Stock market today: S&P 500 closes higher, but Nvidia slip keeps gains in check

This week is huge: revisions to 2023 CPI, US labor market print, the Fed, and, most importantly, the Quarterly Refunding Announcement (QRA) everyone talks about.

So I thought I’d share an initial framework for you to understand why everybody seems to care about the details of the US bond supply announced in the QRA.

The key is to think of bond supply within the context of the US monetary plumbing.

The first thing to understand is the tectonic shift happening at the policymaking level when it comes to the use of fiscal deficits.

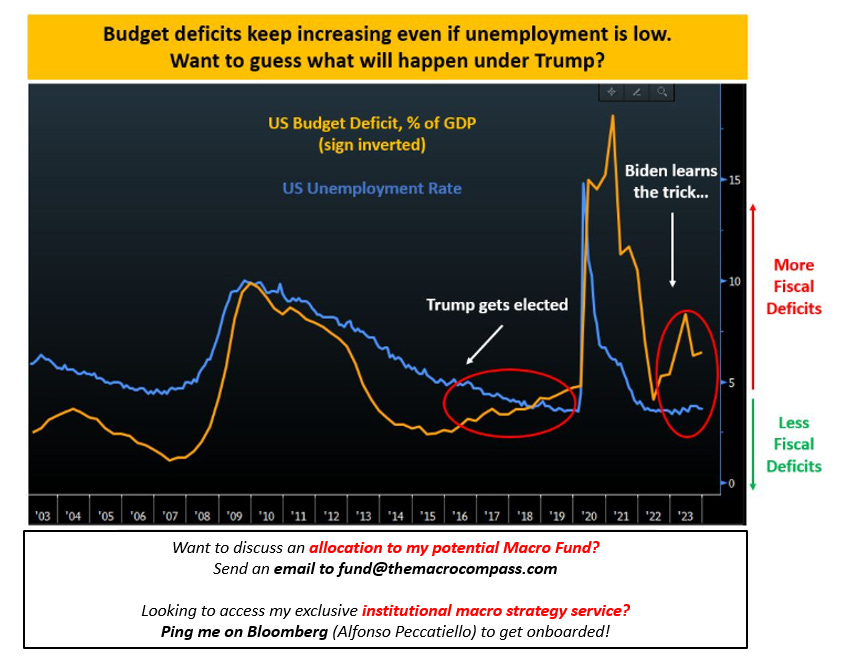

The chart shows how until 2016 US politicians applied fiscal policy in a counter-cyclical fashion.

When the unemployment rate (blue) was low like in 2006-2007, they proceeded with a conservative fiscal stance (orange) and reduced deficits.

Instead when a big crisis hit like in 2008 and the unemployment rate moved higher, they tried to support the economy with more fiscal deficits.

This is a textbook counter-cyclical application of fiscal policy: support the economy by injecting fresh money when it needs it and withdraw support when it's running hot by itself.

But in 2016 something changed.

Trump became the new US president, and despite unemployment rates dipping below 5% the US budget deficit started expanding anyway.

A bit like crocodile jaws opening, for the first time in decades fiscal stimulus was not used to support a weak economy but instead ON TOP of an economy which was already strengthening.

As a result, in 2017-2018 the US economy was quite hot - the Fed raised rates, the stock market puked, and in 2019 Powell had to pivot.

But as Biden got into office, he recently showed he learnt the same trick too!

In the 2023 fiscal year, Biden rapidly expanded fiscal deficits despite a tight job market - hence the crocodile jaws were opened again.

The result?

A prolonged cycle for the US economy, with inflation which perhaps took a bit longer than expected to start slowing down.

As Trump is gaining ground in his race to become the next US president, I wonder whether he's going to continue with this new crocodile jaw paradigm - and my hunch is that he will.

US politicians are becoming familiar with the power of fiscal stimulus (but not with the dangers of its excessive use).

And by 2028 the majority of voters aren’t going to be Boomers & Co anymore, but instead Millennials and Gen-Z looking for a change in wealth distribution.

Therefore, we can expect a robust use of fiscal stimulus in a semi-permanent way.

Now, back to 2024: the Fed is doing QT while Yellen marches ahead with deficits.

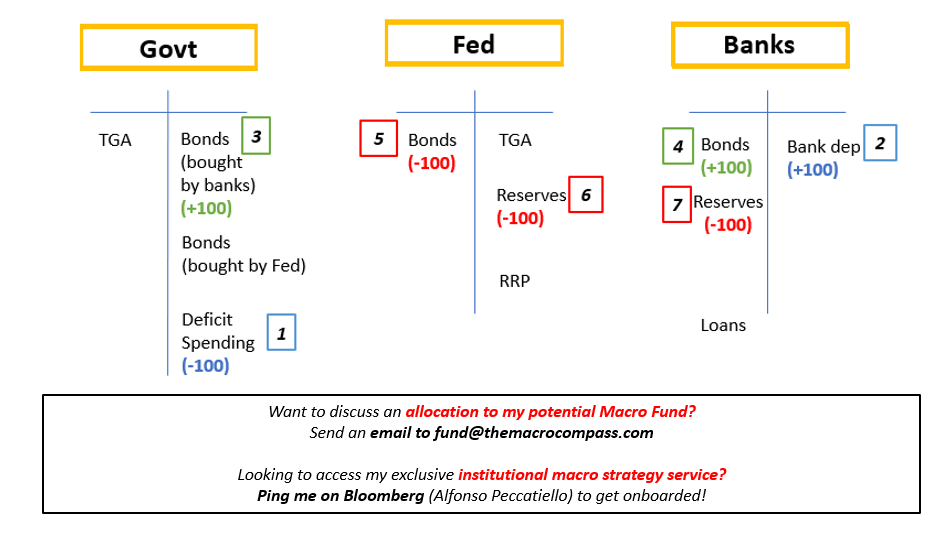

These are the monetary plumbing mechanics of this exercise - visualized:

1-2) The US government proceeds with deficit spending, households and/or corporations get an injection of new money, and (potentially inflationary) bank deposits go up together with reserves in the system;

3-4) Simultaneously, bond issuance takes place: Yellen issues bonds, and banks (primary dealers) use reserves to buy bonds at auctions;

5-6-7) The Fed runs down its balance sheet through QT, and that works like a net drain of reserves from the financial system.

An excessive reduction in bank reserves can become problematic for the smooth functioning of the repo market: banks use reserves to settle repo transactions with each other, and if there is too much collateral (bonds) floating around and too little reserves the repo market can suffer (e.g. 2019).

But there is a way around this problem: Yellen issuing T-Bills instead of bonds. This is one of the reasons why everyone is watching the QRA next week:

In this case, QT does not drain bank reserves but it’s instead ‘‘sterilized’’.

The bottom set of T-Accounts explains why: when the government issues T-Bills and money market funds buy them by draining their existing balances at the RRP facility, bank reserves don’t need to take the hit for QT.

It’s basically sterilized QT.

The other incredibly important dynamic is that issuing T-Bills or long bonds has a very different impact on market participants.

T-Bills have very little interest rate risk, while long bonds are much heavier to absorb because of their big duration risk.

I will be talking about the QRA in details next week, and analyze its direct impact on bond and equity markets.

***

This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds - check out which subscription tier suits you the most using this link.