S&P 500 could hit 8,000 in 2026 on more easing from Fed: JPMorgan

Ray Dalio is considered by many investment professionals to be a market maven. This is because of the wild success of his hedge fund, Bridgewater, with assets under management of $136 billion, as well as several best-selling economics/finance books he has written.

In recent times, Ray Dalio has repeatedly emphasized that markets are in a bubble characterized by unsustainable valuations, excessive leverage, wealth concentration in a few assets (e.g., “the AI beta chase”), and euphoric sentiment. While he paints a disturbingly bearish picture, he also warns that markets may have more room to the upside. In his opinion, the conditions are not ripe for the “pricking” of the bubble that would generate widespread selling.

Ray Dalio cites three conditions or triggers to watch for to gauge when the bubble may pop. They are as follows:

- Tightening Monetary Policy: Easy money sustains market froth. While policy is not easy today, rate cuts are making it easier on the margin.

- Fiscal Policy Shifts: The imposition of new taxes, especially on the wealthy, could arise due to wealth inequality debates. The odds of such action grow if the Democrats win the House or Senate in the midterm elections. Tariffs are another policy to follow.

- Liquidity Crises or Debt Coverage Needs: Sudden demand for cash due to margin calls or debt maturities. Keep an eye on liquidity and gauge how quickly and effectively the Fed is willing to reduce liquidity stress.

Ray Dalio’s views balance optimism about near-term gains with caution about longer-term systemic risks. Furthermore, he believes gold is a good diversification asset to manage the road ahead. His most current longer-term macroviews are expressed in his recent book, How Countries Go Broke.

