ION expands ETF trading capabilities with Tradeweb integration

Investor sentiment has been a paragon of teflon-coated indifference to a run of troubling news headlines over the summer, and there are few signs that potentially bearish developments are starting to resonate. Several risk factors are brewing that will test the optimism anew in the fourth quarter, but the bull trend looks no worse for wear as the trading week begins.

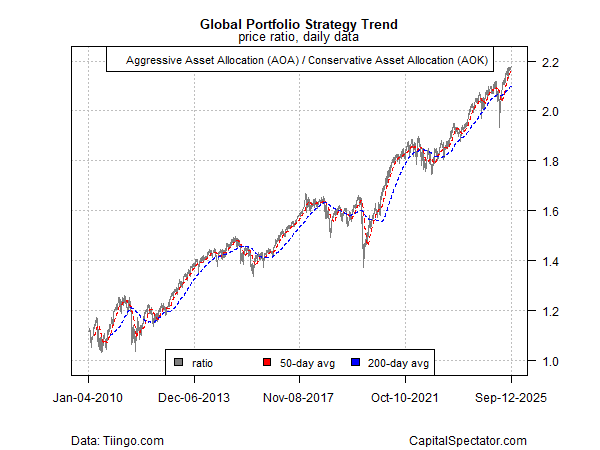

A big-picture measure of the risk appetite via global asset allocation continues to skew positive in no trivial degree, based on the ratio of two ETFs that compare an aggressive strategy (AOA) to its conservative counterpart (AOK) through Friday’s close (Sep. 12). According to this indicator, which has set new highs recently, the trend still looks friendly by a wide margin.

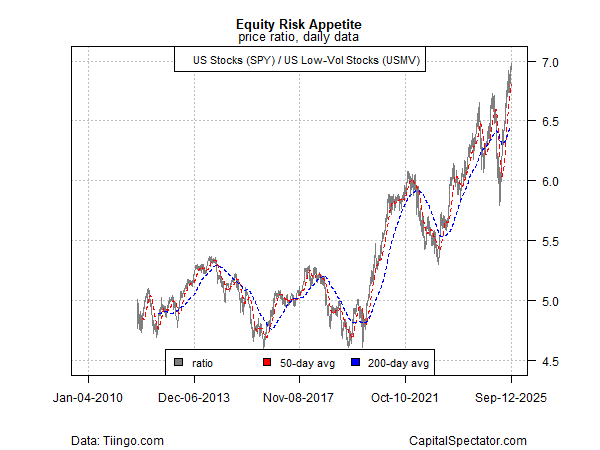

Risk-on looks even stronger for the US equity market, based on the surging ratio for a conventional measure of the US stock market (SPY) vs. a low-volatility (USMV) counterpart.

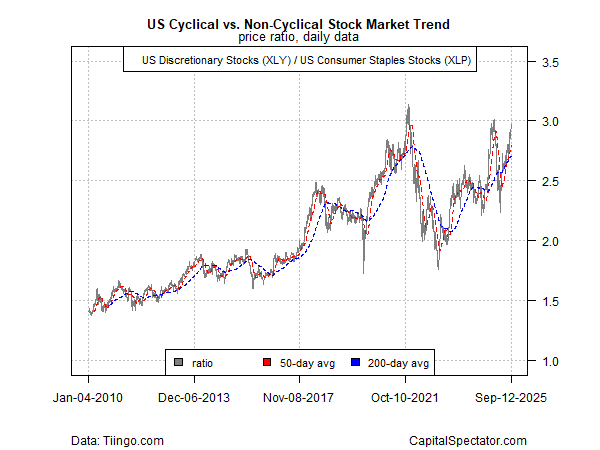

Meanwhile, the rebound in US cycle stocks (XLY) vs. defensive shares (XLP) continues apace. This ratio is still extending its recovery from the April selloff and looks poised to return to the peak that prevailed before the tariff shock in the spring unleashed a brutal correction.

