Can anything shut down the Gold rally?

- Brazilian oil giant's net profit fell in 3Q22

- On the positive side, the company announced $3.57 billion in dividends

- InvestingPro sees positive signs for the future

- Secure your Black Friday gains with InvestingPro's up to 55% discount!

One of the world's largest oil and gas exploration, production and marketing companies, Petroleo Brasileiro Petrobras (NYSE:PBR) released its Q3'23 earnings last Thursday, November 9. Although the figures were slightly disappointing on a first impression, with a big drop in profit, InvestingPro still sees an interesting future for the Brazilian giant.

Let's take a deep dive into the stock's fundamentals to understand whether the Brazilian giant's mighty 23.3% dividend yield is worth the risk.

Ups and Downs

Petrobras reported a 42.2% drop in net profit in 3Q23 compared to the same period in 2022, reaching US$ 5,5 bi. Sales revenue also fell 26.6% year-on-year, to $25.5 billion. The negative figures are credited to the devaluation of the Brazilian real against the dollar and the high price of Brent oil last year, leading to higher numbers at the time.

On the other hand, there are also positive points in the November balance sheet. Adjusted EBITDA fell 27.6% in the year, to $13.5 billion, but rose 16.8% in the quarter. Net Debt also fell to $43.7 bi, 7.9% lower than in 2022. Operating Cash Flow fell 10.6% compared to last year, to $11.5 bi, but is still the fourth highest in the company's history.

Petrobras' Market Capitalization closed the week at almost $96.8 billion. Remember that in October the company had the highest market value in its history, reaching $106 billion.

Dividends and Governance Seen as Key

The company also announced the payment of $3.57 bi in dividends in February. The cut-off date (ex-dividends) will be November 22, so anyone who wants to take advantage of the company's mighty 23%+ yield needs to buy it this week still.

On the other hand, the market is raising doubts about governance at Petrobras. The oil company is due to submit to shareholders a proposal to amend its bylaws which could, among other changes, affect the distribution of dividends above the minimum in the future. In general, the movement was seen as negative.

InvestingPro Sees Positive Signs

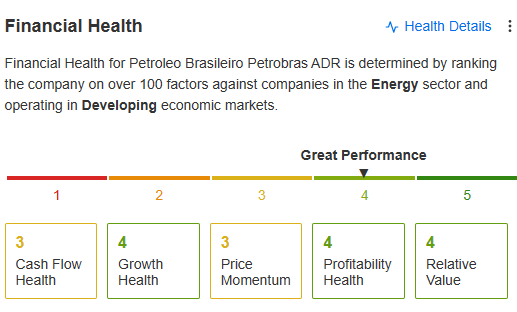

Despite the drop in net profit, InvestingPro considers Petrobras' financial health to be very good. With a score of 3.51, it has a B rating and is among the best in the Brazilian stock exchange.

Source: InvestingPro

With controlled debt and high cash flow, the company shouldn't have any major problems in the short or medium term. It also trades at low multiples. Within the Relative Value category, for example, we highlight the company's EV/EBITDA of 2.3x, as well as a P/L of 3.0x and an Earnings Yield of 34.9%. In Earnings, Net Profit is still very high, despite the fall. ROE of 40%, Gross Margin of 50.6% and Operating Margin of 42.3% are all positive figures.

The fair price tool also sees a promising future for PETR4, the company's preferred share. The paper closed the week quoted at $15.23, but has the potential to rise 55.1% over the next 12 months.

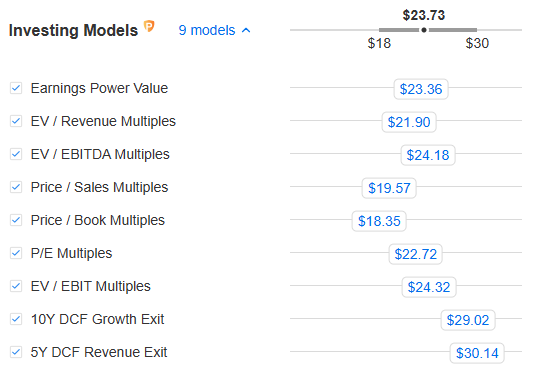

Among the eight valuation models used by InvestingPro, Petrobras' 10-year Discounted Cash Flow projection stands out, with a fair price of $30.14. The least optimistic model, Multiple Price/VPA, projects $18.35 for the share.

Source: InvestingPro

Petrobras Stands Out Among Its Peers

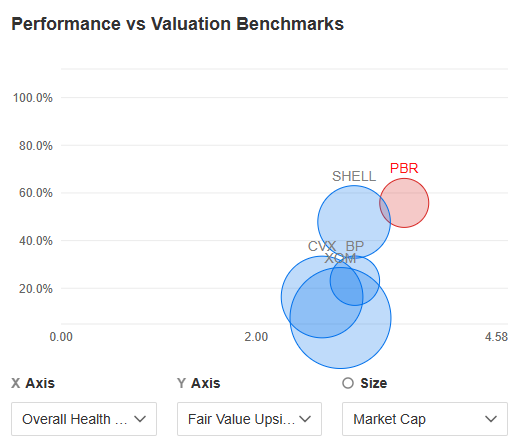

Comparing Petrobras with other oil giants around the world, you can see that the company also stands out as an investment opportunity. We put the Brazilian company side by side with Shell (NYSE:SHEL), BP (NYSE:BP), Exxon Mobil (NYSE:XOM), and Chevron (NYSE:CVX).

The company has the highest upside potential in fair value and the lowest P/L. The runner-up in price upside, for example, is BP, with "only" 23.2%. BP's EV/EBTIDA is slightly lower, trading at 1.8x. But it's worth noting that all the oil companies mentioned are still underpriced and trade at low valuation multiples.

The Brazilian company also has the best Financial Health score (3.52), followed by BP (3.01) and Shell (3.0) with a B rating, while Exxon Mobil and Chevron have a C rating. Petrobras is also, by far, the best dividend payer on the list, with a DY of 26.6%, with Exxon Mobil in second place (6.1%).

Source: InvestingPro

What do you think of Petrobras in the medium term? Is it worth investing in the giant at current levels?

***

Buy or Sell? Get the answer with InvestingPro for Half of the Price This Black Friday!

Timely insights and informed decisions are the keys for maximizing profit potential. This Black Friday, make the smartest investment decision in the market and save up to 55% on InvestingPro subscription plans.

Whether you're a seasoned trader or just starting your investment journey, this offer is designed to equip you with the wisdom needed for more intelligent and profitable trading.

**Disclosure: This article is for information purposes only; it does not constitute an investment recommendation nor is it intended to encourage you to buy the shares mentioned. Remember that every company must be analyzed from different points of view and investing in the variable income market always involves risks.