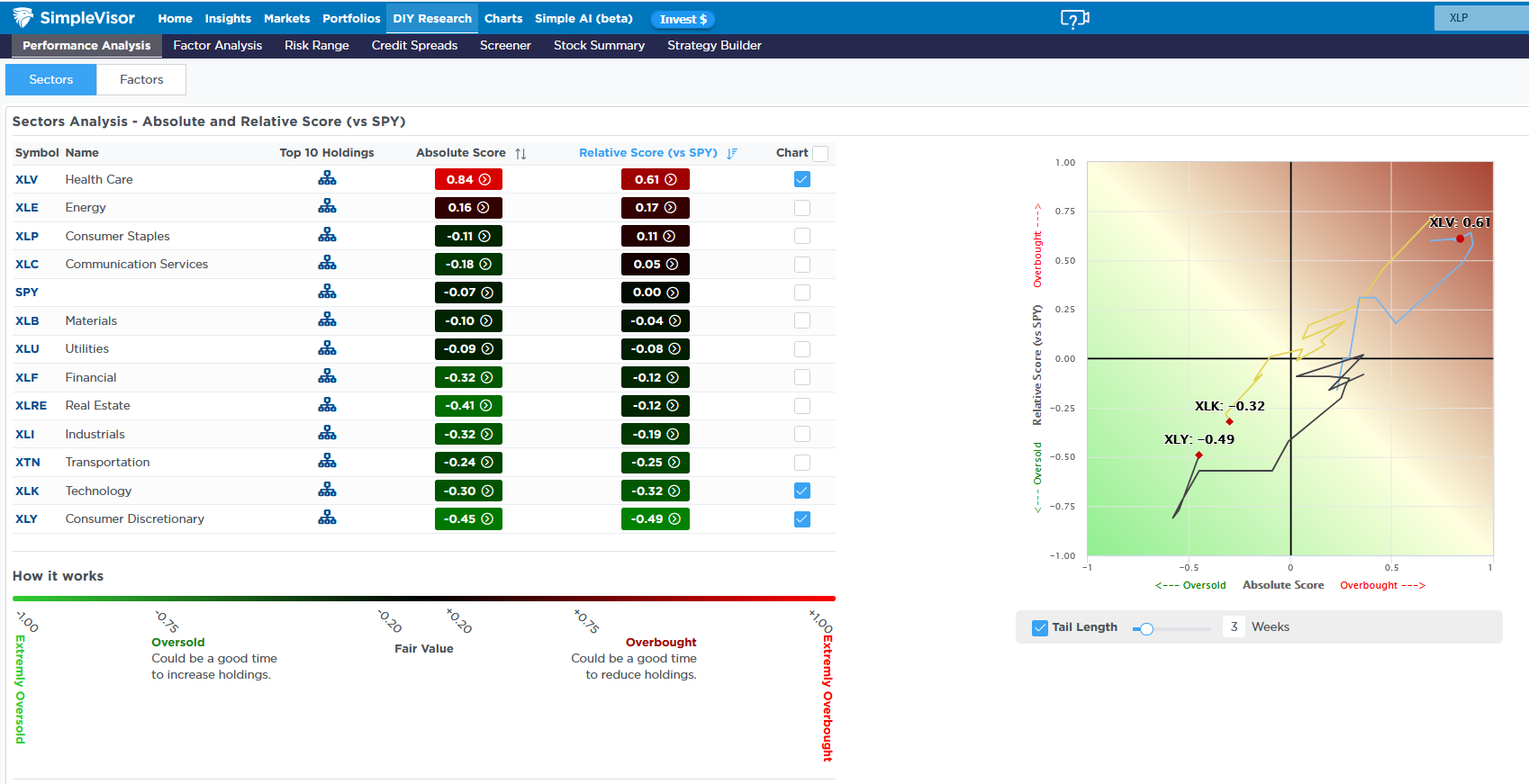

A Full Rotation Has Occurred

Just a couple of months ago, it would have been unfathomable to think that two of the worst-performing sectors at the time would lead the way, while two of the leading sectors would be the most oversold. With the recent sell-off, that is exactly the sector rotation that has occurred. Healthcare and energy stocks are now the most overbought sectors on a relative and absolute basis, while technology and discretionary stocks are the most oversold.

Note, however, that only the scores on the healthcare sector are extreme; thus, the current market trends favoring yesterday’s underperforming stocks may continue, albeit with healthcare slipping back. This is yet another example of the consistent rotation between sectors. It also leads us to ask which sectors may pull up from the rear and lead tomorrow.

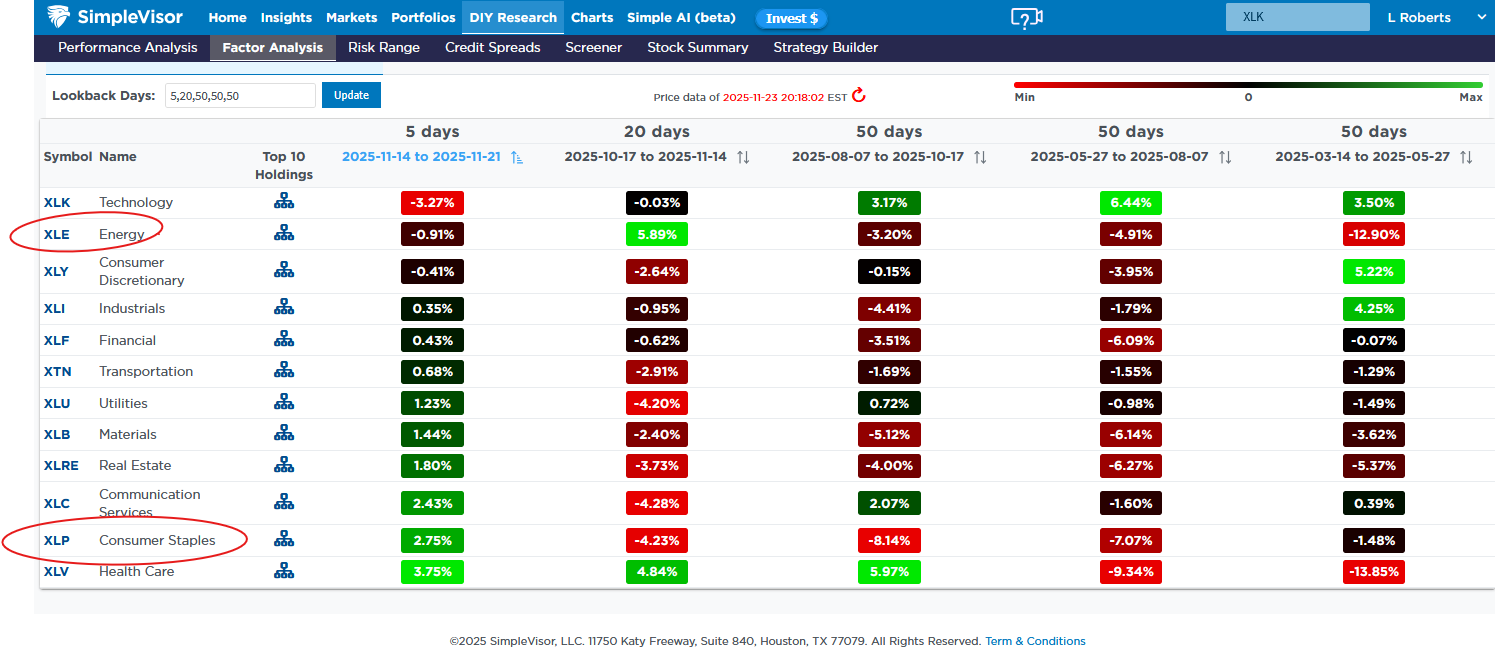

The second table shows that healthcare stocks have been outperforming the market for a while, but outperformance for the energy and staples sectors is relatively new. If the market remains weak, might those be the sectors to outperform in the coming weeks?

Tweet of the Day