Missed the webinar? Here are Investing.com’s top 10 stock picks for 2026

It’s been less than a week since Fed Chairman Powell said the central bank remained in a wait-and-see mode for deciding if tariff-related inflation was a significant risk factor that would delay interest rate cuts. But expectations for monetary policy are moving fast these days and so assumptions from a week ago may already be ancient history.

Fed Chairman Powell is scheduled to testify in Congress today and tomorrow and so it’s possible he may revise his messaging in discussions with lawmakers. Perhaps, but I’m not holding my breath. Most analysts expect the Fed chief to reaffirm what he said last week in a press conference, and I agree, namely: that the central can afford to keep rates steady until the effects of tariffs on inflation become clearer.

Fed funds futures continue to lean into the outlook that rate cuts remain off the table for the next FOMC meeting on July 30. The market is pricing in a roughly 77% implied probability for no change. September’s looking more likely via an 80% probability.

The question is whether shifting commentary from Fed heads will change the outlook? In recent days two Fed officials said rate cuts should be considered for July. “It is likely that the impact of tariffs on inflation may take longer, be more delayed, and have a smaller effect than initially expected,” Federal Reserve governor Michelle Bowman said on Monday. “Should inflation pressures remain contained, I would support lowering the policy rate as soon as our next meeting” in July.

On Friday, Fed Governor Waller also said a rate cut was possibly next month. “I think we’re in the position that we could do this as early as July,” he told CNBC. “That would be my view, whether the committee would go along with it or not.”

Powell, by contrast, has reasoned that while tariff-related inflation may be lurking, there’s no rush to cut rates while the US economy remains resilient – the labor market, in particular. But there are hints that the macro resiliency may be fading, if only marginally, and so the case may be strengthening for easing policy. In support of his view, the Altanta Fed’s GDPNow model is still nowcasting a strong rebound in the upcoming second-quarter GDP report following Q1’s slight contraction.

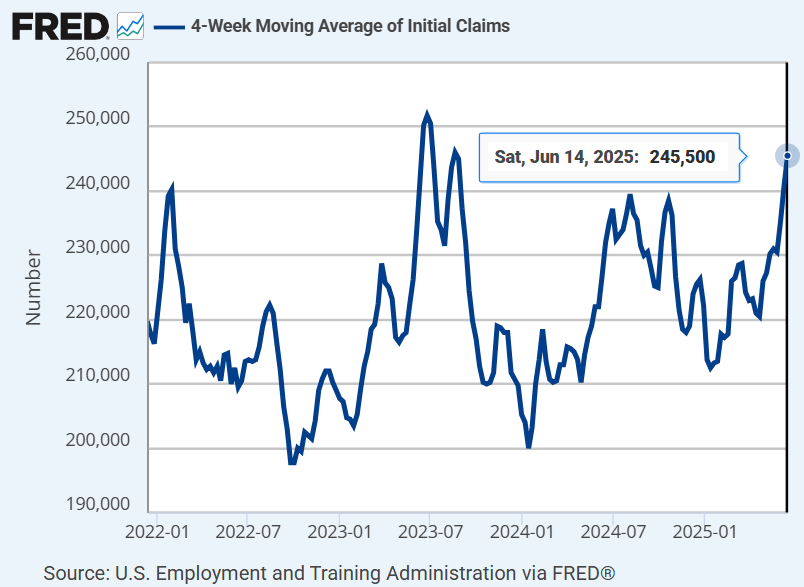

But focusing on forward-looking forward is starting to paint a less-encouraging outlook. Policy doves cite the rise in the four-week moving average of weekly jobless claims, which is a leading indicator for the labor market. The latest reading shows the trend rising to the highest level since 2023, which some analysts see as a warning that hiring is on track to slow to a pace that threatens the economic outlook and strengthens the argument for cutting rates.

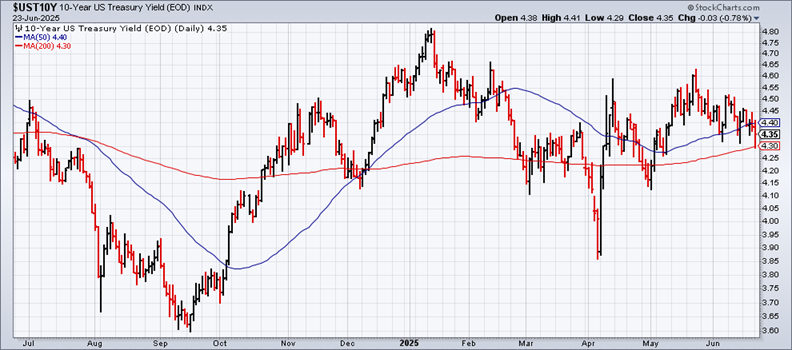

The Treasury market is showing signs of pricing in softer economic conditions. Despite tariff-related inflation concerns, the 10-year yield fell yesterday (June 23) 4.35%, the lowest close in nearly two months. Safe-haven buying linked to the Israel-Iran conflict is probably a factor too.

“We are not in the July [rate-cut] camp, but do believe that data should show signs of weakness over the summer months and hence prompt a rate cut in September,” Mohit Kumar, chief European strategist at Jefferies wrote in a client note.

Meanwhile, President Trump continues to pressure the Fed to cut rates. In a post on social media early this morning he wrote: “I hope Congress really works this very dumb, hardheaded person, over. We will be paying for his incompetence for many years to come.”

The question is how or if Powell can salvage the narrative he made less than a week ago in today’s testimony?

At least one Fed official has Powell’s back. In an interview with Reuters on Monday, Atlanta Fed President Bostic said:

“I think we have some space and time” to watch how the tariff and other policy issues change. “I’m more concerned about what happens if we don’t get to our 2% [inflation] mandate. Because of that I’m willing to stay in this restrictive posture for longer just to be absolutely sure,” a reference to the current 4.25% to 4.5% Fed target rate that’s prevailed since December. “I would see the last quarter [of the year] is sort of when I would expect we would know enough to move.”

The pressure for a rate cut may be building, but July still looks like a long shot, advises Tim Duy, chief S Economist at SGH Macro (BCBA:BMAm) Advisors. In a note to clients on Monday he wrote:

“The Fed’s MAGA contingent is setting the stage for a September cut. It will become more interesting if Waller and Bowman continue to support rate cuts if inflation comes in hot in the next few months on the back of tariffs. It’s however very unlikely that Waller and Bowman can drive the consensus in favor of a July cut. It’s just too much to ask from six weeks of data.”