60%+ returns in 2025: Here’s how AI-powered stock investing has changed the game

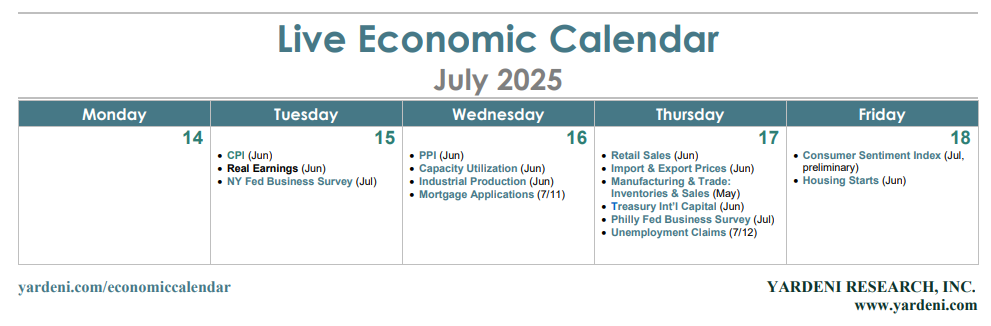

This will be a jam-packed week for economic indicators and big banks’ Q2 earnings reports. We are relatively optimistic about the latter, which should be bullish for the stock market. The inflation news may show some signs of tariff-related warming. Consumer-related data are likely to be mixed.

The White House will probably keep tariffs and the Fed in the news on a daily basis. On balance, we expect the stock market to be choppy over the remainder of the summer into early fall before a year-end rally. The stock market’s V-shaped pattern during H1 should look more like a square-root sign in the coming months.

Consider the following:

(1) S&P 500 earnings.

