IREN proposes $875 million convertible notes offering due 2031

By Padhraic Garvey & Benjamin Schroeder

Rates continue to push lower after a soft 7-year US Treasury auction as Federal Reserve officials offer little pushback against the market's pricing of rate cuts. The spotlight today is on the first eurozone country readings for November inflation, with further improvement on the cards

Fed Speakers Don't Offer Effective Pushback Against Market Pricing

Rates are still looking lower with UST yields pushing through last week’s lows. The 10Y UST yield dipped well over 10bp toward 4.25% and the 2Y rallied by nearly 20bp to below 4.7%, reaching its lowest levels since July - a classic bull steepening move as markets position for a change in the rate cycle. And that narrative trumps softer auction metrics with a weak 7-year UST auction last night only a small hiccup.

Rate cut speculation gained further traction yesterday after Fed speakers sounded somewhat dovish. Governor Christopher Waller was encouraged by recent data on the outlook and saw a soft landing still possible absent big shocks. He also put the recent rally in rates and easing in financial conditions into perspective, saying conditions were still tighter versus mid-year, which should put downward pressure on household and business spending. And, more importantly, he stated there was no reason to insist on rates staying “really high” if there were continued declines in inflation.

The Conference Board measure of consumer confidence rose to 102.0 in November from a downwardly revised 99.1 in September, but as our economist points out, the "jobs hard to get" series rose to its highest reading since March 2021, which chimes with other data suggesting that the labor market is cooling.

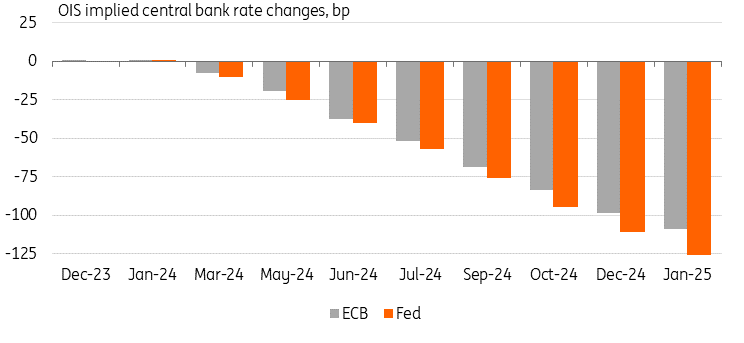

Around 100bp in Cuts Priced From Both the ECB and Fed

Source: Refinitiv, ING

EUR Rates Dip as Germany's Budget Woes Extend and the Next Key Inflation Readings Are Eyed

European rates saw the 10Y Bund yield dipping below 2.5%, marking new lows for the period since the start of September. The bull steepening was more moderate than over in the US, but hawkish comments from the Bundesbank’s Joachim Nagel, who said that even talking about cuts was premature, did little to prevent a further decline in yields. And the hawks will have difficulty in pushing back against markets if inflation data continues to point to further improvements – key today will be the first German inflation figures for November.

Comments from the European Central Bank about still having to shrink the balance sheet significantly were reflected in sovereign spreads. The spread of 10Y Italian government bonds over Bunds briefly rose by 5bp. But overall the spread is still around 175bp, where it has stabilized since mid-November after tightening from above 200bp. On a positive note, the European Commission approved the fourth installment for Italy of €16.5bn from the EU recovery fund.

Bunds outperformed moderately versus swaps with the 10Y Bund ASW nudging further towards 50bp. The German budget woes continue and Chancellor Olaf Scholz shed little light on how he intends to tackle the problems speaking to parliament yesterday. The government coalition will meet this evening, according to Reuters reports, but is unlikely to yield new insight into whether for instance, a debt brake suspension is also part of the plan for 2024, leaving the outlook for next year’s issuance uncertain for now. As Reuters states, the government is hoping to pass the budget by the end of January, at the latest.

Today’s Events and Market View

The market is clearly eyeing the change in the rate cycle with close to 100bp in rate cuts over the next year discounted both for the Fed and ECB. One key variable for the outlook remains inflation, which puts the focus on Thursday’s US PCE inflation data to confirm the improving dynamics. But inflation remains in focus already today in Europe where we get the first country inflation estimates out of Germany and Spain.

The other crucial input is central bank communication, but the pushback against market pricing has been listless, putting the spotlight all the more on Friday’s appearance of Fed Chair Jerome Powell. Scheduled in the US for today is only Loretta Mester, talking on financial stability.

In other data, the main highlights are the second reading for US third-quarter GDP growth, which had stunned markets with a 4.9% annualized quarter-on-quarter figure. Later in the day, the Fed will also release its Beige Book.

In primary markets, Germany auctions €3.5bn in 10Y bonds and Italy up to €7.5bn across 5Y, 10Y and 3Y floating rate bonds.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more