InvestingPro’s Fair Value model captures 63% gain in Steelcase ahead of acquisition

We think both US CPI inflation and the US fiscal deficit can come in higher than expected, with the latter most meaningful. Brewing trouble here for Treasuries. In the eurozone, the 2Y euro swap rate will find it difficult to move higher as a stronger euro and falling oil prices pose downside risks to inflation.

US Inflation and Fiscal Deficit Data for July Likely Impactful for Treasuries

Markets are bracing for the July CPI report, due Tuesday, with expectations of a modest 0.2% month-on-month rise in headline inflation and 0.3% for core. That’s tame enough for the ’nothing to see here’ crowd to argue tariffs haven’t bitten yet. But this is likely just the beginning. We’re in a transitional phase. Inventories of big-ticket items—cars, appliances, electronics—are still being sold at pre-tariff prices.

Once those are cleared, the full force of tariffs will begin to show. We expect inflation readings of 0.4% month-on-month to become more common, possibly even higher. That’s when the market narrative will shift, and long yields could come under renewed pressure.

The July CPI may offer the first glimpse of this shift. Apparel, furniture, and footwear prices already showed signs of upward movement in June. If core inflation prints at 0.3% and headline at 0.2%, it will be easy to dismiss. But give it a few months—tariff effects are coming, and they won’t be subtle.

The other big number on Tuesday is the July fiscal balance. June’s $27bn surplus was a temporary reprieve, driven by one-offs. July is set to swing hard in the opposite direction. Spending lines have overshot norms, and we see a decent chance of a deficit closer to $300bn—well above last year’s $244bn and 2023’s $221bn. This matters.

Tariff revenue was touted as a fiscal fix, but it’s not delivering—at least not yet. If the economy slows, other revenue streams will falter, and the deficit will widen further. That’s trouble for the Treasury market too.

The Front End of the Euro Curve May Not Have Much More to Go for Now

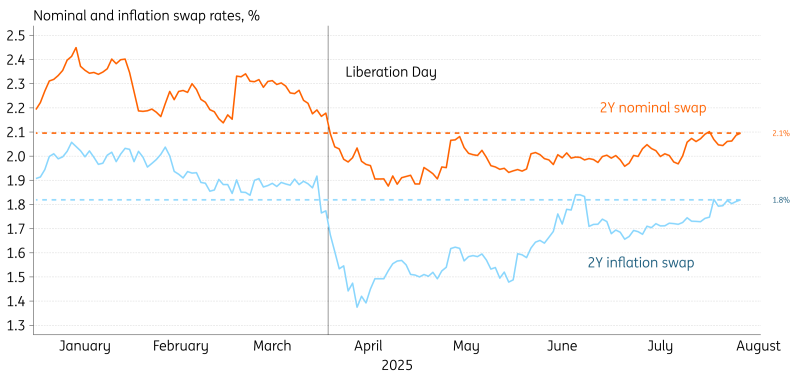

The 2Y EUR swap rate is approaching the levels from before ’Liberation Day’, but we think closing the gap fully will be tough. If we look at the 2Y inflation swaps in the chart below we are now around 1.8%, just 10bp below the levels in March. In the meantime, however, a stronger euro and lower oil prices have tilted the risks to inflation to the downside.

The European Central Bank already responded to this by incorporating an inflation trajectory that undershoots the 2% target in the near term. And once the Fed continues cutting, the euro may appreciate further. As such, the inflation component of the 2Y rate is likely to face resistance against moving higher from here.

What could move the 2Y higher is a material upgrade in the growth outlook, yet this would require a series of better data points. We are seeing more upward economic data surprises, but the bar for markets to price out a last ECB cut would require a more significant turn of the cycle. The GDP growth in the second quarter was just 0.1%, which is not enough for the ECB to be content with growth.

Data like the ZEW survey outcomes on Tuesday can be used to monitor the momentum of the economic recovery, but the bottom line is that better hard data is needed for a more structural rise in short end euro rates.

The 2Y Swap Rate Faces Resistance Amid Disinflationary Forces

Source: ING, Macrobond

Tuesday’s Events and Market Views

The highlight will be the US CPI print for July, which consensus sees at 0.3% month-on-month for the core component. We think an upside surprise is likely because the tariffs start passing through. From the US we’ll also get the NFIB small business optimism index. For the German ZEW survey, consensus sees the expectations index come down from 53 to 40, which would correct the strong upside surprise in June.

In terms of auctions, we have the UK with 5Y gilts for a total of £4.75bn and Finland with 10Y and 15Y RFGBs totalling €1.5bn.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more