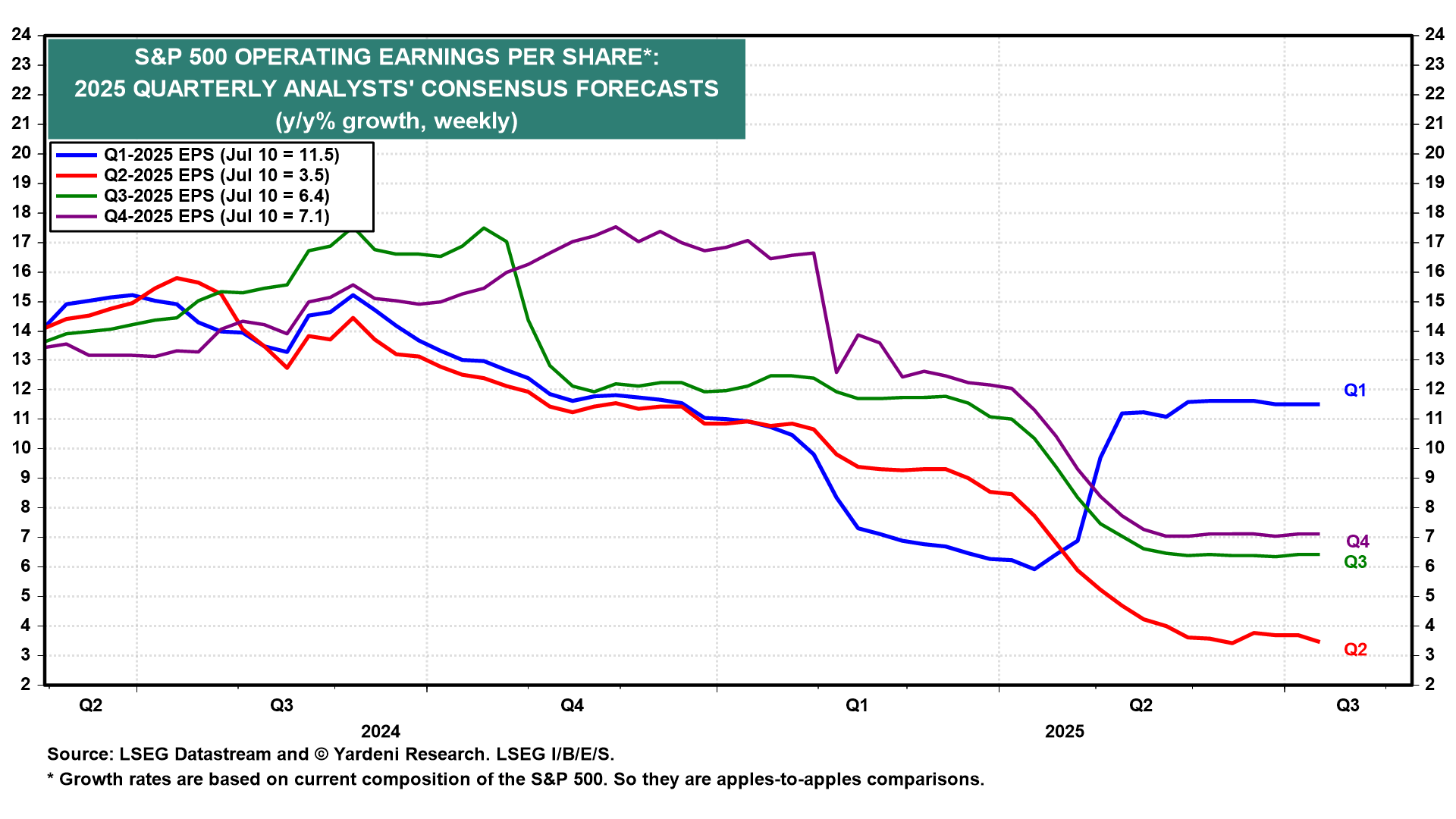

Q2’s earnings reporting season should start out this week with a bang as lots of big banks report strong earnings. Industry analysts have been lowering their earnings estimates for S&P 500 companies over the past several weeks, bringing their earnings growth expectations down to 3.5% y/y as of the July 10 week (chart). That should be easy to beat. We expect to see actual earnings rise by twice that much.

(2) CPI and PPI

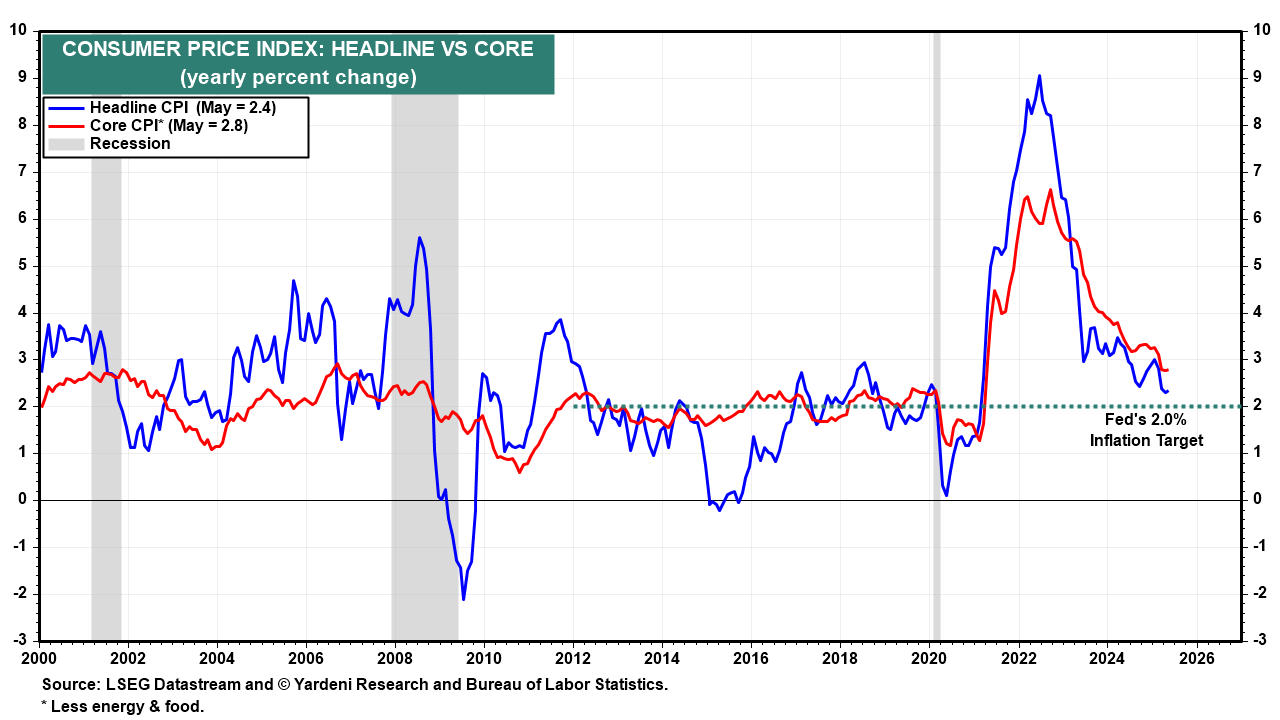

So far, the impact of Trump’s tariffs has been difficult to spot in hard inflation data. That may be about to change, albeit modestly, with June’s CPI report (Tue). The Cleveland Fed’s Inflation Nowcasting is showing a 3.0% y/y increase in this inflation rate, up from 2.8% in May (chart).

June’s PPI report (Wed) might confirm that the downward trend in inflation has been interrupted at least on a transitory basis by Trump’s tariffs. That may be enough to keep the Fed on hold.

