IREN proposes $875 million convertible notes offering due 2031

The Japanese Yen was stronger yesterday, although it’s unclear whether this was due to positioning around the election or the closing out of hedges. Today’s trading should provide a better insight into potential impacts on the long end of the yield curve. It could turn out to be a non-event, but based on price action and reports before the election, there seemed to be heightened anxiety around the vote, similar to events seen in France last summer and perhaps Germany this year.

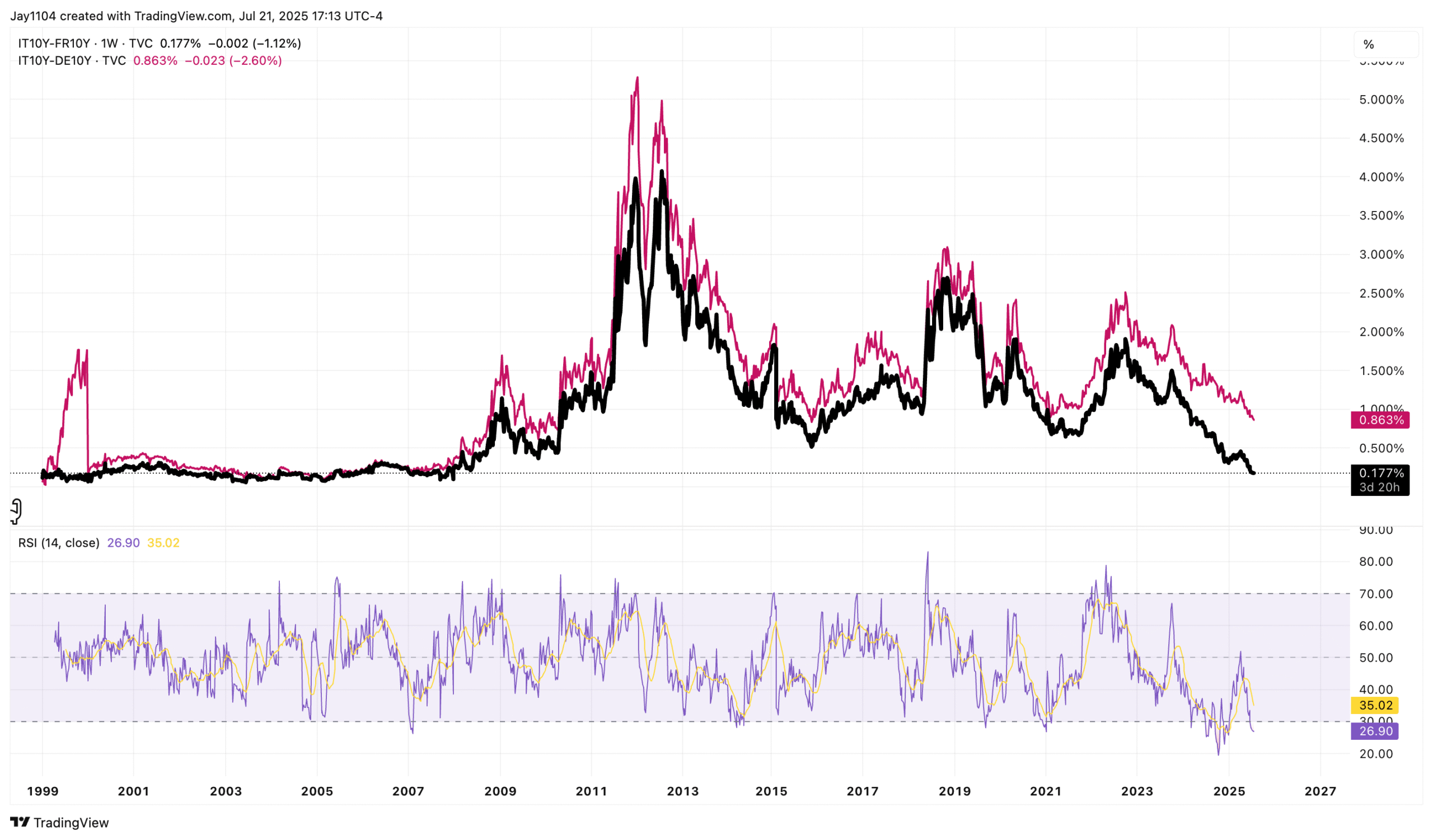

Those effects mainly appeared in bond spreads, particularly with both countries’ 10-year rates trading at their tightest relative to Italian bonds in quite some time.

Additionally, supporting the case for higher long-term rates, 1- and 2-year CPI swaps rose again yesterday, likely driven by rising copper prices. It’s hard to see how rates don’t start climbing.

