Bitcoin price today: gains to $120k, near record high on U.S. regulatory cheer

A little explored aspect of the ETF industry is how retail investors interact with their products on social media sites. Personally, I think aspiring and established ETF managers should keep abreast of these developments to capitalize on investor trends and interests.

A great example is the Reddit forum r/dividends, which hosts a community of over 356,000 income-oriented investors. And one of their most talked-about ETFs throughout the years is the actively managed JPMorgan Equity Premium Income ETF (NYSE:JEPI).

I'm always on the lookout for interesting ETFs to cover, and JEPI is no exception. This ETF employs some fairly unique strategies that make it notable even among its ever-increasing cohort of income-oriented ETFs. Let's break this ETF down and see how it works.

How JEPI Works

JEPI can best be described as a defensive equity ETF with a covered call overlay. As noted earlier, the ETF is actively managed, with the objective of "delivering a significant portion of the returns associated with the S&P 500 Index with less volatility, in addition to monthly income."

On the equity side, this involves a bottom-up fundamental research process that screens large-cap U.S. stocks using a "proprietary risk-adjusted stock rankings" based on their "relative value." This is a fairly "black-box" approach that isn't outlined in detail in JEPI's prospectus.

To generate monthly income, JEPI can invest up to 20% in exchange-linked notes, or ELNs. These are fixed-income products issued by a counterparty that promise a return linked to a reference asset. Specifically, JEPI holds ELNs that provide exposure to out-of-the-money S&P 500 index call options.

Why ELNs? Well, unlike other covered call ETFs, JEPI does not hold all the stocks required to write call options on the S&P 500 itself. Its portfolio is actively managed and unique. Therefore, it must gain exposure via other instruments, in this case an ELN.

JEPI Performance

JEPI is clearly popular. The ETF currently has assets under management (AUM) of over $18 billion, on which it charges a fairly reasonable 0.35% expense ratio. Currently, the ETF has a 12-month dividend yield of 11.29%, which is very high compared to other income-oriented funds.

