Uxin shares drop 45% as predicted by InvestingPro’s Fair Value model

- This week, while the Nasdaq and S&P 500 indexes are poised to close nearly level, a few standout stocks are set to conclude with impressive gains.

- So in this article, we will take a look at the top four stocks in terms of performance this week and use InvestingPro to analyze their prospects going ahead.

- Diamondback Energy and Uber are some of the names we plan to discuss in this analysis.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

While major indexes like the Nasdaq and S&P 500 have seen a relatively stagnant performance this week, several individual stocks have bucked the trend, achieving significant gains.

This article will analyze four notable performers:

- Diamondback Energy (NASDAQ:FANG) +17.65%

- Uber (NYSE:UBER) +14.78%

- Airbnb (NASDAQ:ABNB) +6.84%

- Leonardo (OTC:FINMY) +8.93%

We'll explore the recent news and events that may have contributed to their success, as well as delve into their financial health and potential risks.

What Sparked a Rally in These Stocks?

Diamondback Energy recently announced a 7% increase in its base dividend to $3.60 per share per year, starting in Q4 2023.

Additionally, it entered a definitive merger agreement valued at around $26 billion with Endeavor Energy Resources, expected to close in Q4 2024.

In the last session, Uber led the S&P 500 with a 14% increase, reaching new all-time highs, following a $7 billion share buyback plan announcement. Morgan Stanley, among others, raised the target price to $90.

Airbnb reported positive Q4 2023 earnings, indicating robust overall travel demand, with a modest increase in gross booking value (GBV) and revenue. The quarter saw a strong rise in EBITDA attributed to effective expense management.

Leonardo also exhibited strong performance, expressing confirmed interest in Iveco's defense vehicle unit.

Additionally, it signed an MoU with Saudi Arabia's Ministry of Investment and the General Authority for Military Industry to evaluate investments and collaborations in the aerospace and defense sector.

Is There Still Time to Join the Rally?

Let's take a look at InvestingPro's Fair Values for each stock, based on several recognized financial models tailored to the specific characteristics of the companies to understand where they stand from a fundamental perspective right now:

1. Diamondback Energy

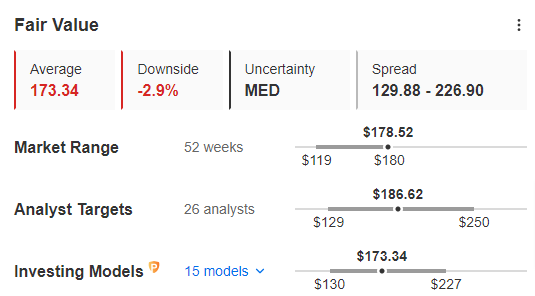

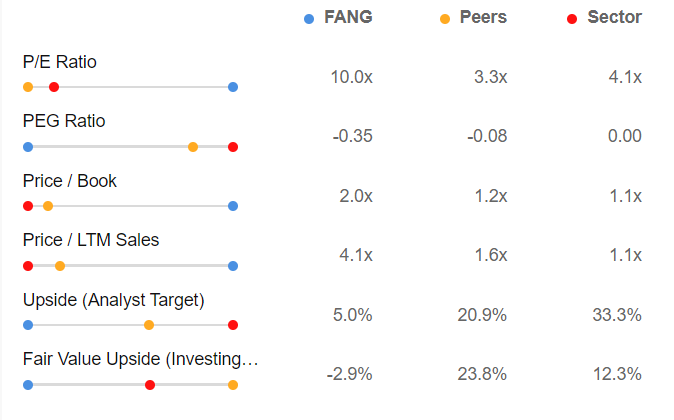

For Diamondback Energy, InvestingPro's Fair Value, which summarizes 15 investment models, stands at $173.34, which is below the current stock price.

Source: InvestingPro

With InvestingPro, you can actively track analysts' forecast developments. Analysts express bullish sentiment on the stock, setting a target price at $186.62, which significantly differs from Fair Value.

Despite the disparity between analysts and Fair Value regarding bullishness and target price, the positive aspect lies in its low-risk profile. The stock demonstrates excellent financial health, receiving a score of 4 out of 5.

Examining the stock in the context of the market and competitors, it is currently deemed overvalued.

Source: InvestingPro

Diamondback Energy is now worth 4.1x its revenue compared to the industry's 1.1x, and the Price/Earnings ratio at which the stock is trading is 10 times against an industry average of 4 times, which again stands to confirm its current overvaluation.

2. Uber

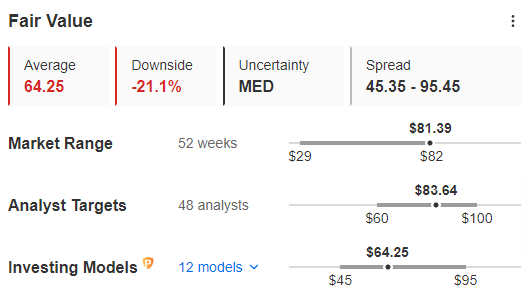

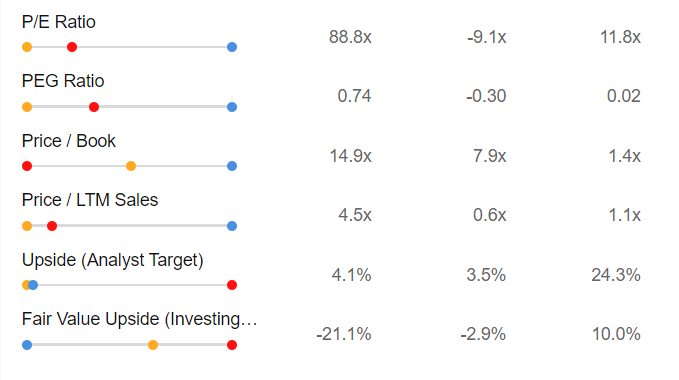

For Uber, InvestingPro's Fair Value, which summarizes 12 investment models, stands at $64.25, which is below the current price.