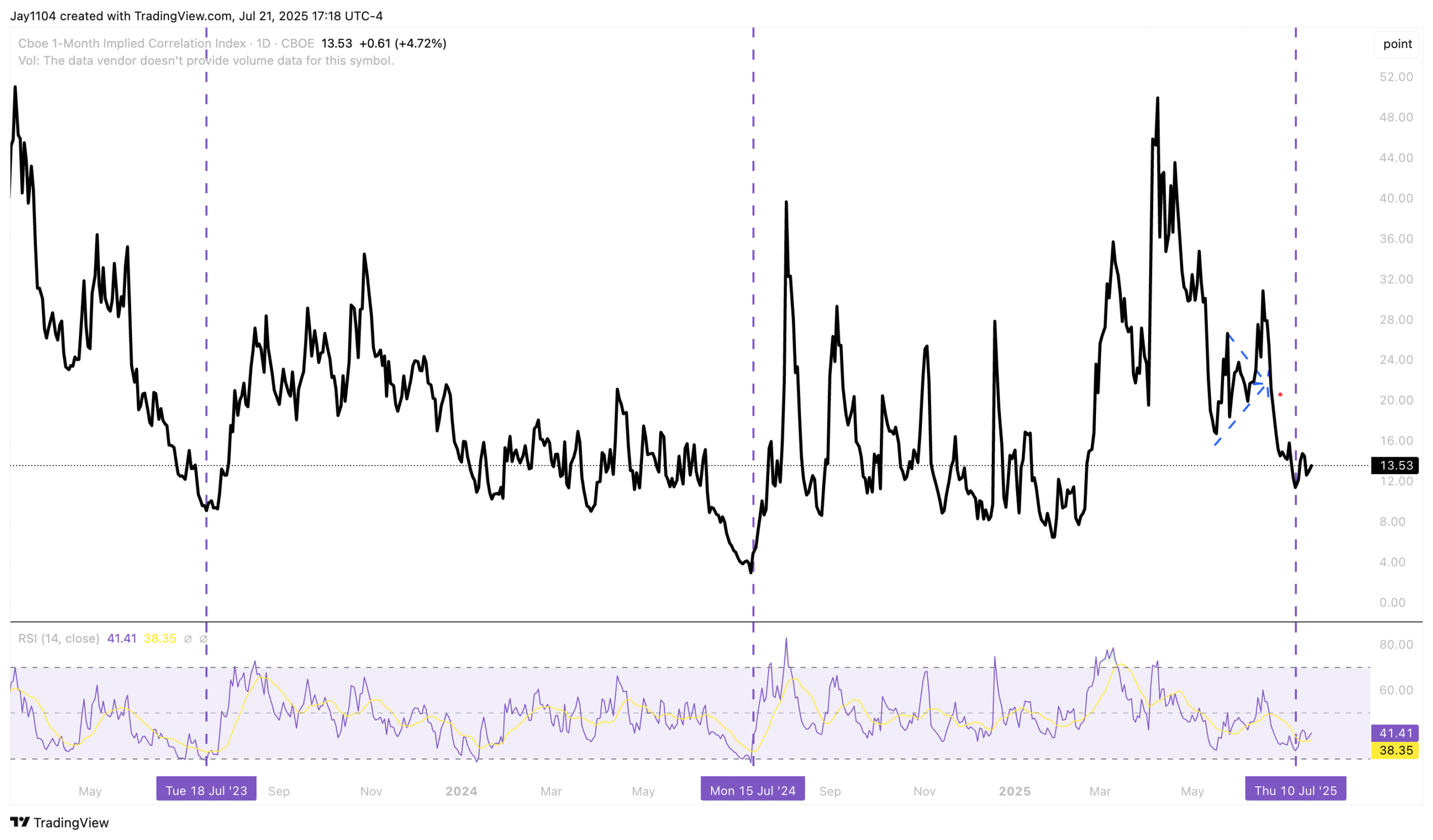

The market currently resembles the setup in July 2024, particularly in terms of volatility. The day before yesterday, for example, the 1-month implied correlation index was slightly higher, indicating the market may have been offside.

Moreover, the VIX index was down for most of the day, while the VIX 9-day index was significantly higher, creating a notable divergence. Fortunately, the VIX index eventually closed higher, resolving that inconsistency.

Realized volatility reached a point where, if the S&P 500 continued rising, the 10-day realized volatility would likely increase. However, the index closed up only 14 basis points, allowing the 10-day realized volatility to finish lower. Today, if there’s a move exceeding 30 basis points, expect 10-day realized volatility to move higher. If the VIX starts rising today, it is a warning signal.

Essentially, we are at a point where volatility and correlations have very little room to move, given that the big earnings start on Wednesday and realized volatility is low. The market has been pushed almost to the maximum, and while I can’t say with certainty that it can’t go higher, the returns should continue to decrease.