Six Flags stock rises after appointing John Reilly as new CEO

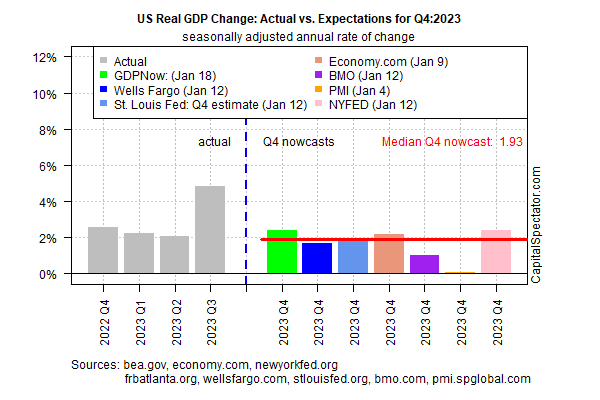

Next week’s official release of US GDP data for the fourth quarter remains on track to post a moderate increase, based on a median estimate for a set of nowcasts compiled by CapitalSpectator.com.

The US Bureau of Economic Analysis is projected to report on Jan. 25 that growth slowed to a 1.9% gain (seasonally adjusted annual rate), according to today’s revised median nowcast.

That’s a sharp slowdown from Q3’s strong 4.9% increase. Nonetheless, the current estimate for the final quarter of 2023 suggests that the US ended last year with a solid, albeit slowing economic tailwind.

Today’s median Q4 nowcast is modestly higher vs. the previous update, published on Jan 5, when the median estimate was 1.6%.

This week’s retail sales report for December underscores the economy’s resilience at the end of 2023.

Retail spending rose more than forecast last month, persuading economists that consumer activity continues to provide a solid base for growth.

“The economy is still flying high enough and economists can take down those recession forecasts this year,” says Christopher Rupkey, chief economist at FWDBONDS.

“For Fed officials, the economy is not too hot and not too cold, but it is just right perhaps for a few interest rate cuts in 2024.”