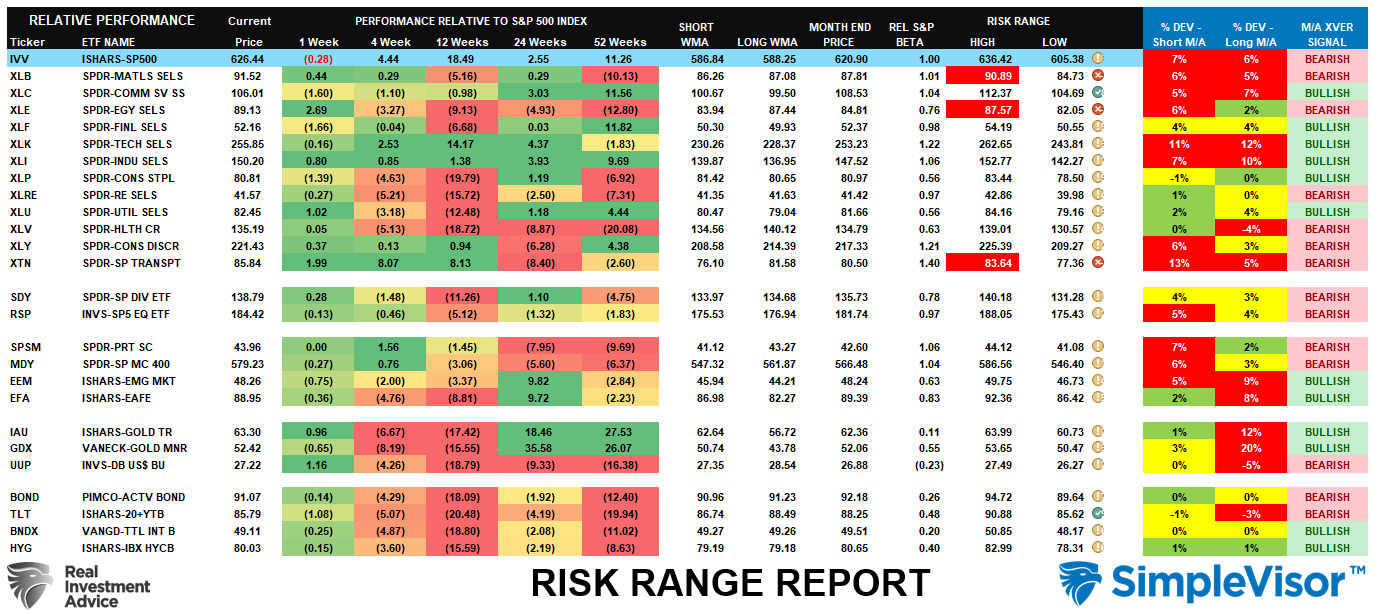

Sector Model & Risk Ranges

The good news for the bulls is that the April low rally has started reducing the number of “bearish moving average crossovers” from 19 weeks ago to 14. That improvement in internals suggests the more bearish backdrop to equities is fading as the bullish trend regains traction. However, that does not exclude risk controls. Currently, Gold and Gold Miners are extremely extended above long-term means, along with Technology and Industrials. Investors should consider taking profits and rebalancing risks in those areas and look to add to deeply out-of-favor sectors.

Watch & Listen

In this video, Lance Roberts discusses whether, with markets at record highs and investor complacency rising, are investors ignoring the warning signs beneath the surface?

Have a great week.