(3) Retail sales

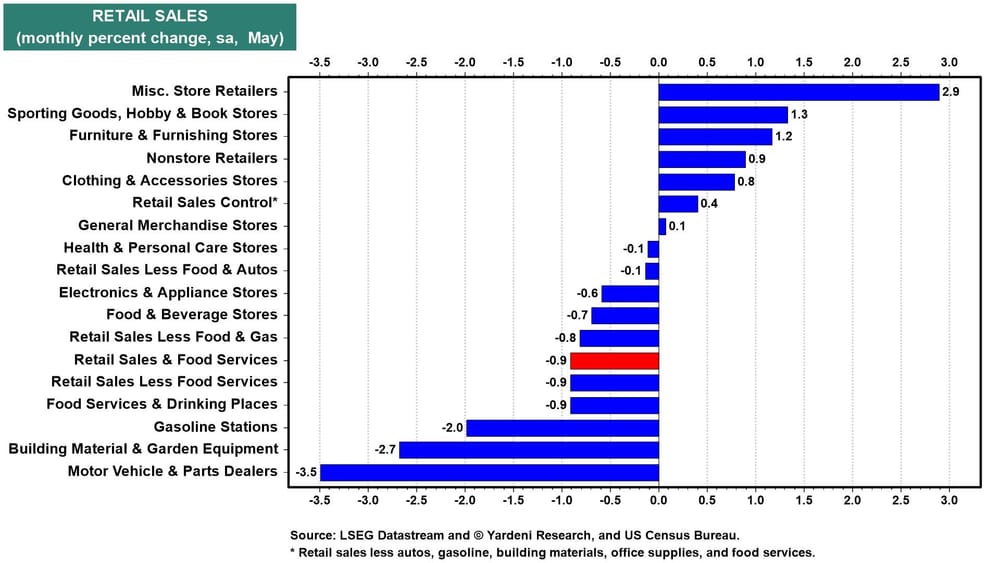

The sizable 0.9% drop in retail sales in May, the first back-to-back monthly decline since the end of 2023, was offset by the month’s "core group," which was up 0.4% (chart). June’s retail sales report (Thu) could also be a mixed bag, with auto sales weak again and a small increase in the control group. Our Earned Income Proxy for private industry wages and salaries in personal income was flat last month.