Source: InvestingPro

InvestingPro subscribers have been tracking analysts' forecasts, and they are optimistic about the stock, setting a bullish target at $83.64.

Despite the current disparity between analysts and Fair Value on the likelihood of a rise, there is positive news regarding the stock's low-risk profile, boasting a solid financial health score of 3 out of 5.

Upon closer examination, when comparing the stock to the market and competitors, it appears to be potentially overvalued.

Source: InvestingPro

If we again look at the best-known indicators, we can see that Uber is now worth four and a half times its revenue compared to the industry's 1.1x, and the Price/Earnings ratio at which the stock is trading is 88.8X against an industry average of 11.8x, which stands to highlight its overvaluation.

3. Airbnb

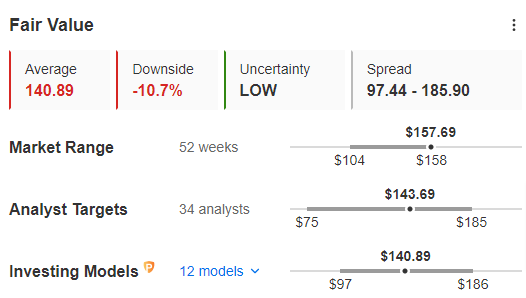

For Airbnb, InvestingPro's Fair Value, which summarizes 12 investment models, stands at $140.89, which is also below the current price.

Source: InvestingPro

The stock has a bearish target price of $143.69, according to analysts.

Despite the consensus between analysts and Fair Value on the potential downside, the stock's low-risk profile is a positive aspect, with an excellent financial health rating of 4 out of 5.

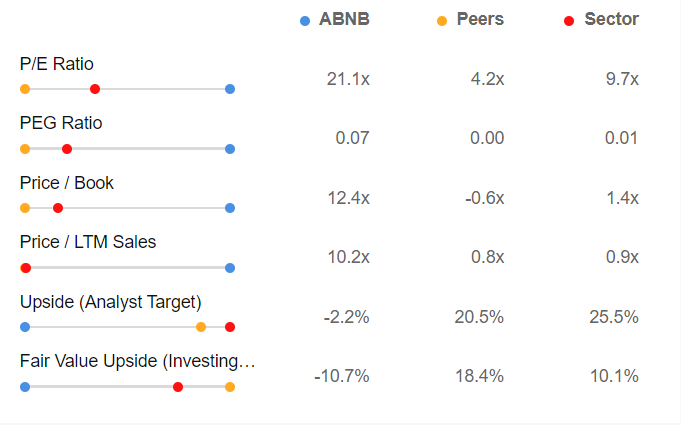

Upon comparing the stock with the market and competitors, it becomes evident that the stock may be potentially overvalued.

Source: InvestingPro

We can see that Airbnb is now worth more than 10 times its revenue compared to 0.9x in the industry, and the Price/Earnings ratio at which the stock is trading is 21.1X against an industry average of 9.7x, which stands to confirm its overvaluation.

4. Leonardo

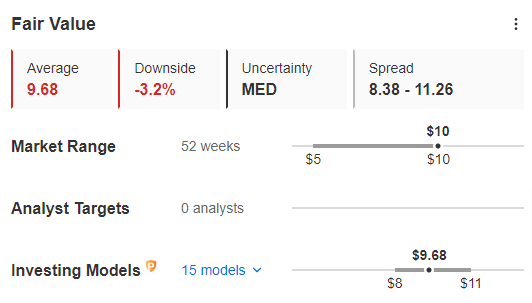

For Leonardo, InvestingPro's Fair Value, which summarizes 15 investment models, stands at $9.68.

Source: InvestingPro

While analysts and Fair Value currently align on the potential downside, there is encouraging news from the low-risk profile, boasting a sound financial health score of 3 out of 5.

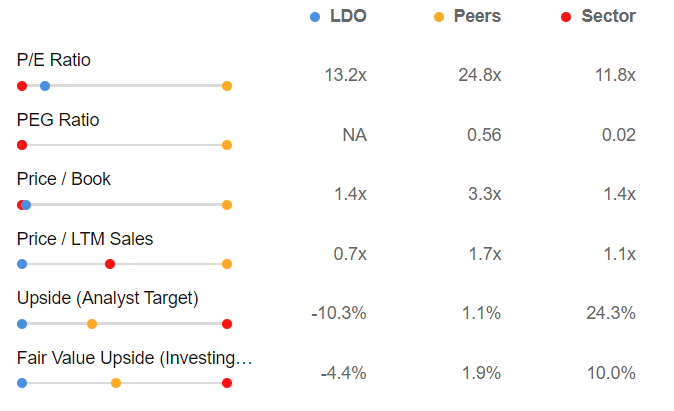

A closer examination reveals that in comparison to the market and competitors, the stock appears to carry a potentially overvalued valuation.

Source: InvestingPro

If we look at the best-known indicators, we can see that Leonardo is now worth 0.7x its revenues compared to the industry's 1.1x, and the Price/Earnings ratio at which the stock is trading is 13.2X against an industry average of 11.8x, which stands to highlight its overvaluation.

Conclusion

In conclusion, although the stocks exhibit a solid financial state with well-defined strengths, investors remain confident in the continuation of the bullish trend.

However, downward forecasts loom given the substantial gains recorded over the past year: Leonardo at +77%, Diamondback Energy at +32.5%, Uber at +134%, and Airbnb at +19.8%.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.