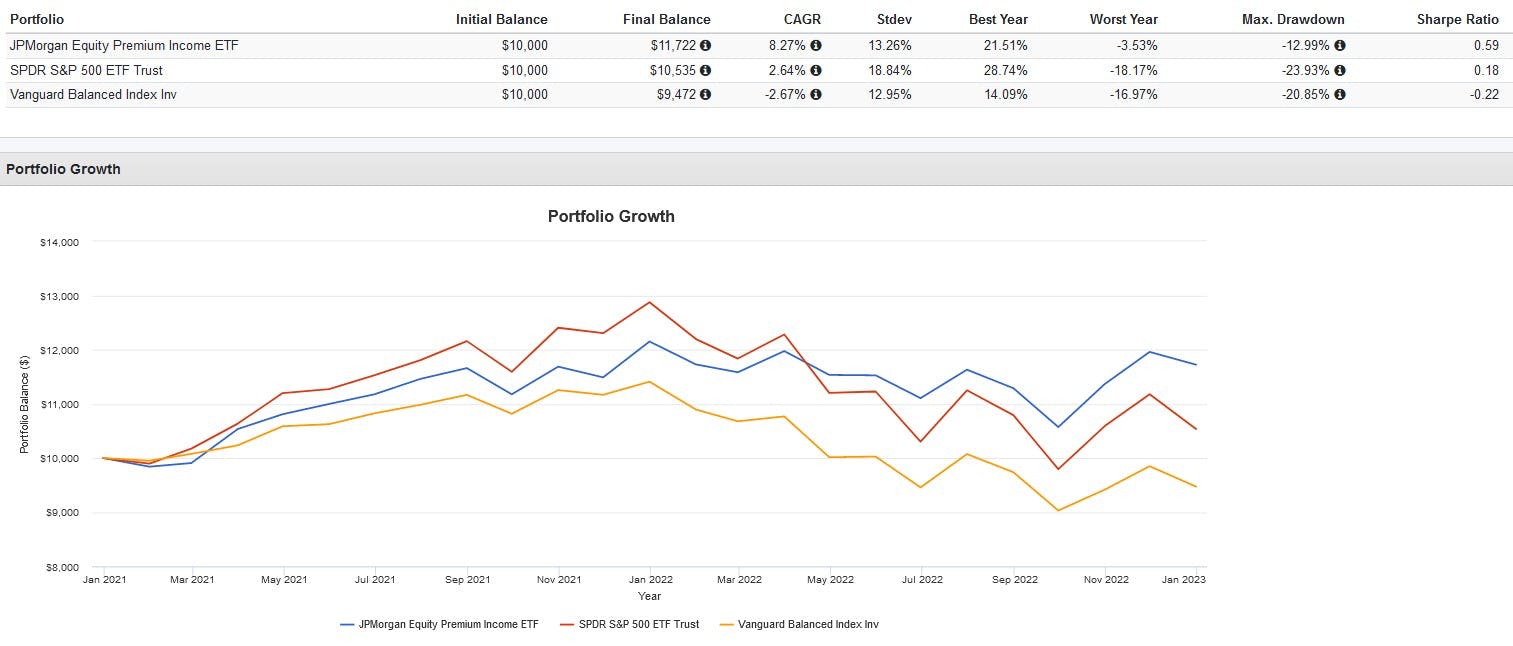

How has the ETF performed historically? I conducted a backtest of the fund versus the S&P 500 and a balanced 60/40 portfolio of U.S. stocks and bonds to find out. However, do note that because JEPI has an inception date of May 2020, this backtest is too short as to draw meaningful conclusions.

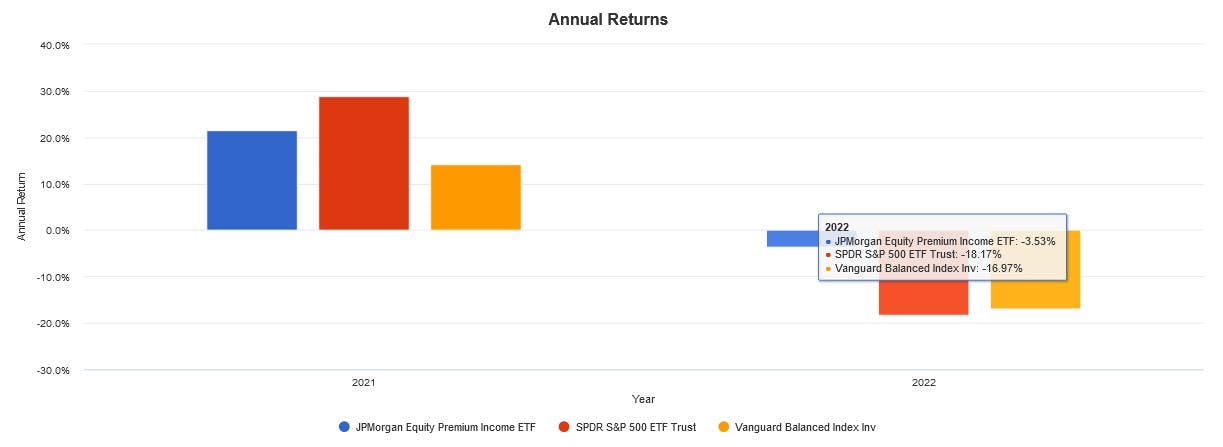

The backtest period was skewed by the 2022 bear market, but one could argue that this was precisely the conditions where JEPI shines. Indeed, we see that while JEPI underperformed the S&P 500 in 2021, it strongly outperformed in 2022. Notably, it beat the 60/40 portfolio in both years. It also did so with lower volatility and drawdowns.