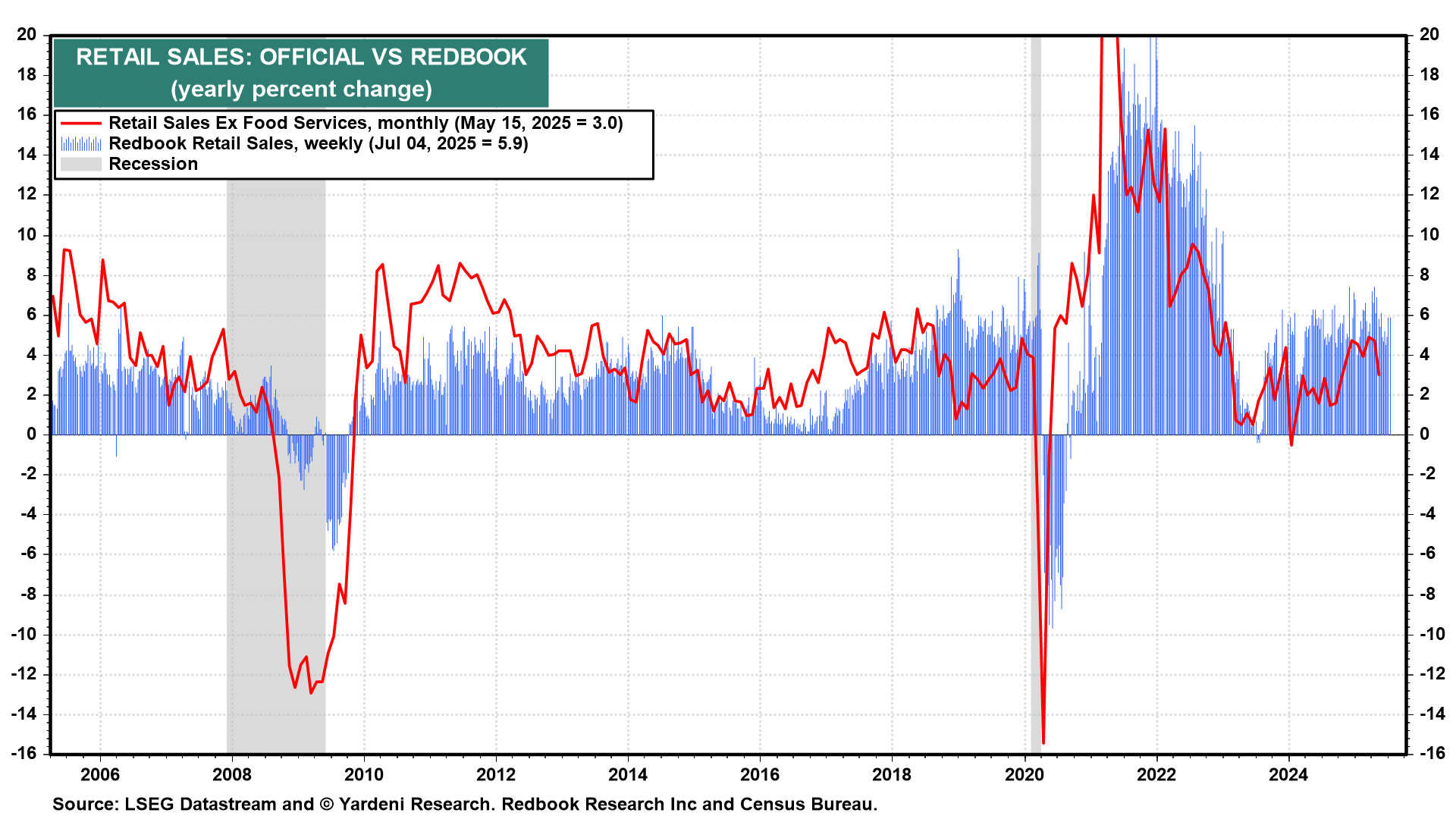

Anticipation of Amazon (NASDAQ:AMZN)’s Prime Day, the annual deal event on July 8-11, might have reduced online shopping last month. However, there’s no sign of that happening in the weekly Redbook retail sales series, which remains robust (chart). That’s consistent with the low readings for weekly initial unemployment claims (Thu).

(4) Industrial production

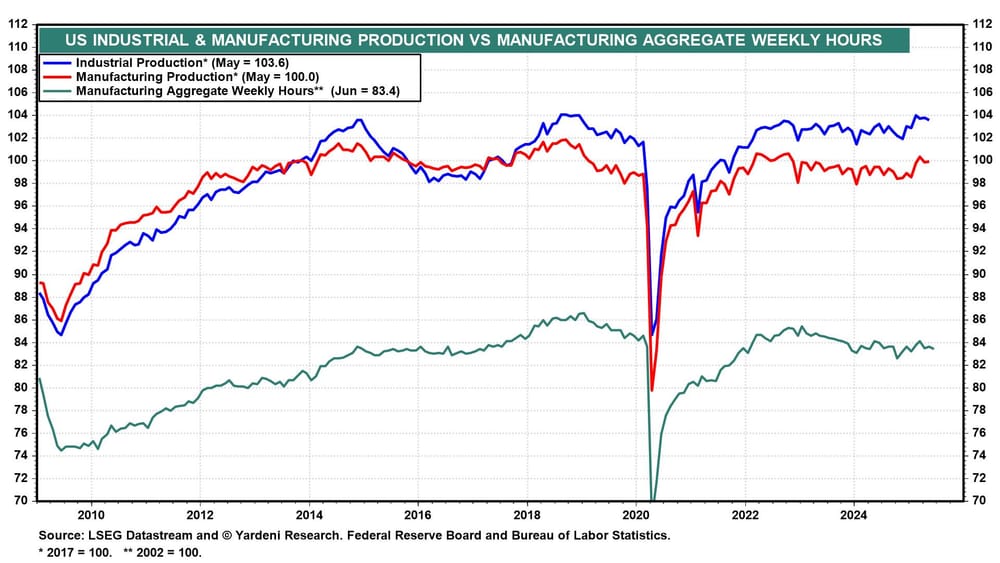

June’s industrial production (Wed) probably edged down, given that manufacturing aggregate weekly hours fell slightly last month (chart). The New York Fed’s July Empire State Manufacturing Index (Tue) could show signs of stabilizing following a surprisingly weak -16.0 reading in June.

(5) Fed fight

A number of Fed officials will have their chance at publicly parsing this week’s economic indicators. Among top Fed policymakers giving speeches are: Governors Michelle Bowman (Tue), Michael Barr (Tue and Wed), Adriana Kugler (Thu), and Christopher Waller (Thu). It will be interesting to see whether any of them takes sides in the Great Fed Fight between Trump and Fed Chair Jerome Powell. The President has been attacking Powell almost daily of late for not lowering interest rates.

Trump still wants Powell gone before his term as Fed chair expires in May 2026. Though the Supreme Court complicated his hopes to fire Powell, Trump World is getting quite creative about grounds for termination. Case in point: arguing that Powell mismanaged renovations at Fed headquarters and lied to Congress about the project.

Let the games begin!