Nvidia and TSMC to unveil first domestic wafer for Blackwell chips, Axios reports

Geopolitical tensions remain high as Iran continues launching ballistic missiles toward Israel, prompting retaliatory strikes from Israel on Iranian military and nuclear infrastructure.

While headlines are still arriving by the minute, the market’s sensitivity has declined somewhat this week, with the conflict increasingly priced in.

Equity indices corrected earlier but rebounded midweek—now selling off again as traders close positions ahead of the weekend, pricing in renewed geopolitical risk.

What has stirred markets more recently is the possibility of US intervention in the conflict. President Trump has indicated a decision may come within the next two weeks, adding a layer of uncertainty.

For position traders, it’s worth noting the elevated risk of price gaps when markets reopen on Sunday evening.

US crude oil is trading higher on the week but has pulled back after a failed breakout attempt near key resistance, closing the week around $75.

On the monetary policy front, major central banks—including the Fed, Bank of England, Swiss National Bank, Bank of Japan, and People’s Bank of China—held rate decisions this week.

Only the SNB moved, cutting rates to 0% and signaling that a return to negative territory remains on the table if the Swiss franc strengthens excessively. This reflects growing concern over a slowing domestic economy and weakening exports.

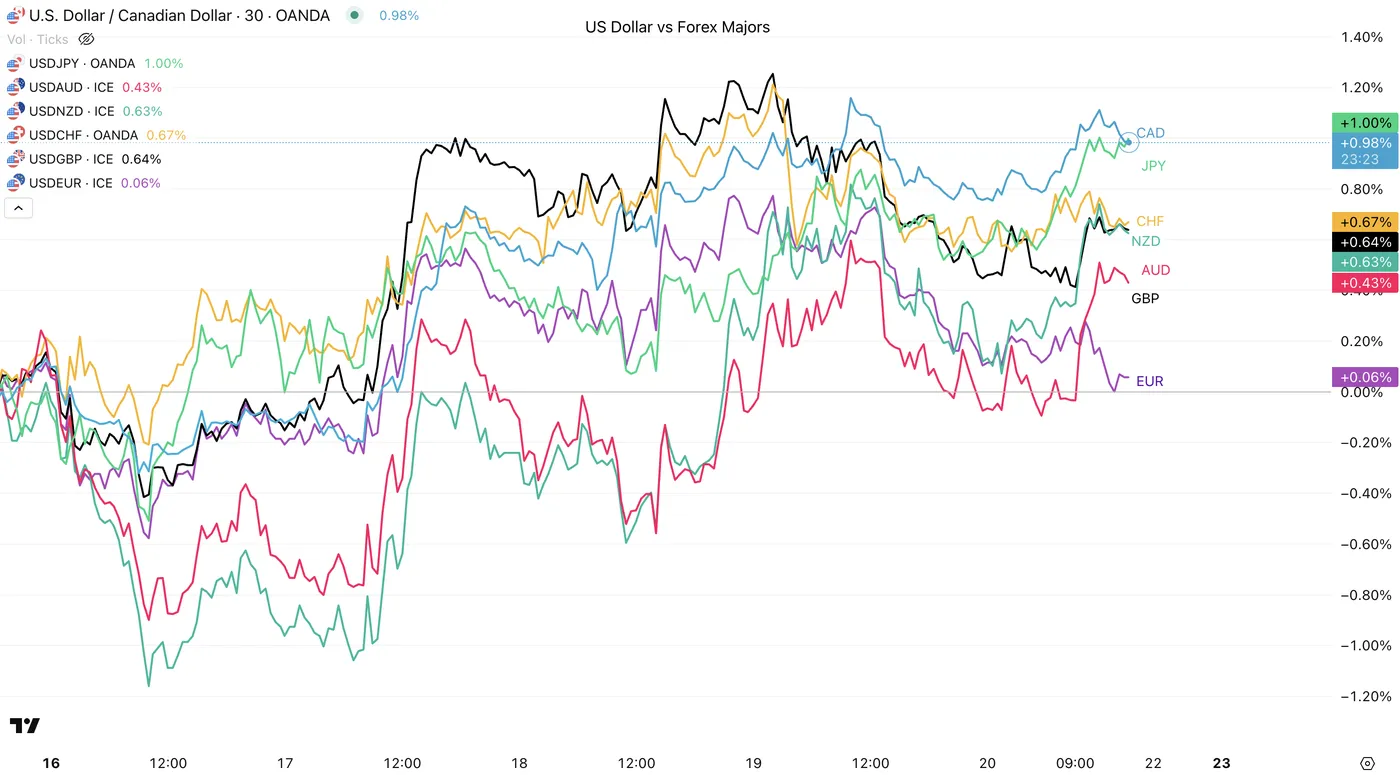

In forex, the US dollar staged a comeback as dollar selling positions became overcrowded and risk sentiment tilted more cautious. Traders are leaning back into the greenback amid global uncertainty.