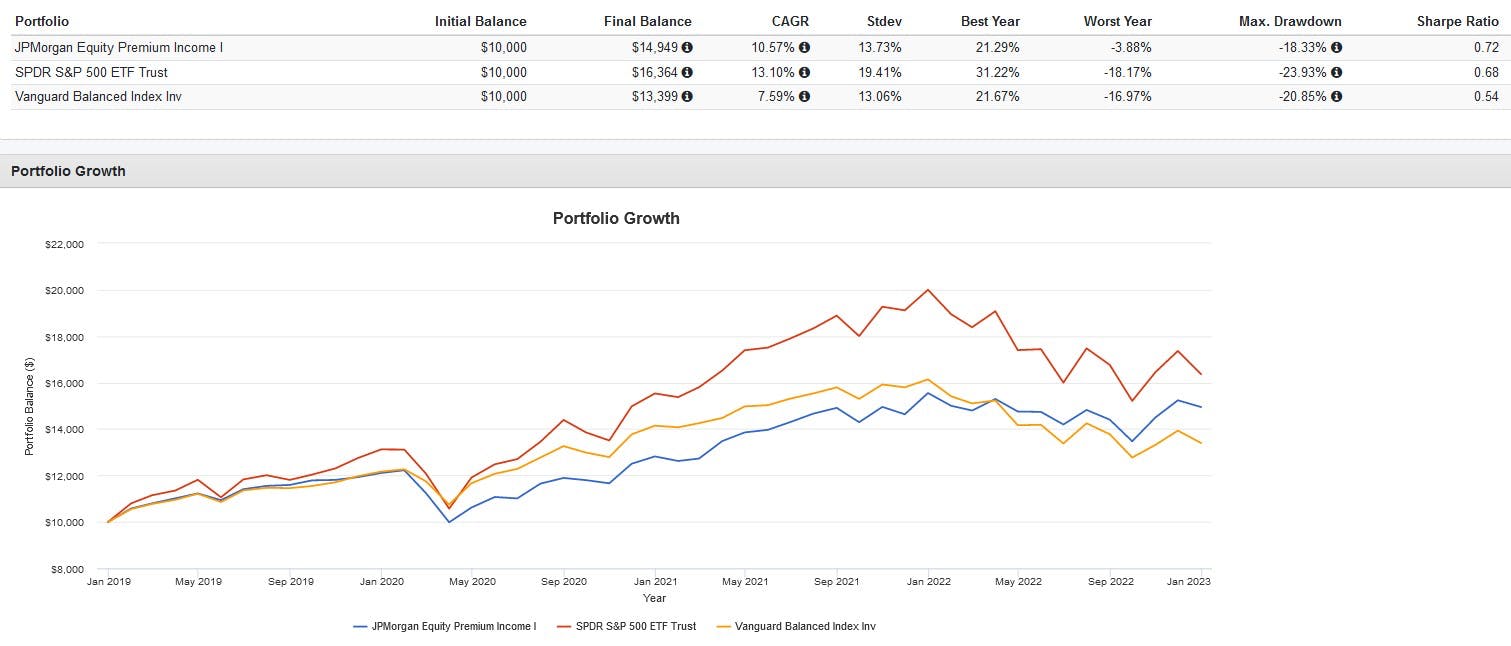

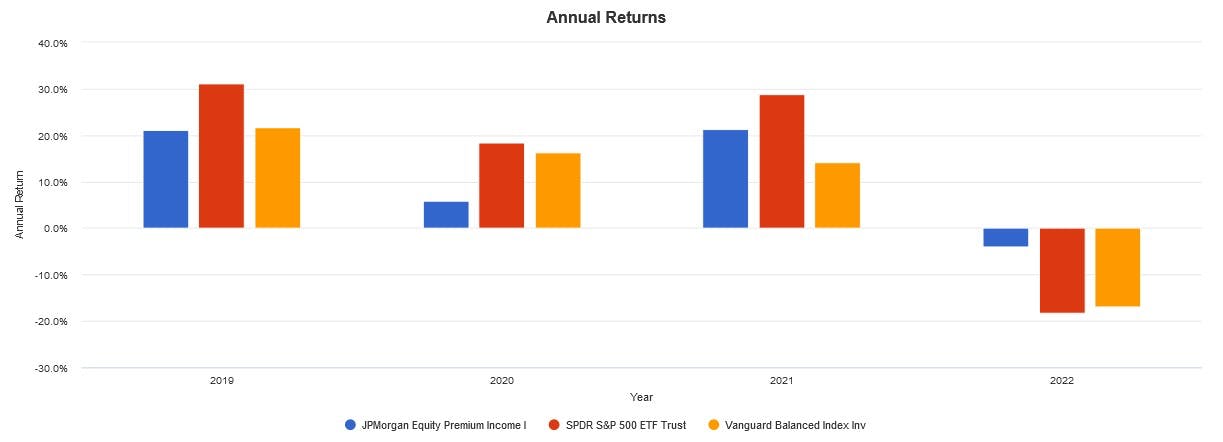

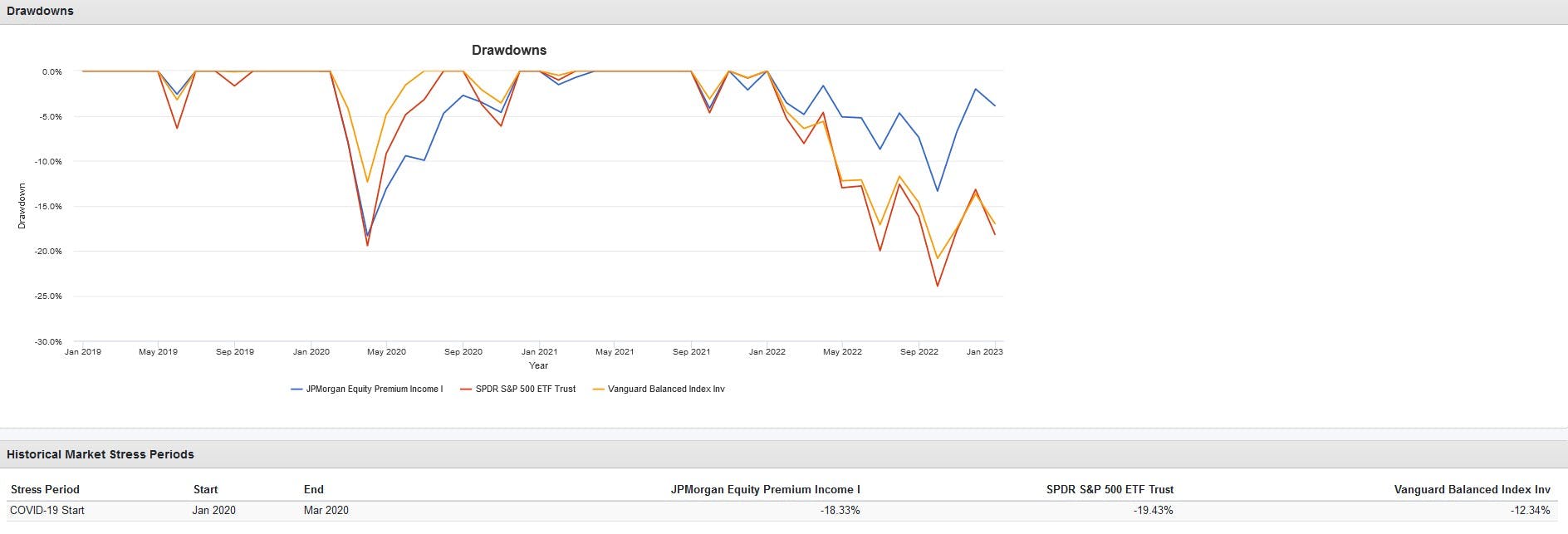

To extend this backtest, I substituted JEPI's mutual fund equivalent, the JPMorgan Equity Premium Income I (JEPIX) to see how it did in 2019 and 2020:

In 2019, JEPI returned almost as well as the 60/40 portfolio, but strongly underperformed in 2020. The reason? The COVID-19 crash. While the 60/40 was cushioned by its bond allocation due to Fed rate cuts, the covered call overlay for JEPI wasn't as great of a hedge.

As seen above, JEPI drew down by nearly as much as a regular S&P 500 index ETF did. The takeaway is that covered calls do not protect the downside effectively and should not be relied upon as crash protection – they're primarily an income solution. Bonds are still needed.

My opinion? ETFs like JEPI are best used to augment a traditional 60/40 allocation for investors concerned about rising rates and desiring similar volatility. Holding JEPI on its own may lower volatility, but it won't protect against a crash. Consider pairing it with something like a Treasury ETF.

***

This content was originally published by our partners at ETF Central.