BitMine stock falls after CEO change and board appointments

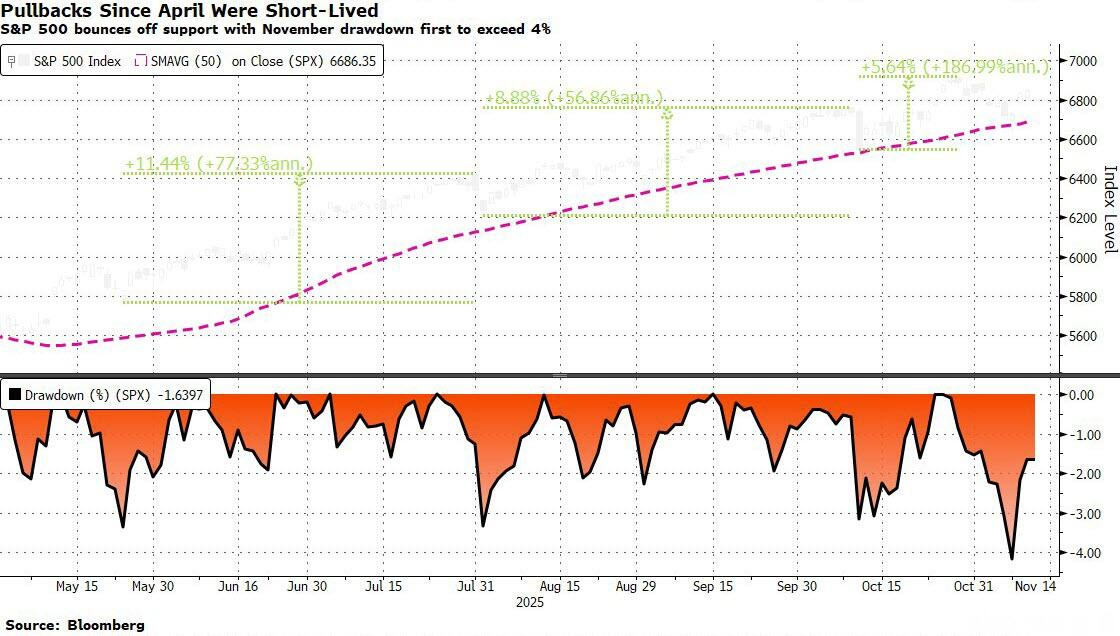

Whatever risks confront this tape, the downside still feels guarded—like a market skating on a thick layer of fiscal ice, with monetary tailwinds and retail inflows hardening it from below. The early-November wobble now appears to be little more than a test of conviction.

With signs that the U.S. government shutdown will finally lift, traders have rediscovered their inner dip-buyers. The reopening brings not only data back into the picture but also the prospect of renewed liquidity flow—a subtle but powerful accelerant in the late-year melt-up machinery.

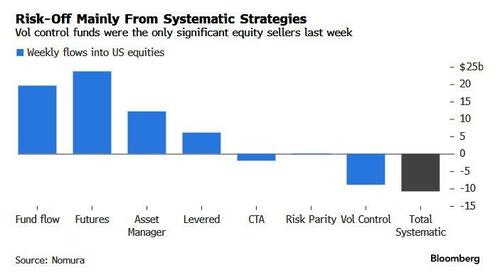

The mood on desks is shifting from caution to quiet determination: everyone wants their year-end rally, and it’ll take something seismic to knock that instinct out of them. Systematic books that had been puking risk last week are now flatlining near neutral, leaving dry powder if the subsequent few sessions hold steady. Volatility control funds have shed roughly $118 billion in equities over the past month, but their models are already signalling “buy back” with the VIX and VVIX remaining tame. Keep it calm, and the machines will re-engage.

Retail money never left. Even as CTAs flinched, the army of zero-DTE punters kept loading up calls, sending the call-to-put ratio to euphoric extremes. Vol spikes have been modest, hedging costs have round-tripped to summer levels, and the reopening narrative is functioning as a de facto “government put.” A shutdown resolution means GDP gets a nudge and liquidity gets a drip feed—both highly combustible ingredients for risk appetite.

This week’s setup has that telltale “pre-rally tension” feel. Technicals are back in bullish formation, buybacks are restarting, and Nvidia’s (NASDAQ:NVDA) looming earnings have become the emotional pivot for every algo on the Street. If Jensen’s crew delivers, it validates the AI super-theme and clears the decks for a December rate-cut reprise. If not, and if bond yields spike or buybacks stall, the narrative could briefly crack—but even then, the dip will be viewed as a reload opportunity rather than a reversal.

The path of least resistance still tilts higher. Seasonality, fiscal grease, and a market that refuses to stay oversold make a powerful trifecta. The bears, already bloodied by the October squeeze, are running out of ammunition. The Santa Ramp is in motion—and this time, it may leave the skeptics buried under the snowdrift they were waiting to surf.