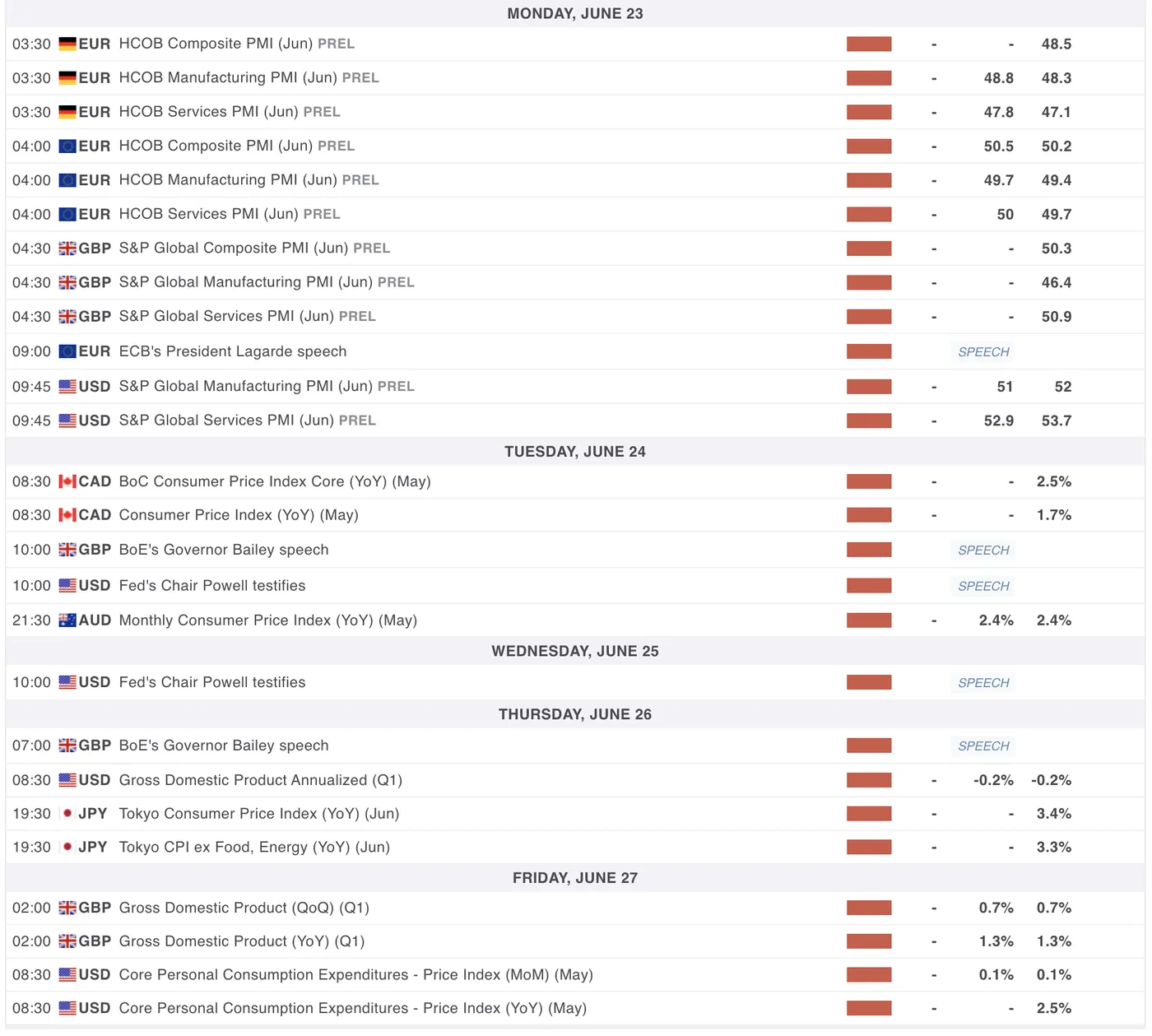

The Week Ahead: Inflation Reports, Central Bank Heads Scheduled

Keep your expectations for volatility high, with conflict headlines still being released throughout the day in every session and a potential US Intervention that would surely be market-moving.

Asia Pacific Markets - Australian CPI and Another Inflation Data Point for Japan

APAC Markets aren’t the busiest in the upcoming week, but one thing to look at is a reversal of previous week gains on currencies such as the AUD and NZD, which had decent performance since the RBA and RBNZ Rate Decisions.

Tuesday evening should see the release of the Australian May Inflation report, expected at 2.4% year-over-year.

Further reports on Japanese Inflation for June are also expected on Thursday at 19:30 ET, with the Core data expected at 3.3% y/y.

Economic Data from Europe, UK, and North America – US GDP, PC,E and Canada CPI

This week also won’t be the busiest in terms of data release, however markets will surely brace for both the US GDP and the Core PCE as markets keep assembling data on the effect of US Tariffs on the world’s largest economy.

Core PCE data is expected at 0.1% month-over-month (Friday morning 8:30 ET), and the annualized Q1 GDP figure is expected at -0.2% on Thursday at 8:30 A.M.

Canada will also see the release of their own CPI report on Wednesday at 8:30, with the Headline data forecasted at 1.5% and Core CPI expected at 2.6%.

Other than data, many Heads of Central Banks will be speaking with ECB’s Lagarde on Monday speaking at the European Parliament in Brussels, Fed Chair Powell testifying on Wednesday (usually accompanied with a speech on Monetary outlooks), BOE’s Bailey talking at the British Chambers of Commerce Global Annual Conference on Thursday.

FED’s Williams will also be speaking on Friday (7:30) in Basel, Switzerland, where we will see his own view on the upcoming Rate Decision after this morning’s dovish surprise from Chris Waller.

Also, as always, stay in touch with the latest developments in the Middle East to avoid being on the wrong side of sudden volatility spikes!

US Dollar Performance Versus Other Forex Major Counterparts

Source: TradingView