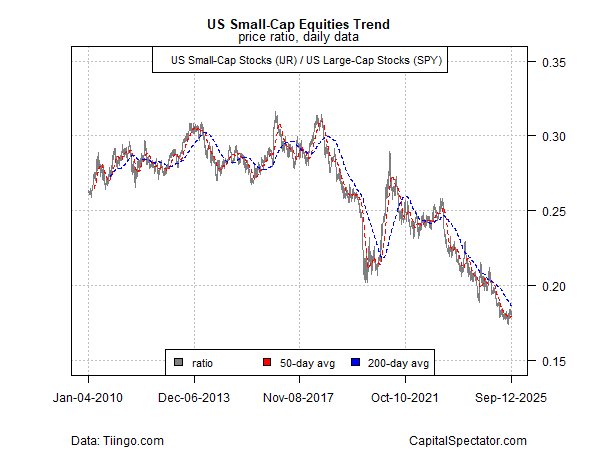

Prospects for a small-cap rebound, on the other hand, have faded–again. Despite recent commentary from some analysts that a new bull run was brewing for US small-cap shares, a ratio these equities (IJR) vs. their large-cap brethren (SPY) suggests that the underperformance trend is still intact.

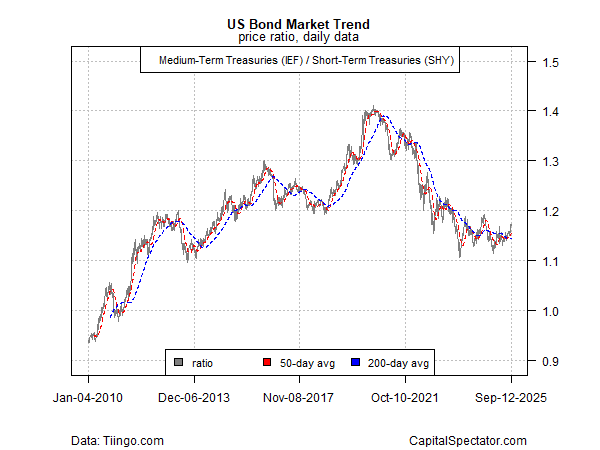

The risk appetite in the US bond market has skewed defensive in recent years, but there are hints that a change may be unfolding, if only for the near term. Medium-term Treasuries (IEF) are again outperforming shorter-term government bonds (SHY) lately.

Investors will be closely watching this week’s Fed meeting, which could provide a new boost for longer-term bond returns if the crowd is correct and the central bank cuts rates on Wed, September 17, per Fed funds futures.

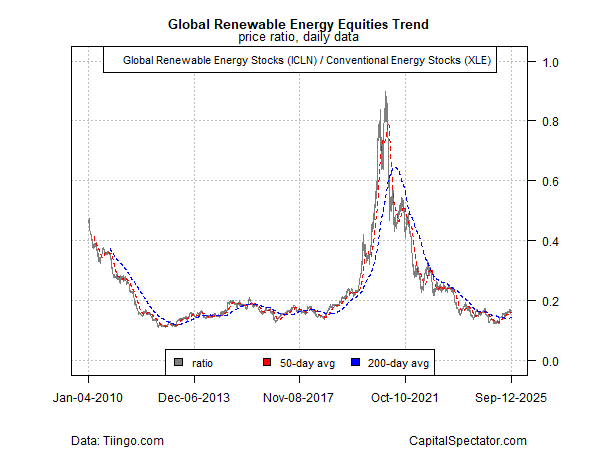

One of the more intriguing turnaround stories we’re watching: the rebound in clean-energy stocks (ICLN) vs. their big-oil counterparts (XLE). As discussed last week, a brutal bear market in green energy shares appears to have run its course and is showing signs of recovery.

The sector is still nursing deep wounds from its crash of a few years back, but the latest relative outperformance over fossil-fuel shares deserves monitoring for deciding if this is the start of a new bull run for this battered sector.